This February update is a bit redundant, isn’t it?

Well, not the February update, itself. I should clarify. But isn’t it getting old to hear that we STILL don’t have enough inventory?

The take-away:

- If you want to sell, do it! You will sell quickly at top dollar, even if you don’t renovate.

- If you are buying, expect multiple offers. But also, don’t expect prices do come down any time soon.

Below are some excerpts from the Cromford Report, real estate market update analyst gurus. (In case you are wondering, this is a special service for realtors and we use this to give our clients an advantage in the market.)

“…the ARMLS numbers for February 1, 2021 compared with February 1, 2020 for all areas & types:

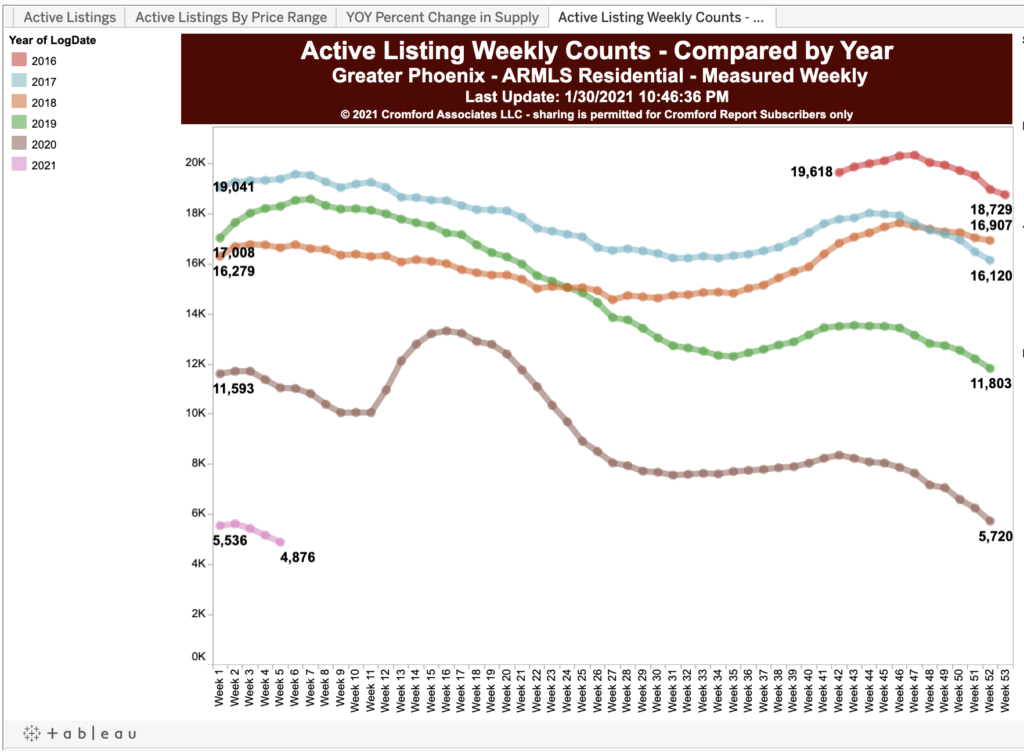

- Active Listings: 5,180 versus 11,974 last year – down 56.7% – and down 14.5% from 6,055 last month

- Pending Listings: 7,070 versus 5,969 last year – up 18.4% – and up 15.2% from 6,135 last month

- Monthly Average Sales Price per Sq. Ft.: $217.59 versus $182.18 last year – up 19.4% – and up 2.9% from $211.50 last month

- Monthly Median Sales Price: $339,000 versus $289,900 last year – up 16.9% – and up 2.1% from $332,000 last month

January is usually a very good month for new listings and overall supply tends to be stronger at the beginning of February than it was at the turn of the year.

However 2021 has been completely different. New listings arrived in the weakest flow we have ever recorded and although demand subsided a bit, it was more than strong enough to soak up almost everything sellers could offer. Instead of rising, supply collapsed another 14.5% during January.

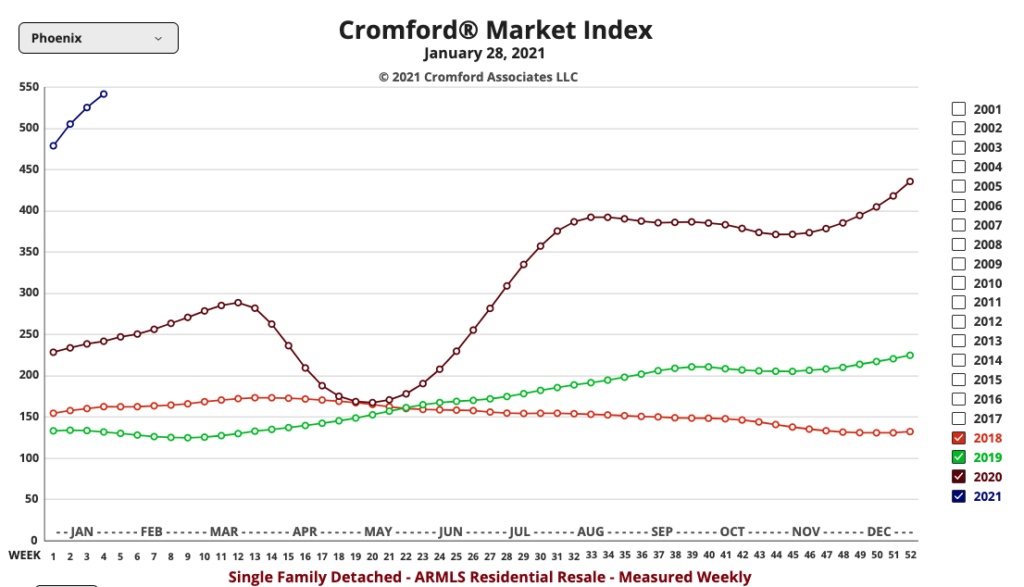

When supply is this low, it starts to drag demand numbers down with it. Sales volumes are limited by the number of homes for sale. Although they are still much higher than January 2020, sales counts and under contract counts are not growing as fast as normal. This is probably due to a combination of factors: higher interest rates, lack of supply and affordability concerns.

Prices rose by almost 3% over the last month, so in theory demand should decline as prices increase. We will see how true that turns out to be as prices are set for extremely high rises over the next several months. The annual appreciation rate has already surpassed 19% and could easily reach 30% by the time we are well into the second quarter.

There is currently no indication that supply trends will improve and at the moment it looks like supply will drop further over the next 2 months. We would not be surprised to see demand continue to trend lower, but this will have little effect on prices. We already have far more buyers than the market can support. Our best guess is that the average price per sq. ft. will continue to rise at about 2% to 3% per month for the next several months.

If you need help navigating this market, call us at 602-456-9388.