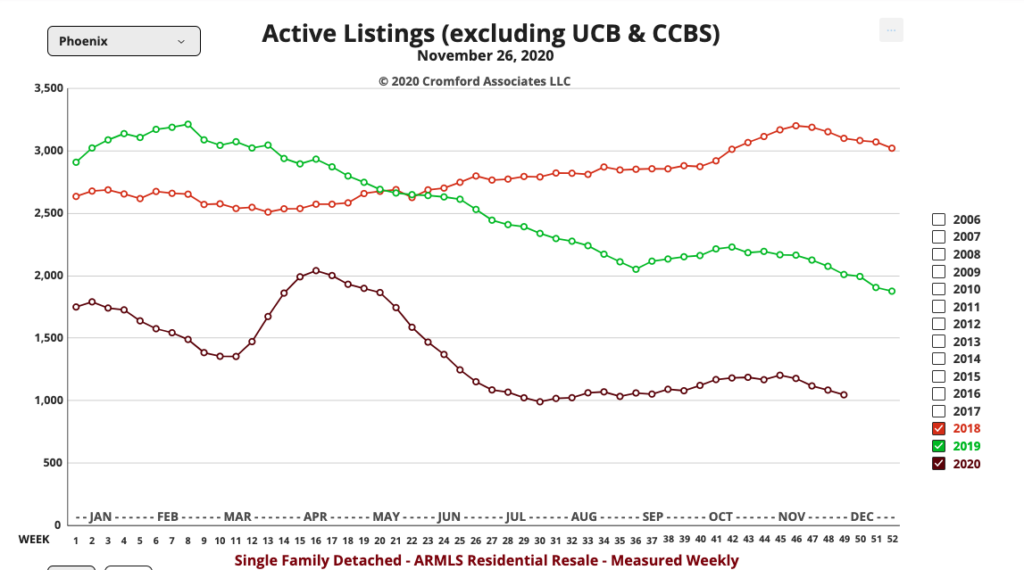

The December Market Update shows the supply problem getting worse. There are only 7,388 listings available in this market, versus 13,869 last year – down 46.7% – and down 14.9% from 8,682 last month.

People continue to ask whether this December market condition is due to Covid. Perhaps. But, I think there are a lot of reasons. I’ve felt for a long time that this problem dates back to the Great Recession. Individuals and corporations starting in about 2009 were buying properties, sometimes 100 at a time, to turn in to rentals. Then, over the past 10 years, people and corporations bought more homes to turn in to short term rentals.

In addition, as prices went up, people who might have wanted to sell and then buy a new home felt they could not afford the move.

In all, these have created a perfect storm in which homes that typically cycle on and off market about every 7-10 years are not.

Here’s what our friends at the Cromford Report have to say about the December market.

“The supply situation has gone from bad to worse with many areas hitting record lows for the number of homes available to buy. This is not because of a low number of new listings. The flow of new listings was respectable in November and exceeded the total for November 2019 and 2018. However, it increased by far less than the annual increase in demand and many of these new listings went under contract within days of listing. We exited November with 15% fewer homes for sale than we entered it. We have run out of adjectives to describe the weakness of the supply situation. It looks almost certain that supply will collapse further during December, so if we had a good adjective we would need a better one for January 3. Demand is extraordinarily strong for this late in the season, so we currently have a market that is more unbalanced (in favor of sellers) than we have ever seen before, even at the height of the 2005 bubble. But next month will be be even more extreme.

There seems to be a certain amount of denial in some quarters. Concerns about delinquency rates and forbearance are being widely discussed. The idea is often expressed that this can reverse the current situation, as if this is a foregone conclusion. We do not think the level of delinquency is anything like high enough to seriously disrupt the housing market. For such drama you probably need to look to the commercial real estate market, particularly the retail, office and hotel sectors. Housing has been bolstered by the pandemic. This is a worldwide phenomenon, not confined to Arizona or even the USA. At times of medical emergency, people really value their homes across the globe.

We would agree that a market cannot keep getting hotter forever, but according to Black Knight Financial Services, the level of delinquency has fallen for the last 5 months. Pre-payment activity is the highest since 2004. It is likely that we will see more distressed sales in 2021 than 2020, but 2020 was a record all-time low and reverting to normal would help a bit with the supply situation. In fact we would have to see a colossal increase in delinquency from current levels just to get back to normal supply conditions.”

We can help you make the best choice in this uncertain market. Contact us or subscribe to the newsletter on the right panel on our home page