You know those companies that claim they will sell (or buy) your house for about 1% commission, and that it’s all hassle free? Beware!

They come from those big companies that are just buying homes, left and right, then putting them back on the market with little or no renovation. I won’t mention names, because I’m hearing that agents like me are getting letters from attorneys if they mention them by name.

That is not only scary, but should tell you all about the caliber of people we are dealing with.

This video gives a real example of the fees that could wipe out everything you think you are saving, and more.

If you are not feeling like watching the video, here are the two most important things to watch for.

#1 – Watch for hidden fees –or whatever they are going to call them.

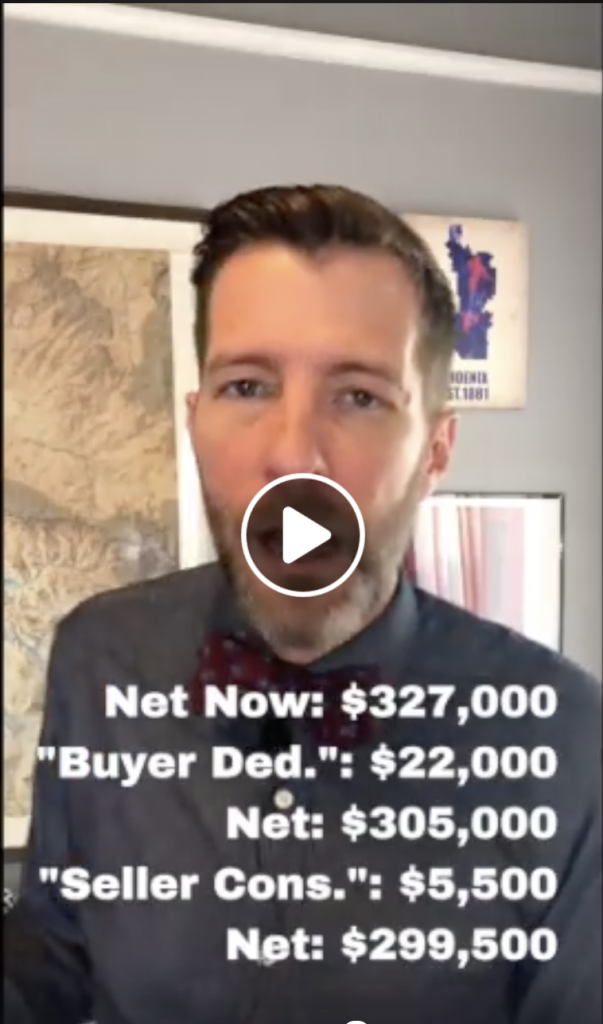

I looked at a settlement statement from a couple to sold their home. I won’t share their names, but here is what I found. The total sales price was listed as $330,000.

(Let’s assume for this example that the offer was actually FAIR for the market, which they usually are not.)

First, there was a buyer’s agent commission at just under 1 percent.

Sounds good, right? Only 1%!

What a savings!

Wait for it….

Then there was a thing called a “buyer deduction” at about $22,000!! What is a buyer deduction? I dunno, other than to say it is less money that the seller got to keep and more than what an agent would normally charge to do the work.

Next there was a “seller concession” of about $5,500. Now, seller concessions are normal. Maybe you pay the buyers’ closing costs. Or maybe there were repairs that you don’t feel like repairing. So, you give a credit.

Was there really that much that needed to be repaired? I have hardly ever seen a seller concession of this magnitude, and probably never on a house at this price point.

We know that the buyer was not a first time home buyer in need of closing cost support. The buyer is a big house flipping company!

If you add up the commission, the “deduction” and the concession, that’s over $30,000 — Or in this case about 9.4% commission.

Had we listed the home, we would have happily worked with them on the commission. Remember, you have the right to negotiate the commission. Nothing is standard.

#2 – Who is representing you?

I know some folks think that realtors just sell homes and then buy a new car. That may be true on TV, but not in the real world for the vast majority of us.

That aside, in this particular case the buyer got the seller to give up about $5,500 in a seller concession, on top of everything else. So, when the “1% buyer’s agent” tells the seller –whom the agent DOES NOT REPRESENT– that they need to pay a concession because the buyer found something in the inspection, who do you think they are representing there?

Right! The buyer!! They have no fiduciary responsibility to the seller.

This is why you get an agent. If you have a contract with an agent, he or she has a fiduciary responsibility to you and could face fines or the loss of license if they don’t keep your interests in first position.

Good agents will protect you. We advise you and we fight back on your behalf.

Period. End of story.

These folks were not represented and they left at least $10,000 on the table.

Now, I happen to know that they did this because they did not want to have to deal with showings or open houses.

First of all, if you don’t want to have an open house, you don’t have to! In fact, there are fewer and fewer open houses all the time. More buyers just want to look at images on line before they call an agent to get a live showing.

Second of all, let’s say you have 10 showings before somebody brings an offer. If you left $10,000 on the table, because you did not want to coordinate leaving the home for a showing, you just paid $1,000 for the privilege of not having a showing.

That’s a lot of money!

Hey, in the end a wholesale buyer may be the right choice for you. We get that. But we suggest two things:

- It is the vast minority of situations where you would really be at an advantage to give up this kind of money.

- Please, please, please please be sure to do your research about these hidden fees before you choose to act.

You don’t have to call us. Call any licensed, experienced agent. Ask them to do comps for you. Ask about what fees and other deductions are coming out.

We are more than happy to compare what we do and how we protect your interests to these guys. Call us at 602-456-9388.