For this December market report, I want to share observations from a webinar put on by the Cromford Report‘s Tina Tamboer.

She addresses some questions that she’s been getting about the market.

“When will we see prices go down?”

Tina says, “not any time soon.”

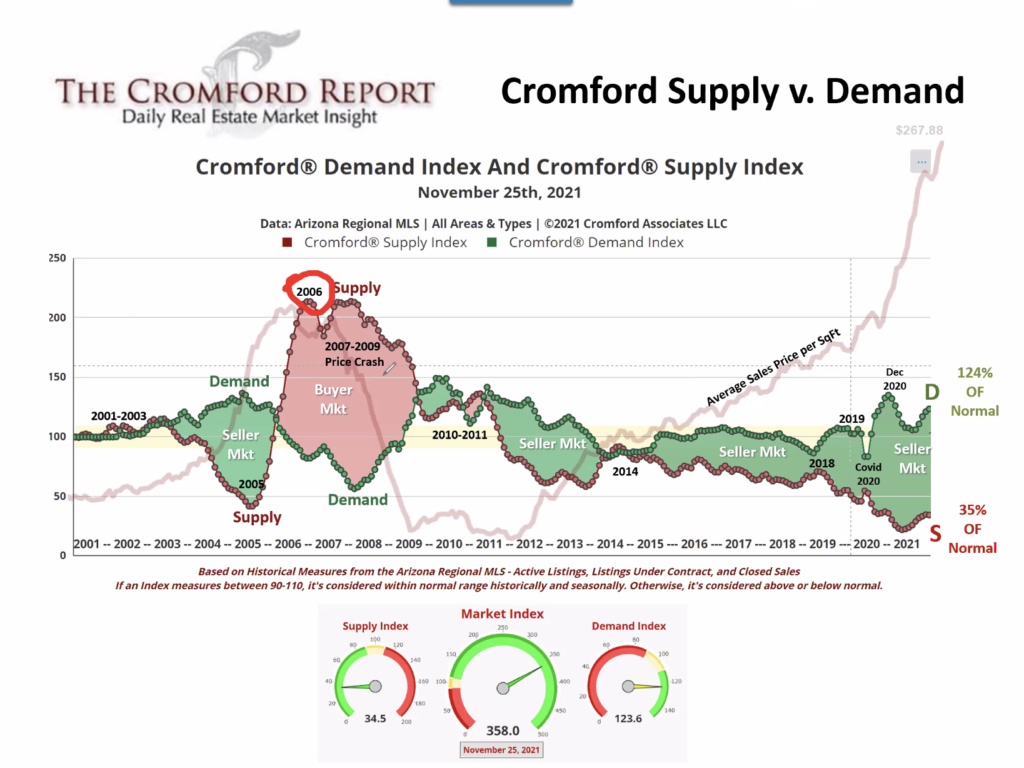

She shared this slide, which shows a long-term perspective of how the Cromford Index relates to supply. If you look at this slide, you might think that we are overdue for a crash and a switch from seller’s market to buyer’s market.

After all, the faint Cromford Index line is high, just like it was at the market crash in 2006.

See that red circle?

That represents the time that the Cromford Index hit a historic high — at least for as long as they had been tracking at that time.

But that index dropped, not because it hit a magical button in the sky, but because there had been a historic over-building of homes in the years prior to the crash.

People like to blame the Great Recession on either loosening of lending standards (which was definitely a problem) or government trying to get everyone in a house (which is a political talking point, really).

But another major driver that people tend to ignore was the over-building of homes prior to this time. People were buying homes in hopes to re-sell them at a profit. But the demand was simply not there and prices fell, causing people to lose their shirts and triggering all those questionable mortgage-backed securities to fail.

So, what’s happening today? Well, there is a huge demand and not enough homes. Kind of the opposite of backthen.

As Tina says, until that supply and demand meet again, the Cromford Index will stay high and there will be an upward pressure on prices.

To be sure, there is a lot of uncertainty and many differing opinions about where this could go.

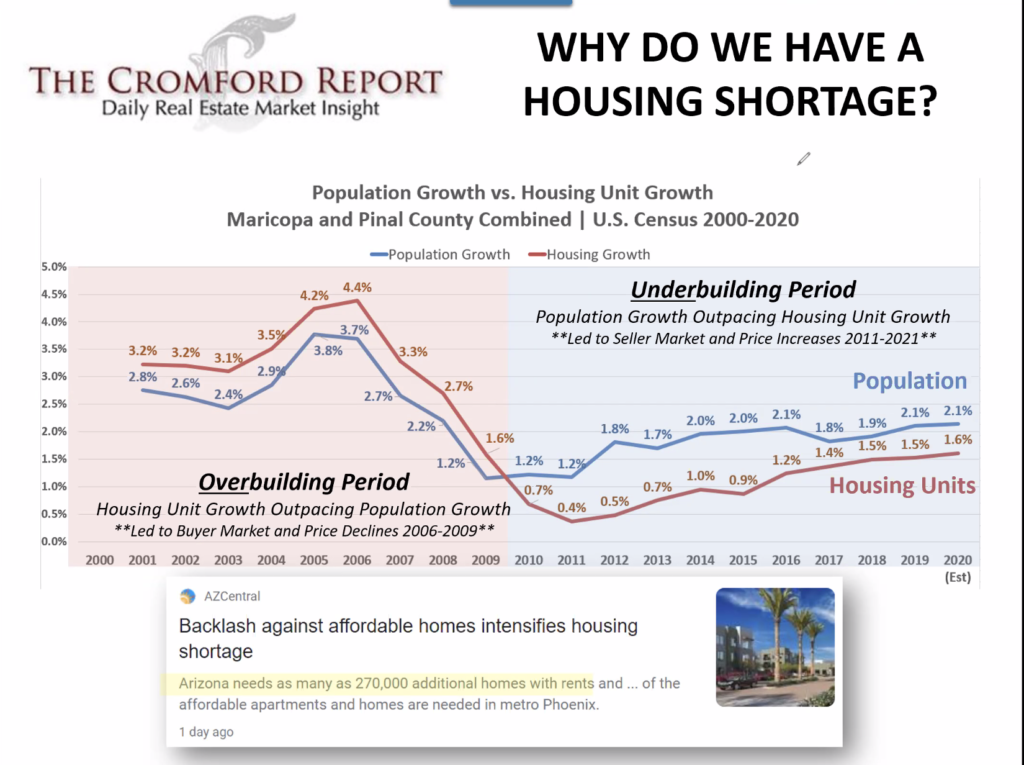

And that will stay the same until we build many, many more units –as many as 270,000 over the next 10 years, by some estimates. Not that it will take 10 years for prices to come down. But, we need more units.

“Why do we still have a housing shortage?”

Well, look back at those last 10 years of under-building. Add to that the senseless purchasing of residential homes by investment companies like Zillow, and short-term rental investors., which sapped tens of thousands of homes out of the available pool of homes.

Developers have not been building as quickly as they would have liked, in part due to labor shortages. Those shortages came from the fact that we don’t have a path to immigration for many foreign workers. More recently, it comes from COVID and supply chain disruptions.

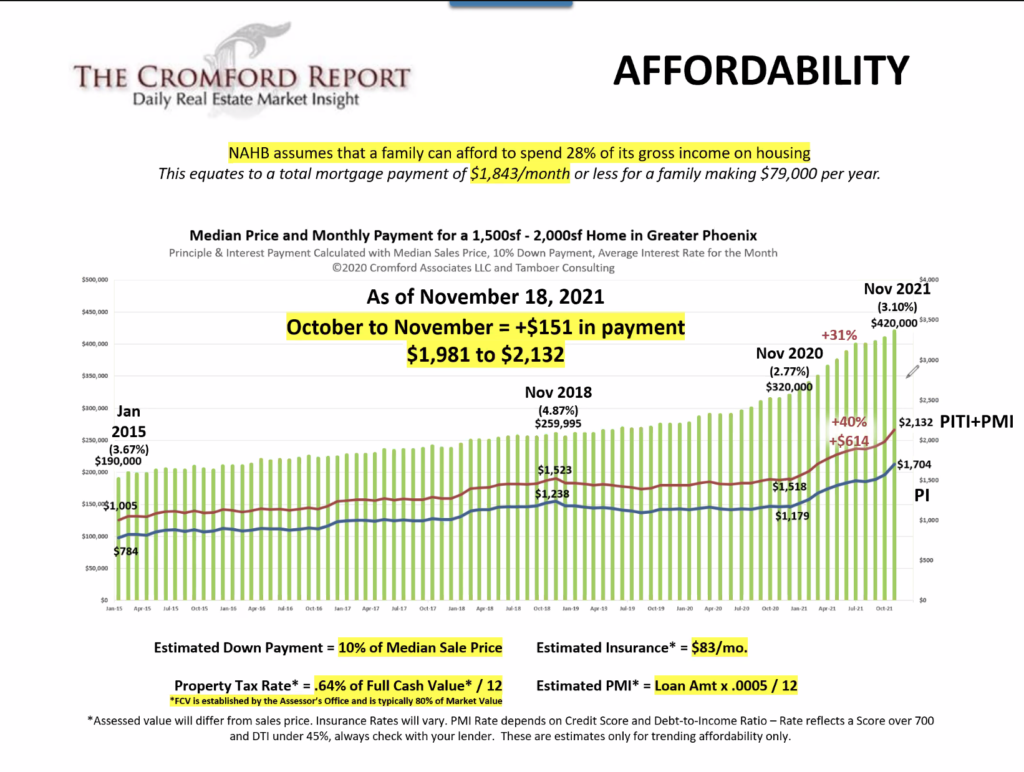

“Will houses get more or less affordable in 2022?”

So long as we don’t have more supply and people continue to move in to AZ as quickly as they have, affordability will be a problem.

Add to that the possibility that interest rates will have to go up at some time –certainly they will if there are fears of inflation on the horizon.

Have a look at this chart. Interest rates have gone up from 2.77% to 3.10% over that last year. That 31% increase in interest rates equates to a 40% increase in mortgage payments on a median-priced home.

The best thing that could happen is that prices could come down on homes. Barring an unforeseen crisis, like water shortages (like I’ve written about in the past), this is not likely. Based on incoming population and the foreseeable shortage in homes, you can feel relatively safe that a home you buy now (even if it is more than you want to pay) will hold its value.

“Should I buy now?”

As we often tell people, the real estate market is not the stock market (and shame on companies like Zillow and others that treat it as if it is). Buy a home if you need it and if you can afford it. In fact, buy a home that is cheaper than you can afford and pay down that debt aggressively. You should be okay.

“Should I sell now?”

If you need to, and if you bought more than a couple years ago, sure. If you own a home that you’ve been using as a short-term rental, I’d almost beg you to sell. Families need places to live more than vacationers need a place to stay.

Contact us if you’d like to dig deeper in to your particular situation at 602-456-9388.

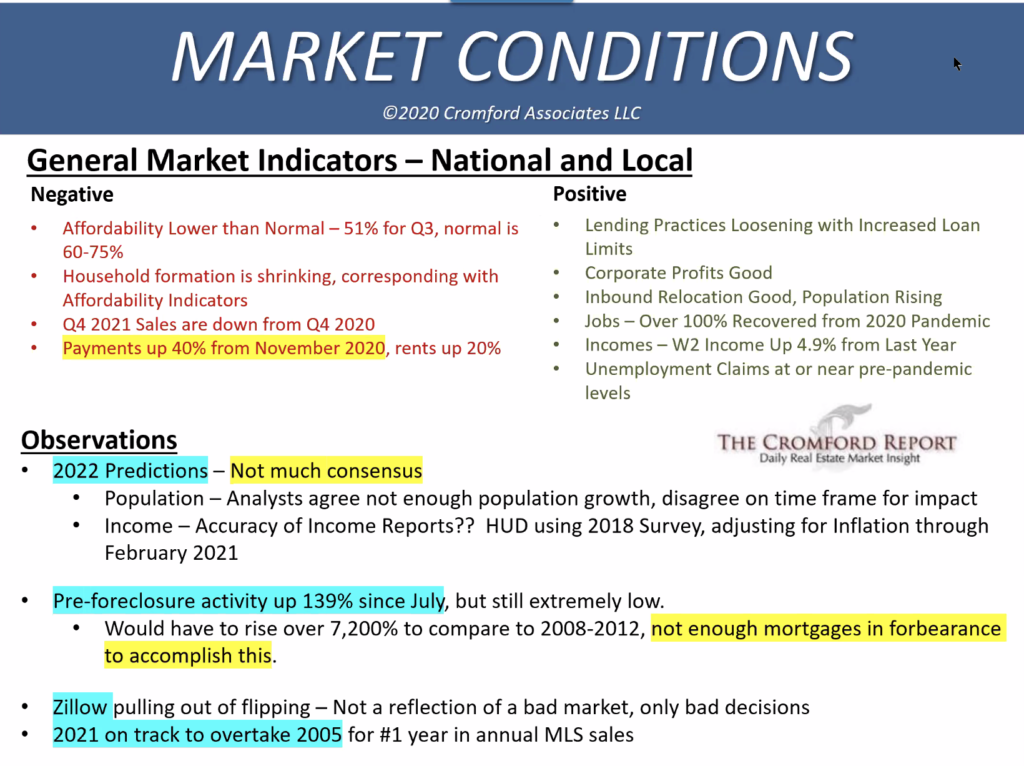

For now, you might find this summary slide from the Cromford webinar to be a great summary.