When we meet a new client, especially a first time home buyer, we grab a cup of coffee and preview the home buying process.

Nobody explained the process for me when I bought my first house and I paid for it. It makes a huge difference to know what to expect next in the process; what to be ready for.

You deserve better, and we deliver.

So, it’s high time that I put the home buying process in writing so you can read about it in the comfort of your home, in your jammies with a cup of your favorite beverage.

If you want to see the previous installment in this series, see Part 2 at this link.

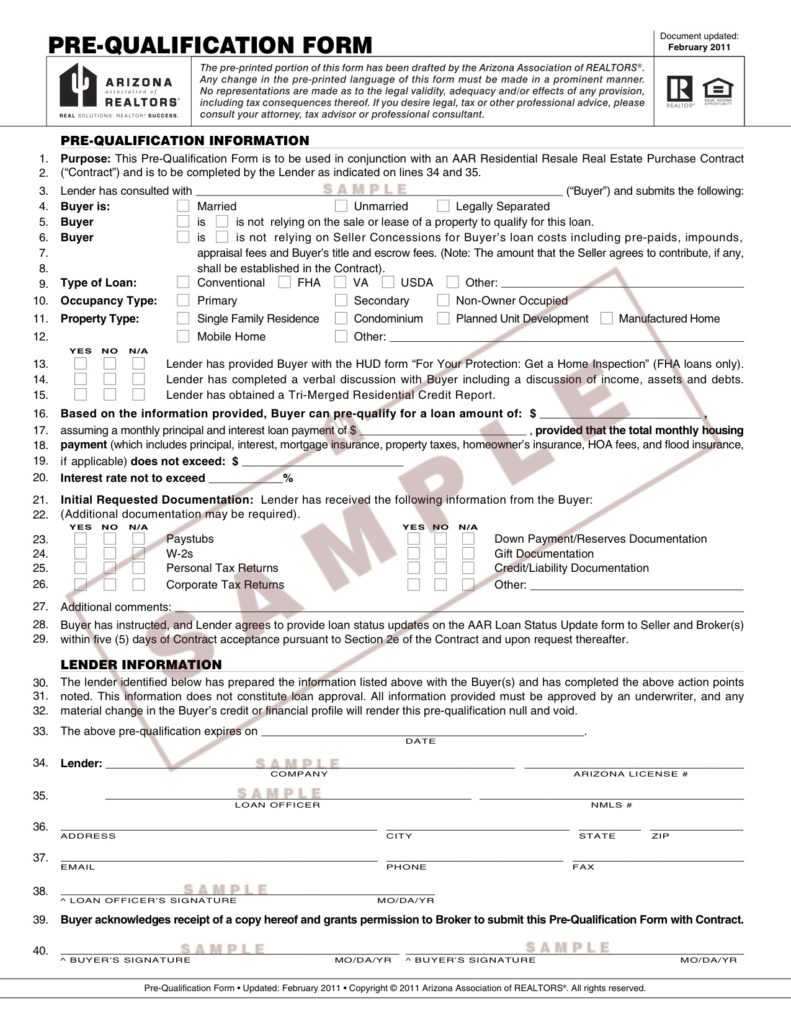

Part 3: Prequalification

First, we don’t prequalify you. Your mortgage broker does. So, let’s start with them.

We recommend to our clients that you don’t go with the big national banks as a lender, if you can help it. We have had better experiences with independent mortgage brokers and locally-owned credit unions.

The big banks are massive bureaucracies and we have found that our clients can feel that in how they must inter-act with them. Expect phone trees and wait times.

We find that independent brokers often have more latitude to help you and more time to spend with you.

Regardless, we recommend that you compare. We typically share a list of several lenders with our clients. You will find that interest rates are often time very much the same between lenders. Naturally, you should compare that.

But, what varies quite a lot is how the lenders relates to you. We suggest that you call several lenders. Ask them about their process, how much they charge for you to get a loan, etc.

See this handy document for some good questions to ask. Here’s a handy HUD document on FHA lenders.

As you are doing this, especially if you are a first time home buyer, ask yourself, “Is this a person I connect with?” Are they brushing you off to an assistant? Do they return your calls? Are they patient with your questions?

Only then should you give them your social security number to run a credit check. If they all run your credit, it can drop your credit score, and that could affect the loan you get.

We are just suggesting that you make certain you are ready to work closely with a person for a month before you make a decision.

Next, we like to tell our clients “Let there Be No Surprises.” In other words, tell your chosen lender everything they need to know about your income and your savings.

We had one client years ago who’s deal fell apart because he failed to disclose that he was still co-signed on a car with his ex-girlfriend, and she would not let him off the loan.

This is important. If you get to three days before close of escrow and only then find out that you can’t get the loan, you may lose your earnest money deposit.

Finally, as a practice, we don’t go out looking at homes until your prequalification is done.

It is the worst feeling in the world for you if you get excited about a house after looking at many homes, only to find that you were never prequalified to buy it.

Sometimes clients want us to get out there with them while they wait for “a last few documents that I have to get out of storage for my lender.”

Sorry. We just can’t. We know how that often goes.

We believe that it is better to be prepared before you start. That is why we are sharing this home-buying process with you and why we recommend you have all your ducks in a row before you set foot in a home.

Next up: The search process using the Multi-Listing Service.