In the US, we mix up terms all the time. It makes public debate and conversation about health, public health and healthcare difficult.

Public health is not the same as healthcare, or a public option, or clinical medicine.

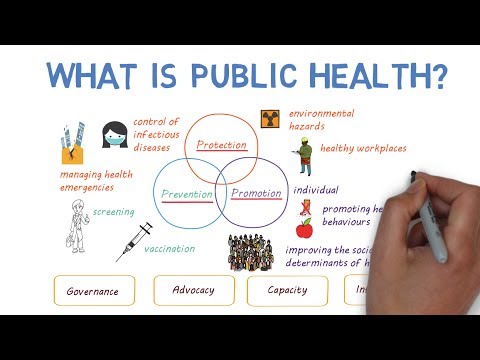

Public health is the branch of medicine dealing with how one person’s health relates to another’s, including hygiene, epidemiology, and disease prevention. It is the science of organizing masses of people and entities to maintain our shared health as a nation or a species.

It mostly lays dormant until natural disasters or the spread of disease, like this one.

Healthcare is a broader, catch-all term, which can apply to a public option for healthcare or a private option.

I’ve been trying to stay out of the social media pile-on of the Arizona Governor’s handling of this crisis. The same with the President, although that has been much harder to do.

I will just make one point, for your consideration. Over the past decades, federal and state governments have been cutting the budgets that we need to maintain a strong public health response.

Do I have data on that? Nope. Not right now, and I’m not going bother my friends in government to get it. They are dealing with a pandemic. But, you can be certain I’ll be following up with this later.

My perspective is that some lawmakers have seen “public health” as something that they don’t use, or that is only for “those people who didn’t make good life decisions.”

It is a second thought. It has been something that some ideologues in government think we should not spend money on.

That’s the problem. Because we have not fully funded public health, we were caught off-guard.

We did not have systems in place to communicate accurate information, and push back against the false information out there –sometimes with a profit motive behind it.

We did not have the ability to roll out testing quickly. We did not have the stockpiles of masks that we needed. We were not able to have the extra beds ready for this –remember that the free market hospitals see extra beds as “waste.”

Look at how South Korea responded vs the US. They have a strong public health system and they were ready.

Also, when you think about it, doesn’t the term “public health” make you think of state-owned hospitals, all run-down and drab?

In our country, we have been told for so long that “public” things are somehow lesser than private things. Public buildings are not as good as private one. Public pools and parks gave way to private pools and parks.

So, the word “public”, placed in front of “health” takes on a lesser-than status.

Again, I have no data on this. I’m not a pollster or linguist. Just observation from years in public service.

So, rather than being part of the daily Twitter fight, I hope that we will all file this thought away and come back to it once we are through this crisis.

Then we can begin the long process of re-building our public health system.

Perhaps we need to re-name it something that is clearer and brings a more positive image of its purpose. Maybe societal health or shared health or ‘merica! health.