I’m picking up mixed signals in the market right now. While I can’t explain what’s happening, I wanted to share it with you for your consideration.

On Saturday I showed properties around the valley and saw the first of the mixed signals. Of the four houses I showed, three of them had buyers either finishing up their appointment or waiting to look after our clients.

So, multiple potential buyers. I’ve not seen that since this time last year. One property had multiple offers prior to our showing.

Another property had the sellers son and nephew sitting around drinking beer in the living room and looking at their computers while we showed. Needless to say that did not go over well and gave a different sort of mixed signals: “I want to sell this out, but I really don’t want to appeal to anybody.”

Anywho….

While this represents an anecdotal experience, I’ve learned not to ignore things like this. However, the Cromford Report tells us that the number of buyers is dropping and, oddly, the number of listings.

“Here are the basics – the ARMLS numbers for December 1, 2022 compared with December 1, 2021 for all areas & types:

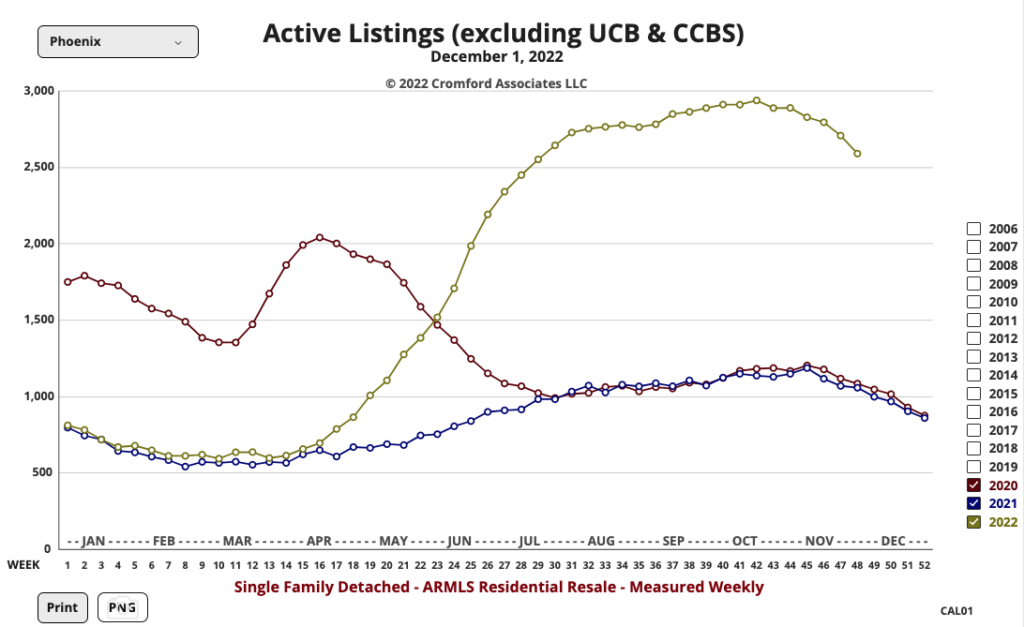

- Active Listings (excluding UCB & CCBS): 19,155 versus 6,825 last year – up 181% – but down 6.9% from 20,582 last month

- Pending Listings: 4,301 versus 7,830 last year – down 45.1% – and down 2.5% from 4,411 last month

- Monthly Sales: 4,909 versus 8,957 last year – down 45.2% – and down 9.5% from 5,425 last month

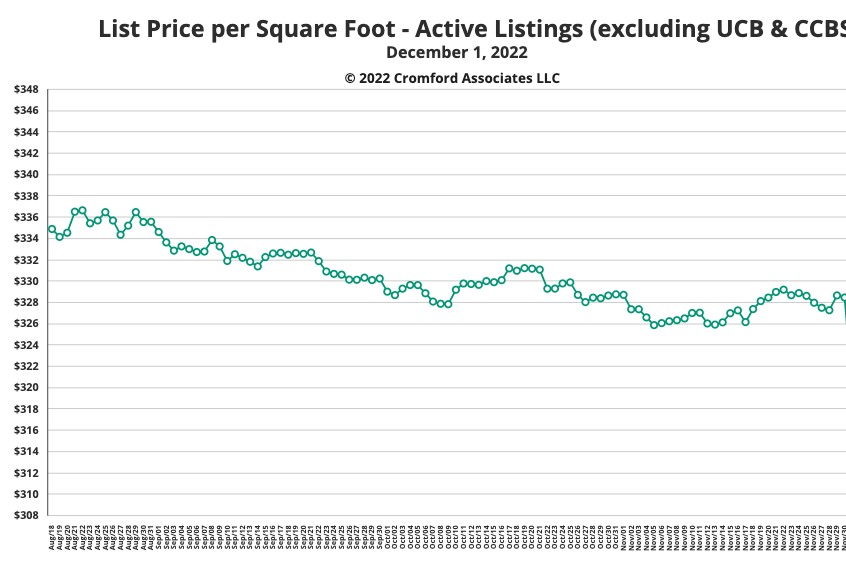

- Monthly Average Sales Price per Sq. Ft.: $272.34 versus $264.36 last year – up 3.0% – but down 1.6% from $276.79 last month

- Monthly Median Sales Price: $420,000 the same as last year – but down 3.7% from $436,000 last month

Demand not only remains weak, but it became even weaker during November with under contract listings down 3% from a month earlier and sales down a massive 45% from a year ago. After so many years with strong demand this feels very unusual and a little unnerving. This lack of demand is far worse for re-sale homes than it is for brand new homes, which are experiencing relatively brisk closings and little downward pressure in gross contract prices…

The big news since last month is that supply has changed direction and is now declining fairly rapidly. Almost 7% fewer active listings than a month ago means sellers have less competition.

Mortgage interest rates have stabilized and if they were to fall meaningfully, demand might recover once the new year is well underway. However, no-one can really predict the next interest rate move with any confidence.”

That previous point about the decrease in listings may indicate why I was seeing lines of people to look at homes. Hopefully the market will respond with more listings.