When we meet a new client, especially a first time home buyer, we grab a cup of coffee and preview the home buying and sales contract process and.

Nobody explained the process for me when I bought my first house and I paid for it. It makes a huge difference to know what to expect next in the process; what to be ready for.

You deserve better, and we deliver.

So, it’s high time that I put the home buying process in writing so you can read about it in the comfort of your home, in your jammies with a cup of your favorite beverage.

If you want to see the previous installment in this series, see Part 4 at this link.

Part 5: Writing a Sales Contract

So, you found the house you want and you are ready to go.

Hold on. We want to make certain you are not paying too much.

The first thing we do is run comps to make certain they are not asking above market price. Your biggest concern is that you don’t pay too much.

You also don’t want to pay $500 for an appraisal, just to find out that the house is over-priced and the seller is not willing to negotiate.

The second thing we do is go over all of the sales contract with you. We can do that in person, or over the phone; with all of us reviewing the documents on our computers.

We will explain the sales contract as slowly or as quickly as slowly as you would like to understand all of the terms.

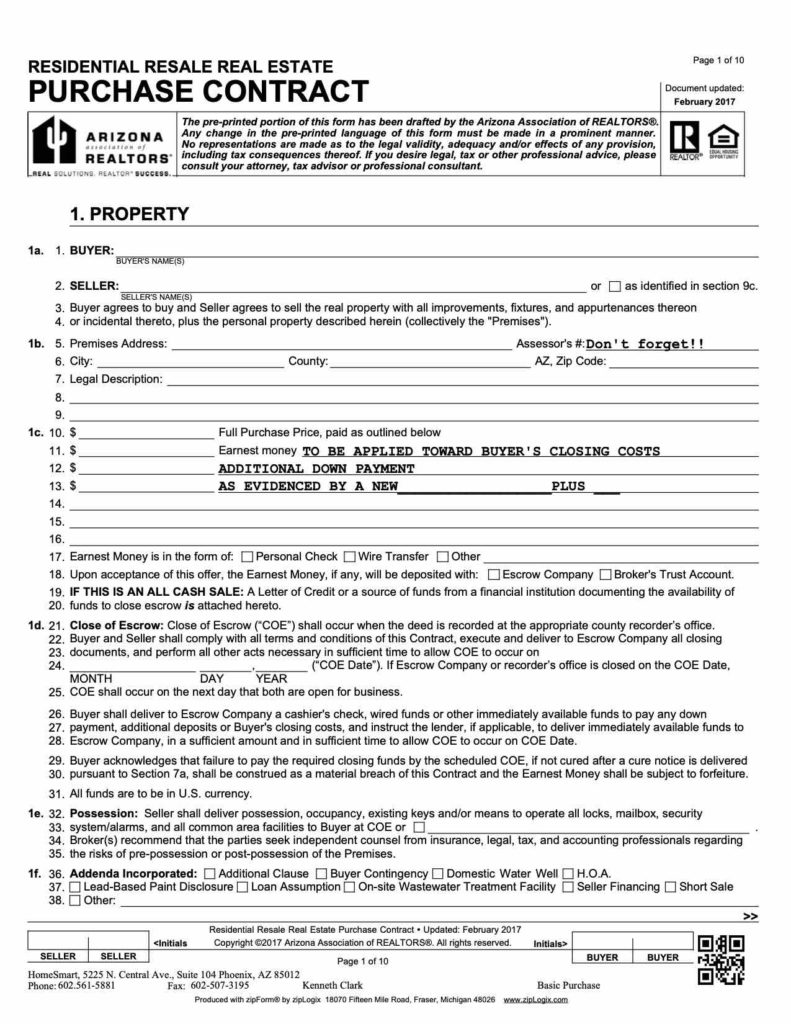

You can expect to see some or all of these sales contracts and addendums:

- The 9-page sales contract.

- The lead-based paint addendum, if the home was built prior to 1978.

- A home owner’s association addendum, which tell the HOA what information to disclose to you.

- A seller property disclosure addendum (“SPDS”), in which the seller should disclose all they know about the property.

- A wire fraud advisory, which just tells you that you should be careful of wire fraud.

- An affiliated business disclosure, in which our broker just discloses that they have sister businesses, such as title services or home warranty services, and that you are not required to use them. We don’t, by the way.

- If both sides of the contract are represented by our broker (even if we’ve never met the other agent), there is a consent to limited dual representation.

So, plan for about an hour to go over all of these and ask questions about what is coming next.

We often use digital signing tools these days, such as Docusign or others so that you can sign from the comfort of your office, or in your PJs at home.

Once we submit the contract, you can expect to see either:

- A counter offer from the seller,

- A rejection from the seller or,

- An acceptance from the seller.

We do all of the negotiating for you. So, you can relax and cheer us on.

Sometimes, but not often, the counter offer process goes back and forth for a few rounds, but that seldom lasts more than a day.

So, be available for calls and consultation.

With contract acceptance, we are off to the next stage: the escrow period.