Expect slower activity around the holidays, but a boost in the near year as all those people who were put to sleep by turkey, or were busy hiding their elf on the shelf all December decide to get active again.

From our friends at the Cromford Report:

Here are the basics – the ARMLS numbers for December 1, 2023 compared with December 1, 2022 for all areas & types:

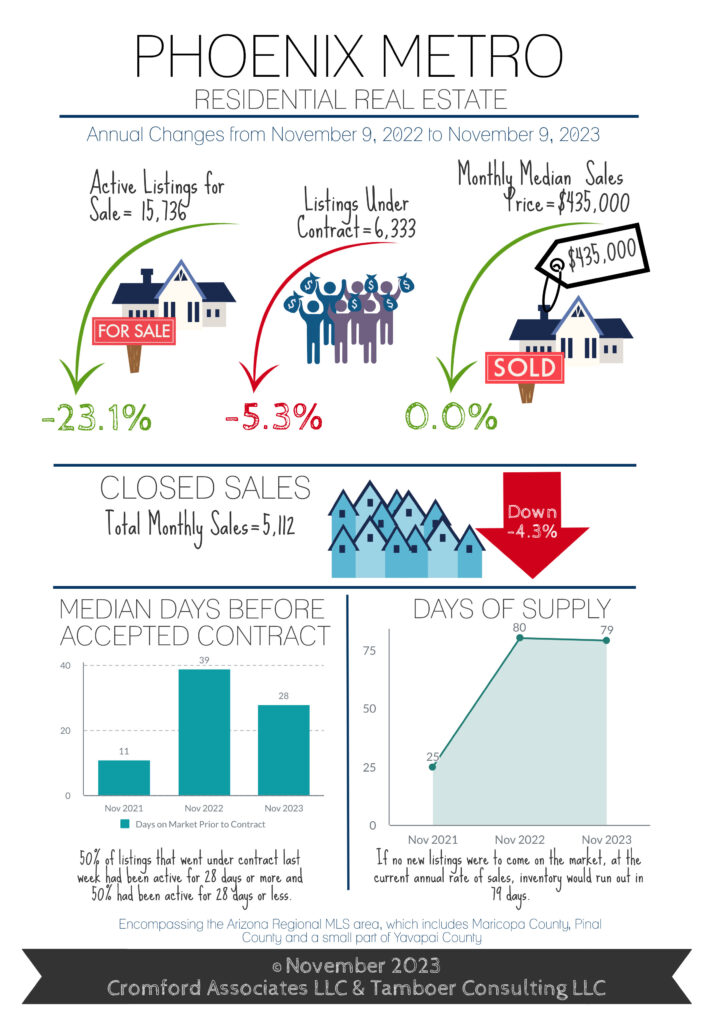

- Active Listings (excluding UCB & CCBS): 15,981 versus 19,155 last year – down 17% – but up 4.8% from 15,247 last month

- Active Listings (including UCB & CCBS): 18,050 versus 21,206 last year – down 15% – but up 4.0% compared with 17,364 last month

- Pending Listings: 3,798 versus 4,301 last year – down 12% – and down 2.9% from 3,911 last month

- Monthly Sales: 4,616 versus 4,928 last year – down 6.3% – and down 11% from 5,210 last month

- Monthly Average Sales Price per Sq. Ft.: $288.97 versus $272.29 last year – up 6.1% – but down 2.1% from $295.13 last month

- Monthly Median Sales Price: $439,000 versus $420,000 last year – up 4.6% – and up 0.9% from $435,000 last month

After rising during October, and peaking at an average just over 8% mid-month, mortgage rates declined thereafter and tumbled throughout November. In theory this should have injected some life into housing demand, but there is precious little evidence of this in the numbers above. We have fewer homes under contract than last month and far fewer than a year ago, when we were all depressed about the low demand. Sales counts are also down from last year and last month reaching the unusually low level of 4,616 in November.

One reason for the severe lack of demand may be that home prices are noticeably higher than a year ago, something few people were predicting 12 months ago. Over the last months there were mixed signals. The median sales price grew almost 1% but the average price per square foot dropped by over 2%. This followed a sharp in crease the month before. When this happens it is usually caused by the luxury market. With much lower unit volumes, the luxury market can vary a lot month to month and the effect on the $/SF can be substantial. The luxury market has negligible effect on the median sales price. The median sales price tends to be strongly influenced by unit volumes at the low end. Despite the weak demand, supply is still below normal which is preventing prices from tumbling. Supply has risen for several months but is now stable again as few people list there homes in December and several take their homes off the market for the holiday season. We anticipate more supply appearing in January.

The new home market continues to outperform the re-sale market. Mortgage rate buy-downs have kept new home demand at a healthy level.

December is not usually a month for us to see a flood of new home buyers, so we anticipate the the second half of January will tell us whether buyers see a big difference between mortgage rates around 7% compared with 8%. The last 12 months have been full of surprises, so caution and watching the statistics carefully is still the order of the day.