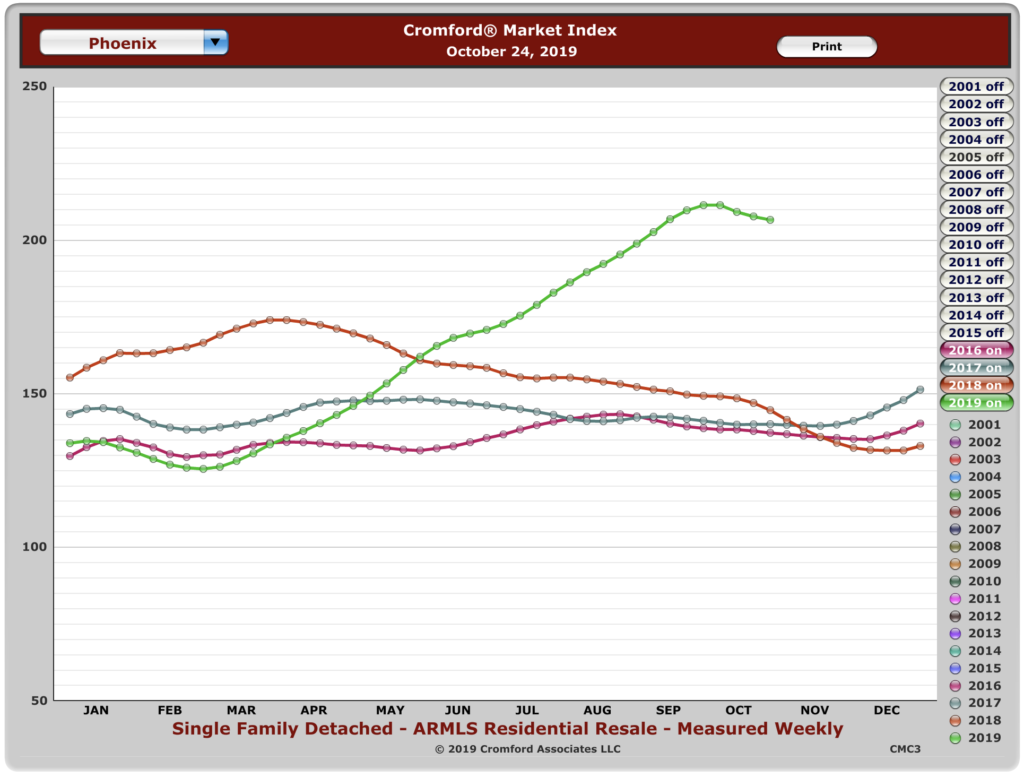

The November Market Update witnesses the Cromford Index (showing seller’s advantage) leveling off a little.

That should not be read as a re-direction in the market.

The Index went from “really high” to “a little less really high”. Plus prices continue to be strong, as described by the Cromford Report:

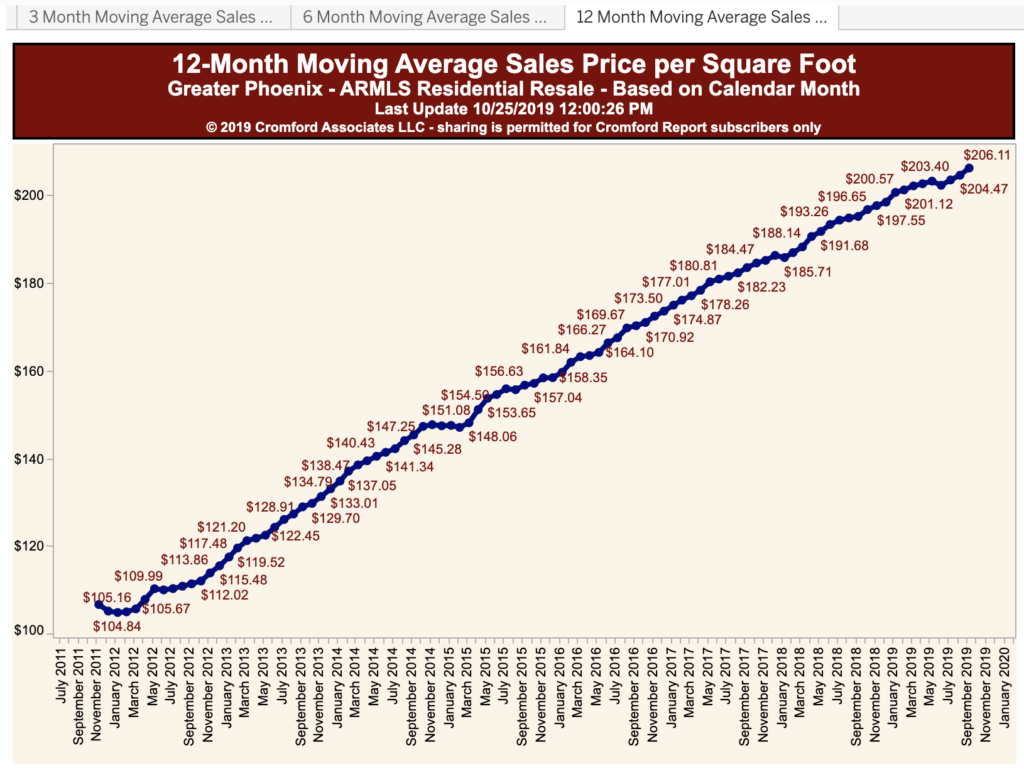

“For the monthly period ending October 15, we are currently recording a sales $/SF of $171.20 averaged for all areas and types across the ARMLS database. This is up 1.0% or $1.74 from the $169.46 we now measure for September 15.

On October 15 the pending listings for all areas & types show an average list $/SF of $178.66, up 1.5% from the reading for September 15.

Our mid-point forecast for the average monthly sales $/SF on November 15 is $173.79, which is 1.5% above the October 15 reading. We have a 90% confidence that it will fall within ± 2% of this mid point, i.e. in the range $170.31 to $177.27.

Average $/SF for listings under contract has been rising fast over the past 2 months. It will be interesting to see how far the average for closed listings follows suit.”

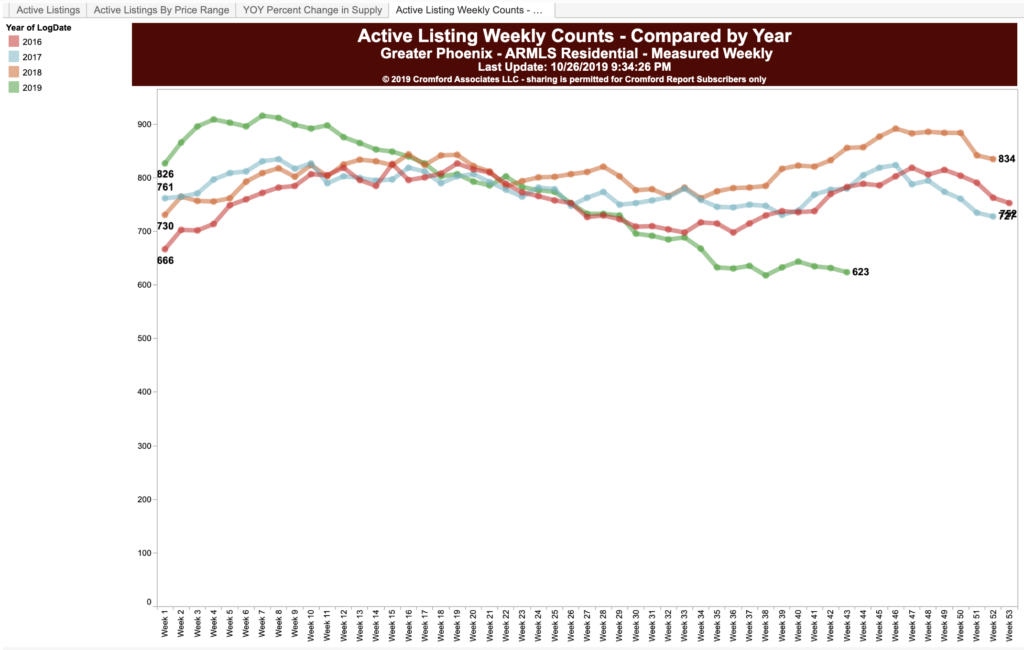

For the Central Phoenix (historic neighborhood-dominated) areas, active listings are starting to recover a little, as they are valley-wide. You might recall that over the last months we were concerned about the low inventory, as compared to previous years.

What we need more than anything is for more listings to come on the market to increase affordability for those looking for a property.

But, if you have been thinking of selling, now might be the time. We are seeing signs of over-all economic shifting, and that could mean real estate market shifts to follow.

Call us at 602-4546-9388 and let’s build a strategy that is right for you.