I’ve been a reform-minded guy for a long time, in addition to being a realtor. Over the years, I’ve written about necessary political reforms that impact you as a home owner. These following four reforms are pretty crucial to healing our democracy.

As we start 2021 (hopefully fresh), we need to take a deeper look at reforms.

You can’t have good outcomes if your voting system is a mess. Our is.

The system intentionally discourages participation (at least in Arizona), even as individuals work to bring out more voters. The system creates a feeling among voters that their votes don’t count. I excludes many people.

Setting aside lies about voter fraud in America and the many laws in place that are nothing other than voter suppression, I put together these four reforms that politicians will never get behind, but which could dramatically improve our democracy if regular people like you step up and make it happen.

I’ll summarize here, with links so you can dig in a little, if you are so inclined. These four reforms address specific and inter-related issues around corruption, fair representation, finding common ground.

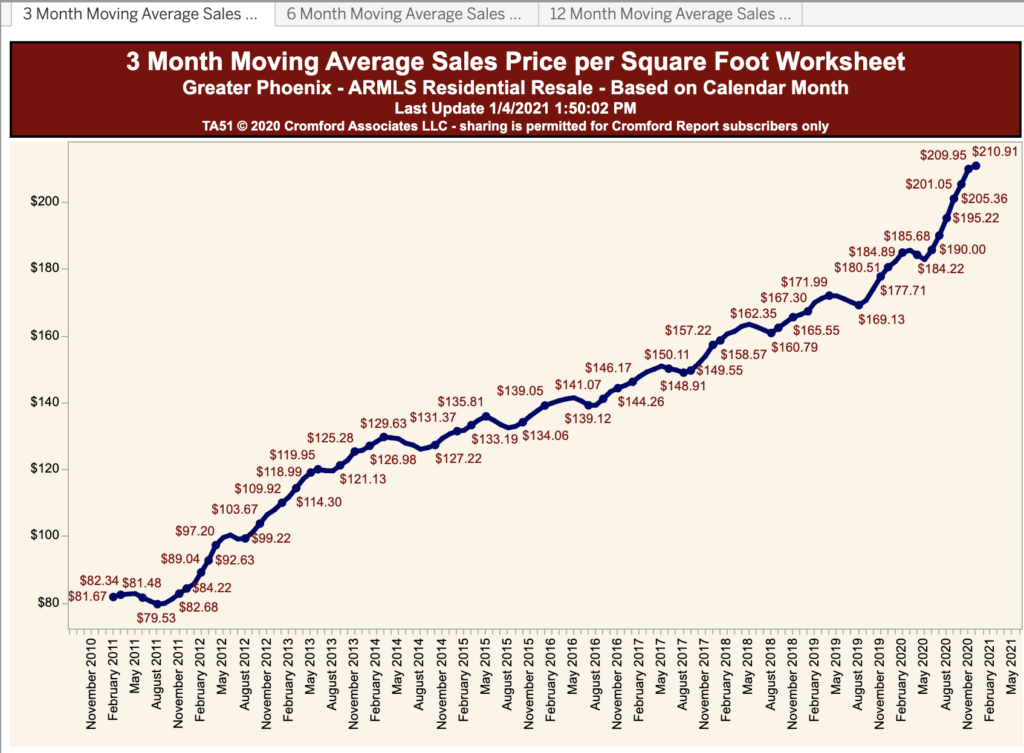

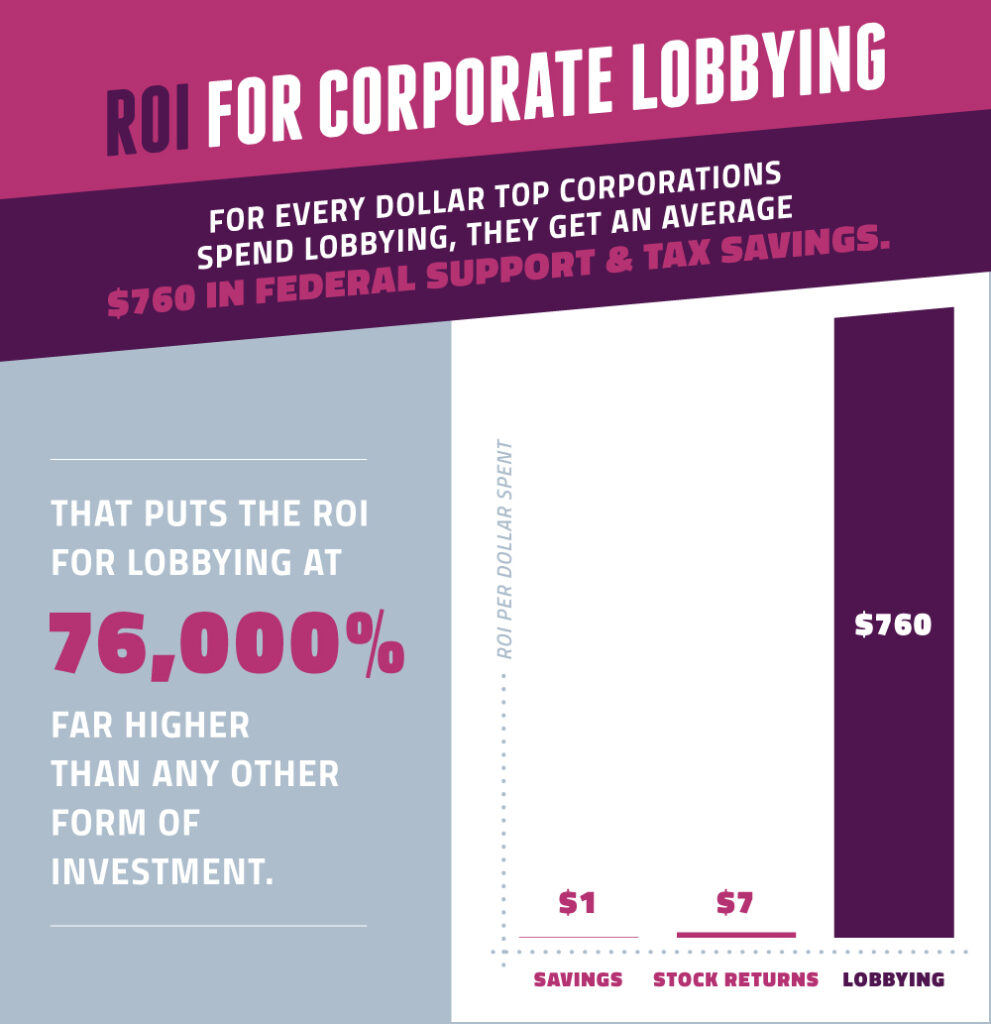

1. Lobbying Reform

We don’t like lobbyists. They seem so sketchy. However, lobbying is protected in the first amendment as your right to “petition the government for the redress of grievances.” So, we can’t outlaw lobbying.

What you call a “bad lobbyist” may be my “protector of freedoms.”

However, nothing in the Constitution says we can’t restrict how much money lobbyists or the companies that employ them can give to elected officials as campaign contributions. In fact, I discovered when I was in office that there is clear legal precedence from Wall Street for dramatically restricting how much money lobbyists can contribute to politicians.

In other words, lobby all you want, but you need to win on the argument, not on the weight of stack of dollars you hand over.

In the 1940’s the investment industry restricted how much individuals can give to politicians because they did not want undue influence to corrupt the market, particularly the municipal bond market.

Why can’t this same reasoning about conflict of interest be applied to the lobbying industry?

Have a look at my piece laying out that argument here.

2. Ranked Choice Voting

Ranked Choice Voting, or “RCV” is all the rage. Conservative-leaning Alaska just passed an initiative to vote using this system and the more moderate-leaning Maine did in 2018.

It is an intuitive system, especially once you try it.

In short, it allows you to vote for the candidates in the order you’d like to see them win.

In our state, with a very independent and “maverick” tradition, RCV is perfect and would result in candidates who have to appeal beyond their extreme base, either right or left.

In other words, the political parties will fight it.

This reform would result in a legislature that is more likely to find common ground and laws that work for more people.

Have a look at this article, which describes how it works and introduces you to a group in Arizona that is organizing toward the reform.

3. Independent Redistricting

Redistricting informs everything, but the public knows the least about the process. Further, in many states the elected officials draw their own lines.

And, while Arizona created an independent redistricting commission in 2000, both parties have over the years discovered ways to manipulate the process.

We are in a position now that I predicted years ago –the governor has rigged the system of appointing the next commission to favor his party.

I don’t care which party it is, that is wrong.

Our commission is made up of 5 members, 2 Dems, 2 Republicans and 1 independent. That creates a terrible situation in which both parties try to put a phony independent in that seat.

I hate to be the guy who said, “I told you so”, but we could have fixed this years ago.

We need to have a commission made up of 9 members: 3 Dems, 3 Republicans and 3 Independents. We need to remove the power that the governor has over vetting commissioners and we need to allow the commission to make a greater number of competitive districts so that we all have actual choices in our elections.

See this piece on some efforts in early 2020 that would have undermined the Voting Rights Act in Arizona redistricting

4. Dark Money

People have been mis-using the term “dark money” to mean “money that my political enemies use to influence the election.”

Dark money is actually something very specific. It is money that corporations (read “companies, unions, charities, uber-wealthy or political non-profits”) can use to influence the election without disclosing who is behind it.

In other words, they can spend incredible amounts of money to lie or mislead people and we don’t know who’s doing the lying.

And the reality is that both parties have become addicted to dark money.

Why is this a problem? Proponents say it’s our 1st amendment right to spend as much money as we want on elections, right?

That is true. Kinda.

The amounts are unlimited and can come from corporations (per a Supreme Court ruling called Citizen’s United v. FEC), but disclosure can still happen –even though few states or the federal government require it.

Even the very conservative Justice Scalia, while ruling that the amount of money corporations spend should be unlimited, was very clear that we have the right to force disclosure of who is behind those expenditures.

He said, “(r)equiring people to stand up in public for their political acts fosters civic courage, without which democracy is doomed. For my part, I do not look forward to a society which, thanks to the Supreme Court, campaigns anonymously . . . hidden from public scrutiny and protected from the accountability of criticism. This does not resemble the Home of the Brave.“

In Arizona, former Attorney General Terry Goddard has pointed the way to how we can create this disclosure, via a couple ballot measure attempts. He has just missed the mark, in part because of GOP roadblocks to the citizen initiative process and in part because Democratic-leaning groups are equally addicted to dark money and resisted his efforts.

You can read about that a little here, but unfortunately the Outlaw Dirty Money website is down as they decide whether to try to run another initiative in 2022.

Without reforms like these four, we are going to find ourselves continuing the our path toward less democracy and more corruption.