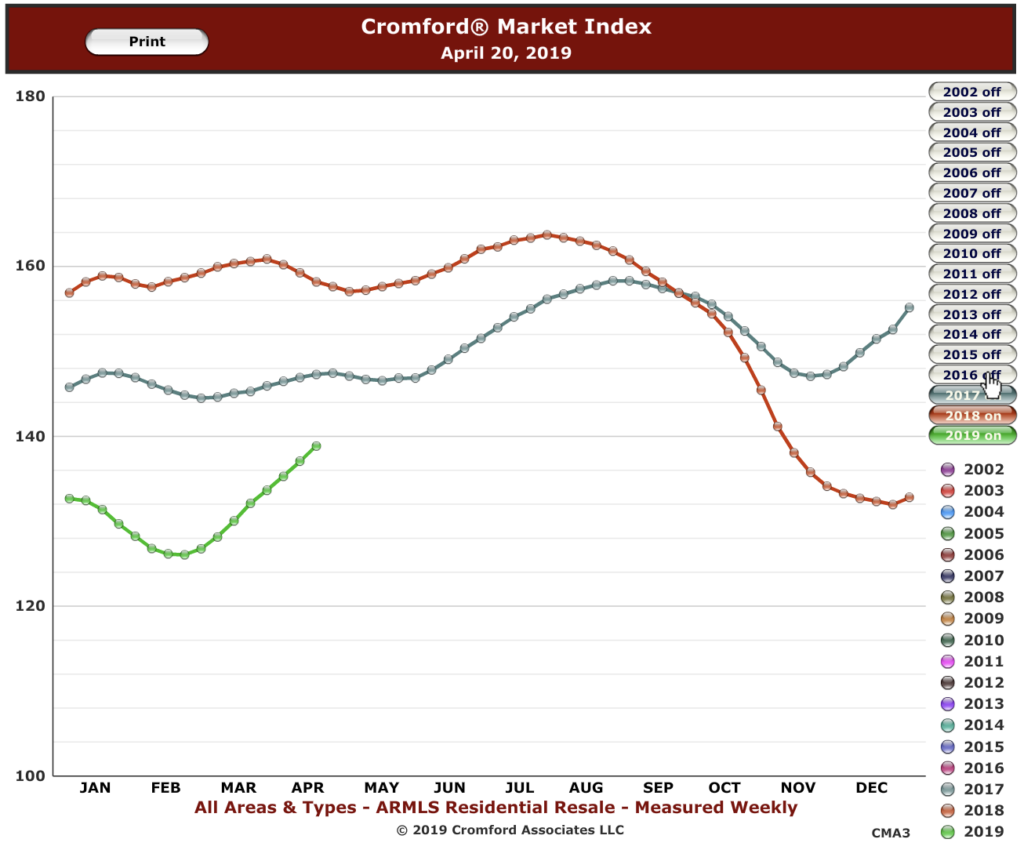

It’s been a crazy last few months. At the end of last year, we saw signs that the market was flattening out. You might recall that the Cromford Index took a bit of a dive last year, and in to the beginning of this year.

But, around about the beginning of March, it began a healthy upward climb.

For those of you who follow our analysis, you know that the Cromford Index is a great predictor of where the market is going. It tracks a list of proprietary data, which we know includes things like price drops and seller concessions.

As such, it can confidently predict whether the seller’s advantage is slipping or gaining.

So, what does that mean?

It’s a particularly interesting question when you consider that sales price per square foot ($/SF) is still flat? According to the analysts at Cromford:

“For the monthly period ending April 15, we are currently recording a sales $/SF of $171.31 averaged for all areas and types across the ARMLS database. This is down 0.3% or 57 cents from the $171.88 we now measure for March 15. Our forecast range mid-point was $170.73, with a 90% confidence range of $167.32 to $174.14. The actual result was a little higher than the mid-point but well within the 90% confidence range.”

Part of this has to do with how long it takes houses to close. The homes that went under contract while the Index was dropping are now showing up as completed sales. To quote Cromford again:

“The average $/SF has been stronger than predicted over the last 3 months, but this was largely due to the mix of homes that closed. High end homes were better represented in January through March. The average $/SF for pending listings has fallen back a little over the last 2 months as the mix reverts closer to normal. The overall price trend continues to move higher, as is normal for the spring season, but we see April and May both lower than the March reading which was exceptionally strong.”

So, what does this mean for you? Well, if you were thinking of selling and you were concerned that your advantage was weakening, it is not.

Dire predictions of a flat market (from us, as well), were premature. Just bear in mind that “summer is coming,” and if you are selling you are better off listing before people leave for cooler climates.

If you are buying, you definitely want to get in now before prices go up. This is particularly true if you are looking in CenPho. As we’ve discussed in past blogs, the maddening pace of building of apartments and the anemic construction of owner-occupied properties in this area could create a shortage-like condition.

It is almost impossible to find a home under $300,000 in Cenpho, unless it needs major renovation. There are townhouses and condos, however.

Contact us for more information and targeted market analysis at 602-456-9388.