The January Market Report comes at a time when we don’t expect to see any change in the upward march in prices.

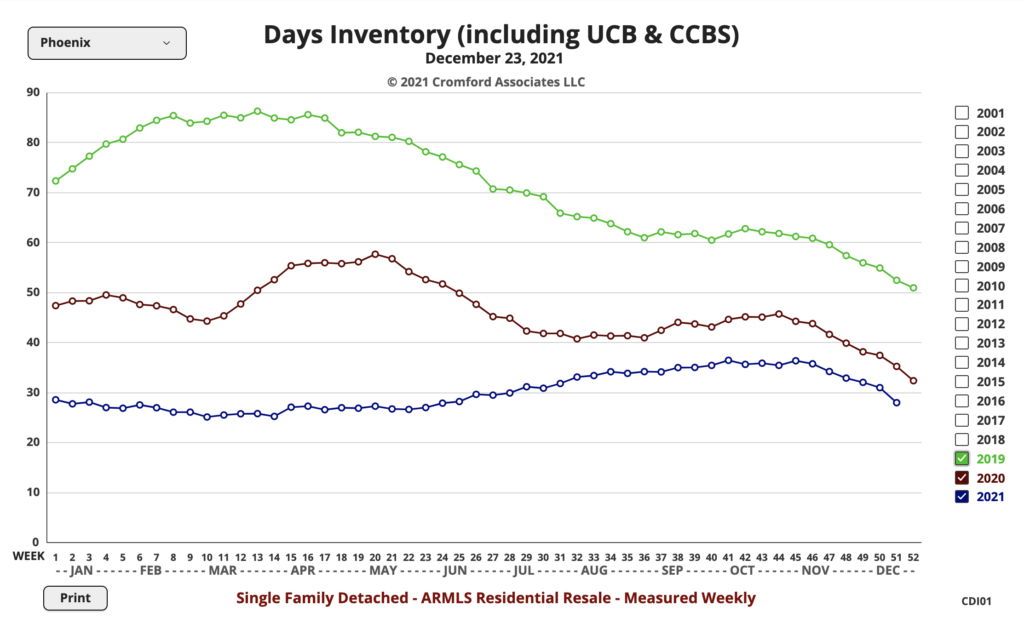

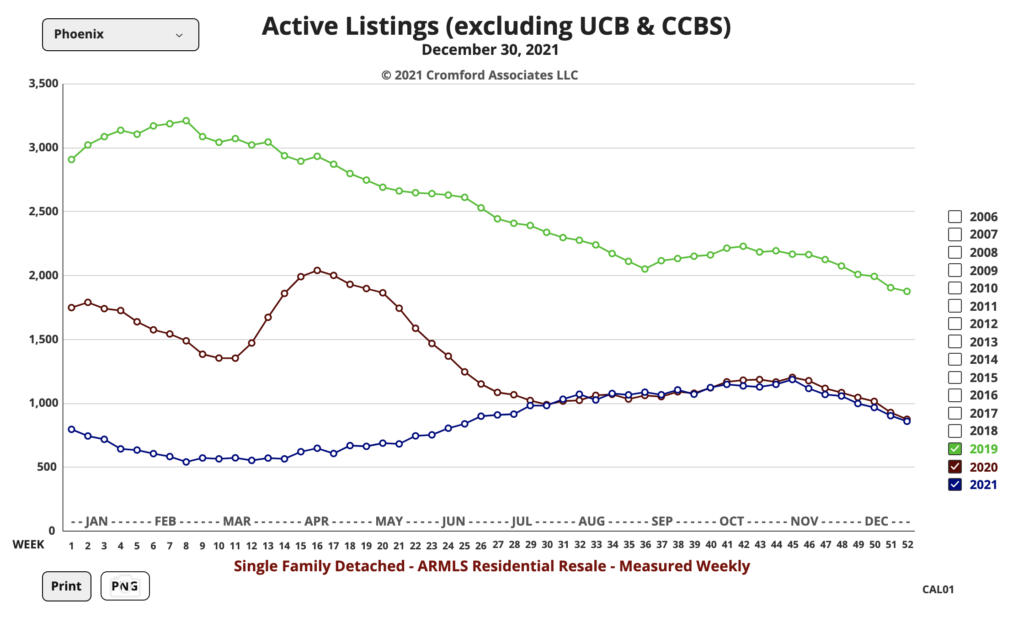

As I presented last month, the folks at the Cromford Report don’t see an end in sight to the shortage of homes.

They expect we will need about 270,000 more homes over the next decade. Unless investors are forced to sell the homes they scooped up to turn in to rentals; unless people sell off thousands of short term rentals, unless we find a path to citizenship so that home builders can hire more workers; and unless fewer people move to Arizona, there will continue to be a shortage.

But, then again, nobody every sees a market correction until it happens. Who knows what could catalyze the next downturn. The only thing I can see is that Arizona still does not take water conservation seriously enough.

Here is what the Cromford Report said about December:

“Each month about this time we look back at the previous month, analyze how pricing has behaved and report on how well our forecasting techniques performed. We also give a forecast for how pricing will move over the next month.

For the monthly period ending December 15, we are currently recording a sales $/SF of $264.00 averaged for all areas and types across the ARMLS database. This is down 0.3% from the $264.70 we now measure for November 15. Our forecast range mid-point was $266.85, so we were expecting a 0.7% rise and saw instead a 0.3% fall. However the result was still within our 90% confidence window. The monthly average $/SF can often vary by as much as 1% from day to day, so there is little significance to these numbers.

On December 15 the pending listings for all areas & types show an average list $/SF of $274.41, up 3.0% from the reading for November 15. Among those pending listings we have 99.5% normal, 0.2% in REOs and 0.3% in short sales and pre-foreclosures. The short sale and pre-foreclosure percentages remain extremely low and are having no impact whatsoever on market pricing.

Our mid-point forecast for the average monthly sales $/SF on January 15 is $273.21, which is 3.2% above the December 15 reading. We have a 90% confidence that it will fall within ± 2% of this mid point, i.e. in the range $267.75 to $279.67.

Prices had been pretty flat for 4 months, then rose dramatically between October and November, only for them to stay flat again over the last month. We remain convinced that prices will rise again over the the next month and unless the situation changes significantly the same can probably be said for at least the next 6 months.