For the 2020 June Market Update, we are seeing some price dropping, about $7/sqft from last month. But that’s not the big news.

Michael Orr of the Cromford Report says in his latest update that this market is changing very quickly and we are starting to see some gathering storm clouds on the horizon:

“Active listings dropped only 3.9% from last month, but active listings without a contract fell over 15%. This tells us that a large chunk of the available supply went under contract during May and very little was replaced by new inventory. It is therefore getting much harder for buyers to find the home they want and when they find it, they are likely to find many other buyers trying to buy the same house. Multiple offers are piling up. The huge recovery in demand is confirmed by the under contract count which surged over 31% over the month of May and now stands 4.5% higher than this time last year.”

Anecdotally, we are seeing strong sales under $400,000. Our listings under that price went very quickly.

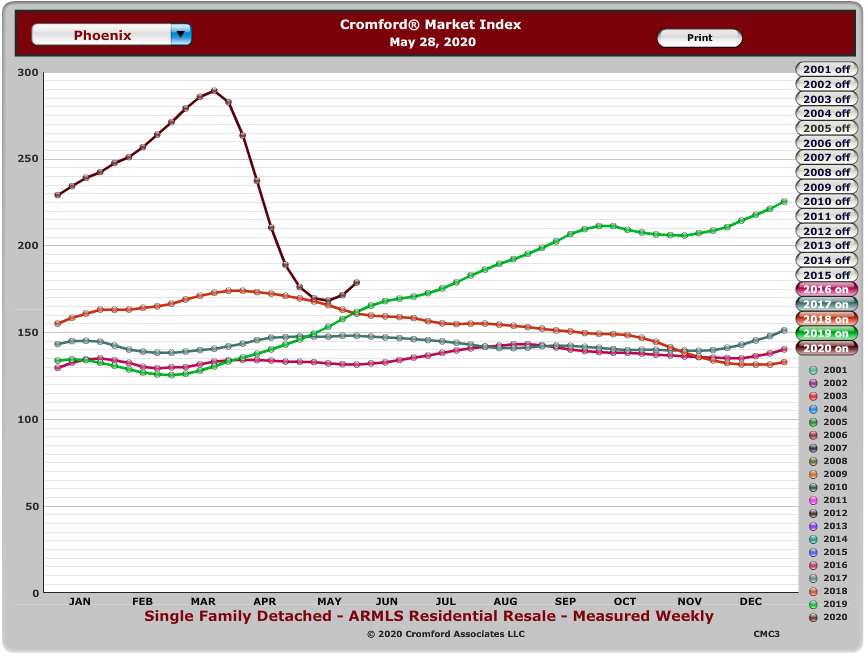

Regardless, if you look at the Cromford Report and the Supply & Demand charts, we still have a way to go from this point going into the June Market before the conditions are right for serious price drops.

It is particularly notable that the Cromford Index turning upward again. For those of you who are new to this blog, the Cromford Index is a measure of whether it is a seller’s market (above 100) or a buyer’s market (below 100), and by how much.

The Index is a really good predictor of where things are going to go. Expect prices to stay stable, or go up as we recover from this calamity.

I think this demonstrates what we said last month: that the reduced demand matched the reduced supply and prices stayed the same in the June market. Now that we are opening up a bit, people are buying. Until more properties come on the market, watch for prices to stay high.

Orr also expresses concerns about the continued impact of COVID-19:

“So the Greater Phoenix housing market proved its resilience over the last 3 months and short term trends strongly favor sellers. However what about those ominous dark clouds? There are several. First, COVID-19 has not gone away, in fact the global infection rate is currently hitting new peaks. The USA as a whole is seeing a slow fall in new cases, but Arizona is not. The weekly new case count for Arizona on June 2 was 4,467, the highest yet reported and more than doubled from a week ago. This is not a second wave. The first wave has not peaked yet and is currently growing at the fastest rate since April 4.”

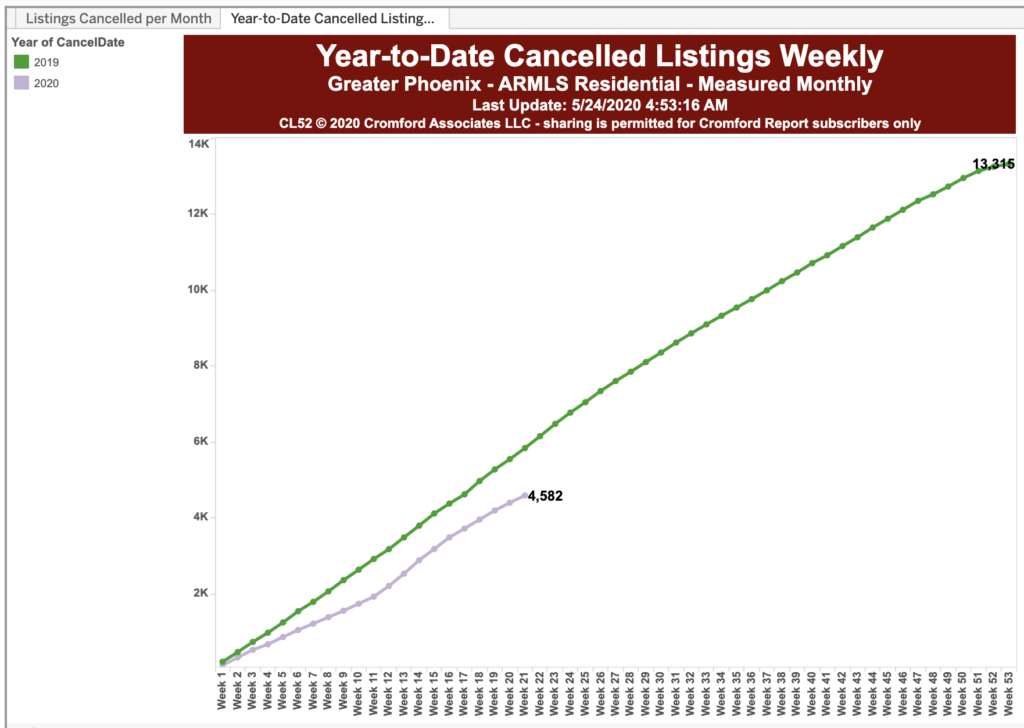

An even bigger cloud for the housing market and a medium-term threat to its stability is the fact that so many people have stopped paying their mortgage or their rent. This would not be a problem if they started paying them again soon. But what if they have lost their job and have little saved to fall back on? With unemployment around 20%, the threat that many tenants will be evicted is very high. It is a less immediate problem, but some home-owners will receive Notices of Trustee Sale over the next 12 months because of damage to their income and thus their ability to pay their mortgage. This will probably include landlords who cannot pay their mortgage because their tenants cannot pay their rent.

What’s the long and short of it? If you are thinking of selling, you are in a strong position and may be for a while (unless unemployment persists and people cannot purchase homes).

If you are thinking of buying, don’t expect prices to drop any time soon.