Don’t you love those mornings where you walk outside and get a little puff of “almost chilly” air on your cheek?

Well, along with the cooler temperatures come a little more activity in the market, at least compared to summer. Yet, that comparison between summer and fall does not over-come the year-over-year doldrums that we are experiencing as a result of higher interest rates.

Here is what our friends at the Cromford Report are, er, well, reporting. Notice, if you will that sales prices are actually up from last year by a smidge.

“Here are the basics – the ARMLS numbers for September 1, 2023 compared with September 1, 2022 for all areas & types:

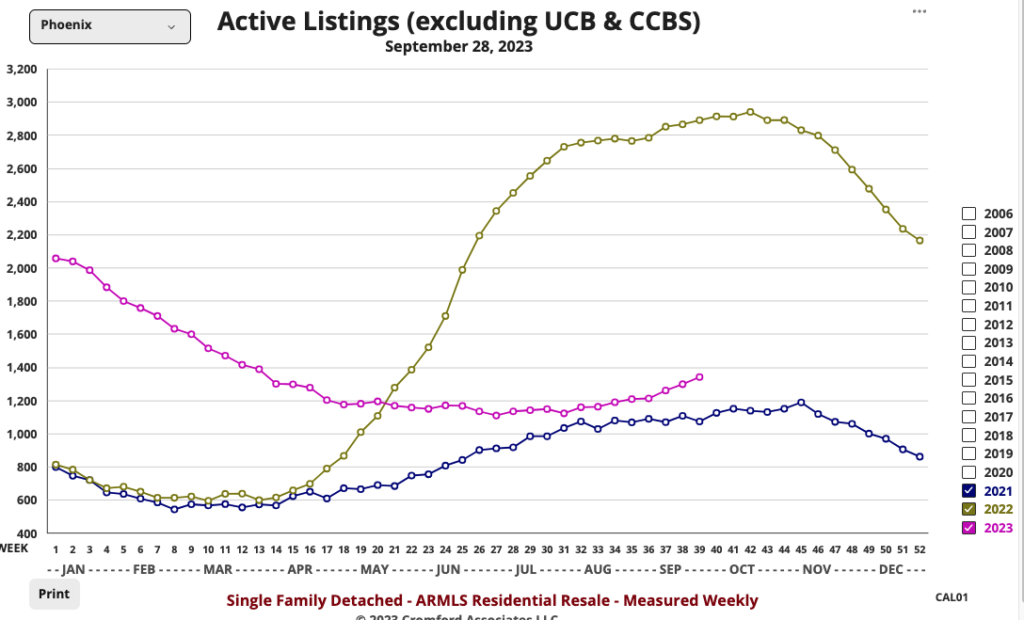

- Active Listings (excluding UCB & CCBS): 13,404 versus 20,084 last year – down 33% – but up 12% from 11,969 last month

- Pending Listings: 4,264 versus 4,862 last year – down 12% – and down 7.4% from 4,604 last month

- Monthly Sales: 5,563 versus 6,460 last year – down 14% – and down 11% from 6,261 last month

- Monthly Average Sales Price per Sq. Ft.: $285.08 versus $276.60 last year – up 3.1% – and up 1.1% from $281.99 last month

- Monthly Median Sales Price: $432,000 versus $439,000 last year – down 1.6% – and down 0.7% from $435,000 last month

Mortgage rates have hit their highest levels in 20 years and the impact on demand can be seen in the numbers. Listings under contract fell another 8.6% from the dismal level of last month. Closed sales were also disappointing dropping another 11% from last month.

New listings remain scarce, but the flow has increased over the last 2 months. Demand is so poor that the active listing count is starting to build, up 12% over the last month. However it remains well below last year at this time.

The balance between supply and demand still favors sellers in the majority of markets, (emphasis added) but negotiating power is swinging towards buyers with every day that passes. Supply rising and demand falling means this trend is gathering strength. If interest rates remain in the high sevens or increase further, then we can expect market balance to hit within 2 months or so. However we usually see a significant weakening of supply from the middle of November to the end of the year and this could temper the downward direction in the Cromford® Market Index.

Demand remains much better in the new home market, though even here buyers will find it increasingly hard to qualify for loans if interest rates get closer to 8%.”