In this part two of a multi-part series. I’m exploring at how investors and other factors drove driving up home prices and what we should do to keep it from happening again.

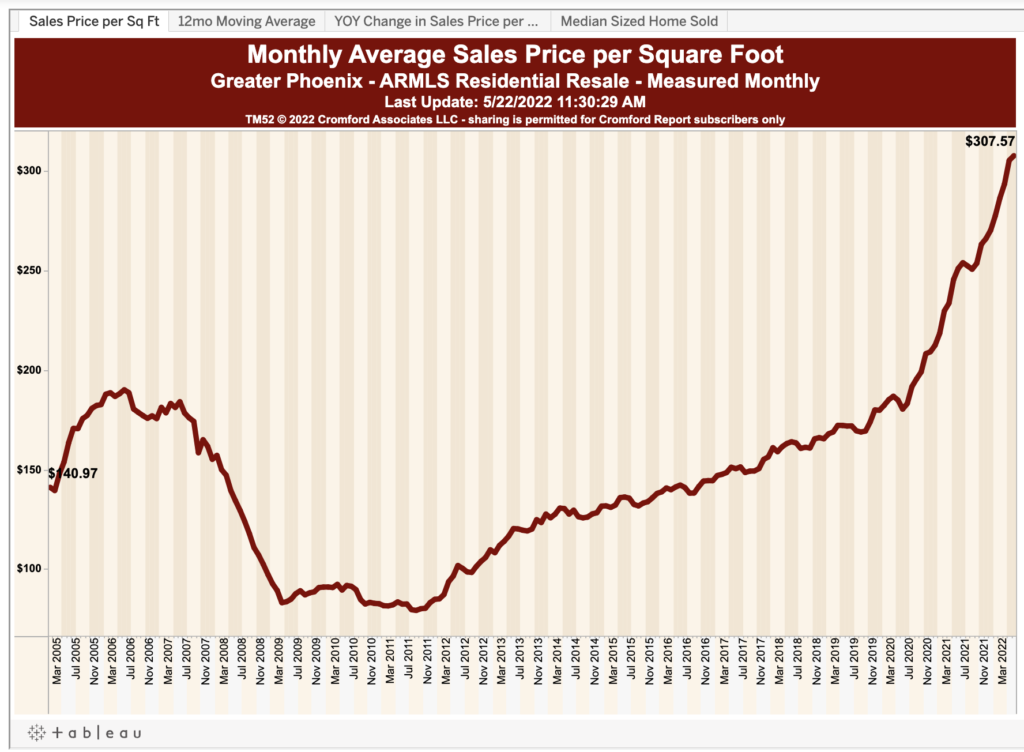

Home prices are up dramatically in Phoenix over the last few years. The price per square foot today looks down on the seemingly manic days of 2005 like a quaint hill across a valley, as if viewed from a mountain top.

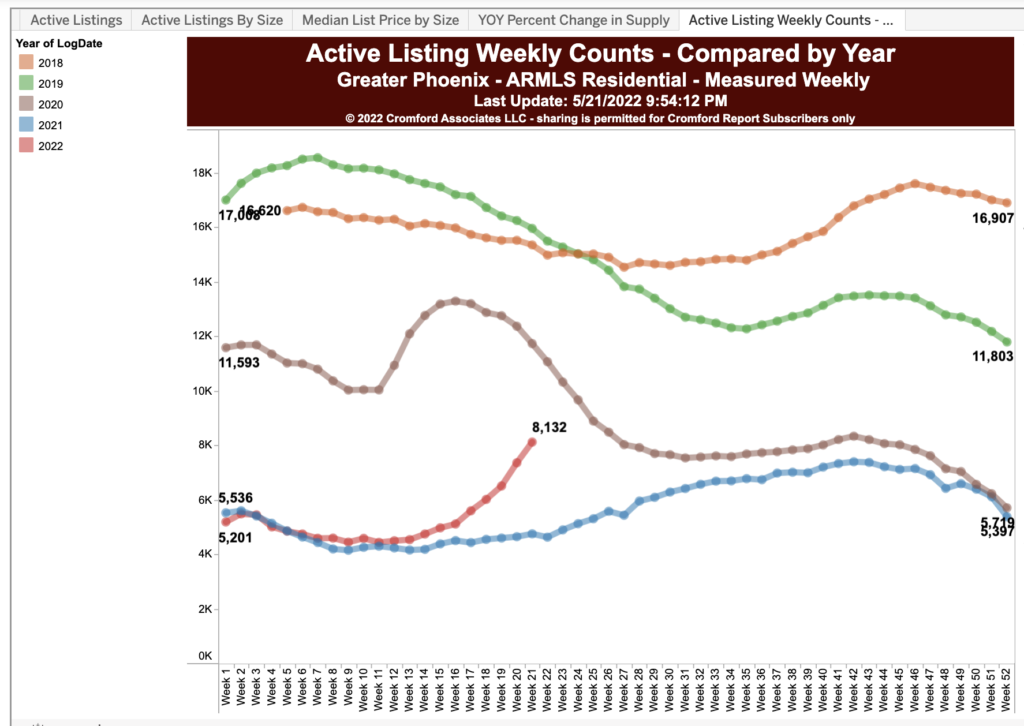

The available inventory, seen below in different colors representing the last four years, is a weak shadow of the flood of homes we feared in 2009 would sit empty for a generation.

It’s gotten to the point that new home buyers are dropping out of the market. Or, they are signing up for mortgages that may be unsustainable in the long term, which are also driving up rents for those who can’t think of purchasing a home, and which are ultimately contributing to increases in homelessness.

We have a huge problem, and no clear end in sight.

Let me begin this series by saying that, if you are looking for a single enemy or scapegoat to pin this problem on, you won’t find it.

This is a layer cake of contributing factors. Some is outright institutional greed. Some of it is political and some of it is downright short-sightedness. To be sure, there are reckless actors who care little about the health of our communities. But they are playing in the ball park that we all built though countless small actions.

If you are a regular reader, you might have heard this: the number of homes available for re-sale has been shrinking every year since the Great Recession.

The Layer Cake of Causes

First, investors bought homes in the tens or hundreds at a time, sometimes reselling, but often turning them to rentals.

Second, over the decade, mom and pop investors got in the game, lapping up even more.

Third, political fights over immigration prevented the US from having a working visa program so home builders could meet labor demands.

Fourth, both individuals and companies got in to the short term rental (“STRs”) game, draining even more homes out of regular market rotation.

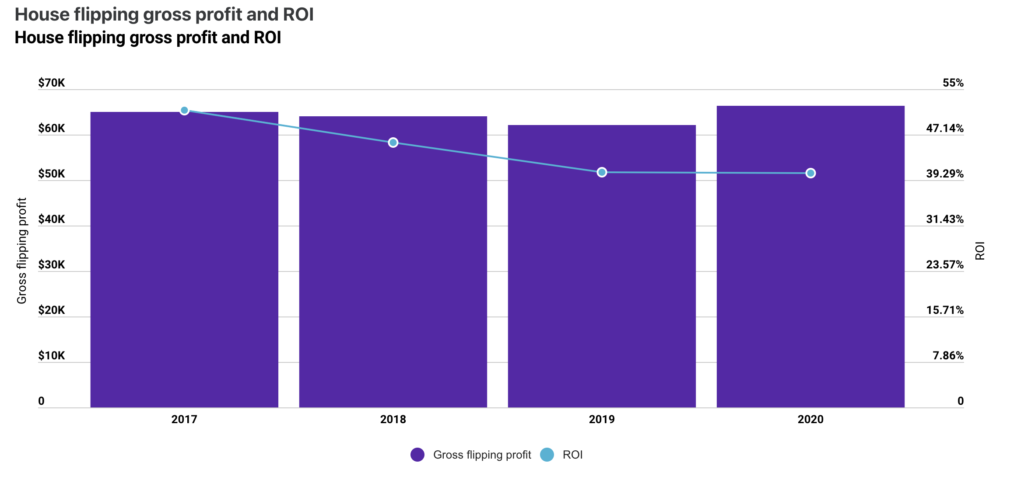

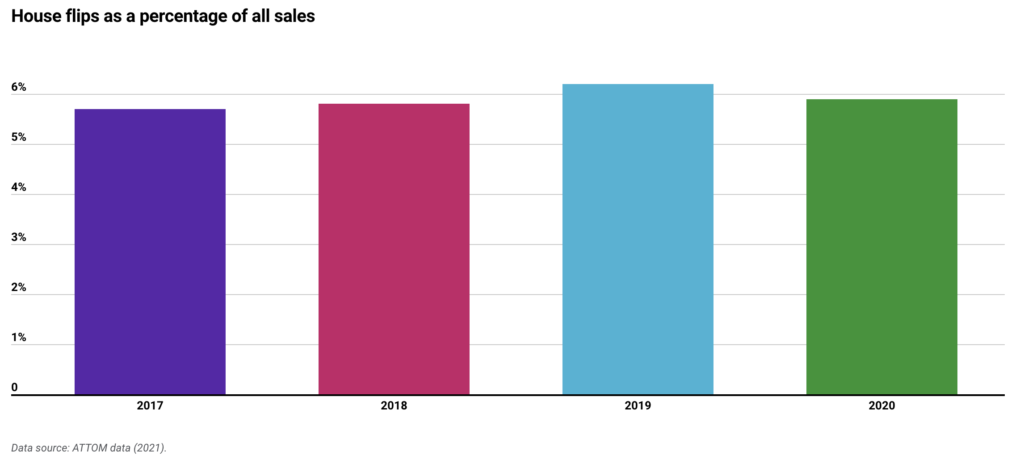

Fifth, house flippers were grabbing 40% profits on their often meager renovations, which added to price increases.

Sixth, private equity firms –fueled by massive pension funds from states and universities– got in to the game, turning hundreds of thousands of homes in to permanent rentals.

Seventh, the ability of condo developers to build lower-cost owner-occupied homes was curtailed because they could not get insurance to cover the increased amount of post-build litigation.

Eighth, NIMBY neighbors have successfully resisted in-fill projects for low-to-moderate income housing.

Ninth, as we approached 2019, empty nesters –who would normally sell their homes to down-size– found that they would be paying more to live in a smaller home. So, those homes did not cycle on to the market.

Tenth, COVID supply chain shortages have delayed projects, raised costs and pushed otherwise new home buyers to the existing residential markets.

So, the reasons are many and the solutions are complicated.

But, we need to look at ourselves, as voting citizens for the answers. The market investors won’t solve this any more than they solved high price issues in 2006. In fact, if we rely on market actors, we will see the next Great Recession.

In this multi-part series, I’m going to focus mostly on private equity firms, other investors and STRs. I’ll look at the arguments against them, the arguments for them and finally some suggestions for how we can get out of this mess.

So, stay tuned in this newsletter and on the GetYourPHX.com blog roll for the next installment.