This is the sweet time of year, yeah? I’ve got some great reads and fun events for you.

Your Brain on the Internet. I’m not sure how many of y’all take my suggestions for interesting reads or viewings. But if you don’t usually, I encourage you to watch this video. It’s from one of my favorite science-related YouTube channels, called Kurzgesagt, and it describes what scientists have recently learned about how the Internet affects our brains, how it is breaking down our social order, and what we can do about it. Left, right or center, this is worth a watch.

Cosmic Sleighride. Climb aboard your cosmic sleigh with your host Shiny the Star on a mystical holiday adventure that is out of this world at Cosmic Sleighride produced by World of Illumination. Shoot past the sun, race among the stars and pass through Kris Kringle’s celestial portal where toys prepare for launch. Orbit around a team of astro elves hoverboarding through the cosmos as you enter the stratosphere of Santa City, where all the holiday magic happens. Hold on to your seat — you’re in for one stellar ride.

You Can Choose Your Local Power Company’s Board of Directors. SRP has severely restricted residential solar an is installing over 2,000 MW more of dirty methane gas. They are ignoring climate science. You may have the right to vote in the Salt River Project election in March and not even know it. Even parts of APS territory used to be SRP territory and you still may have voting rights. For instance, I live at about Central and McDowell, I’m an APS customer and I can vote in the SRP board election. Funny how they don’t advertise that, huh? Even if you are not certain, go ahead and register at this link and find out. You can see a map of the SRP voting districts at this link. Be sure to scroll down to see it.

Lawn Care Going Electric. If you own a home, there is a good chance you either mow or blow your lawn or desert garden. Gasoline-powered lawn and garden equipment, which don’t have pollution controls, often emit as much pollution in an hour as driving hundreds of miles in a car. Let’s set aside for a moment the war machine-level of noise that leaf blowers set off when they invariably start going on a Saturday morning in your neighbor’s yard. =These things are a huge contributor to Phoenix air pollution and one of the reasons that we are usually in the top 5 or 6 most polluted cities in the nation. Lawn equipment alone in Arizona contributes 985 tons of nitrogen oxide and 333 tons of particulates, which are small enough to invade your lungs. You can learn on this website about ways that you can push our local government to encourage a move to clean, quieter electric lawn equipment.

While we are on the topic, please take a moment to tell the Maricopa Association of Governments what you think they should do to help reduce air pollution at this public survey. The results will help them build a Climate Action Plan and access tens of millions of dollars from the federal government.

Lights on the Farm. Lights at the Farm and Vertuccio Farms have partnered together to bring Arizona’s Largest Walk-Thru Synchronized Light Show. Come on out and unwrap new traditions and make memories with your family and friends as you make your way through the dazzling lights, larger-than-life lighted displays, mesmerizing tunnel of lights and so much more. Lights at the Farm offers a holiday entertainment experience for all ages. They’ve decked the farm with 2 million dazzling lights, brilliant decor, and inspiring displays to create a Christmas light show. Each display is synchronized to a variety of Christmas classics that will have you singing along. It is stretched out over 10 acres; these dazzling lights will take you through a spectacular journey that will delight your senses and put you in the Holiday spirit.

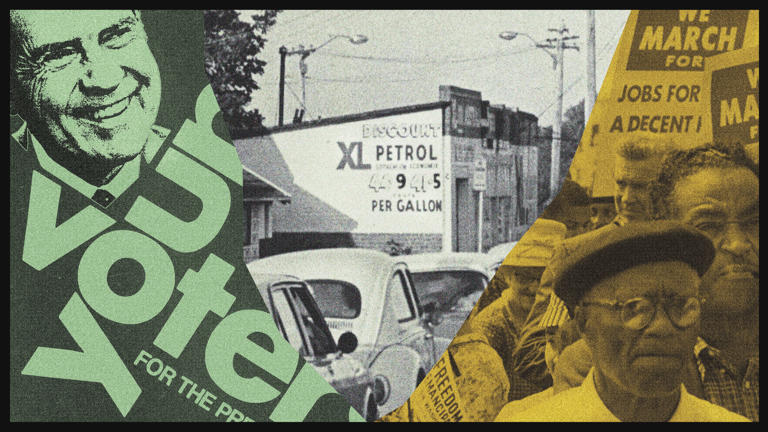

Did we Abandon the Greatest Economy in History? This is relevant to why so few people can afford a house now, at least the long term view of it. This is a great article on the history of the political shifts that took us from economic domination in the 1950s to space where the disparity of income is about as large as it was during the gilded age. Hint: if you are thinking its an all-left or all-right account of history, you’d be wrong.

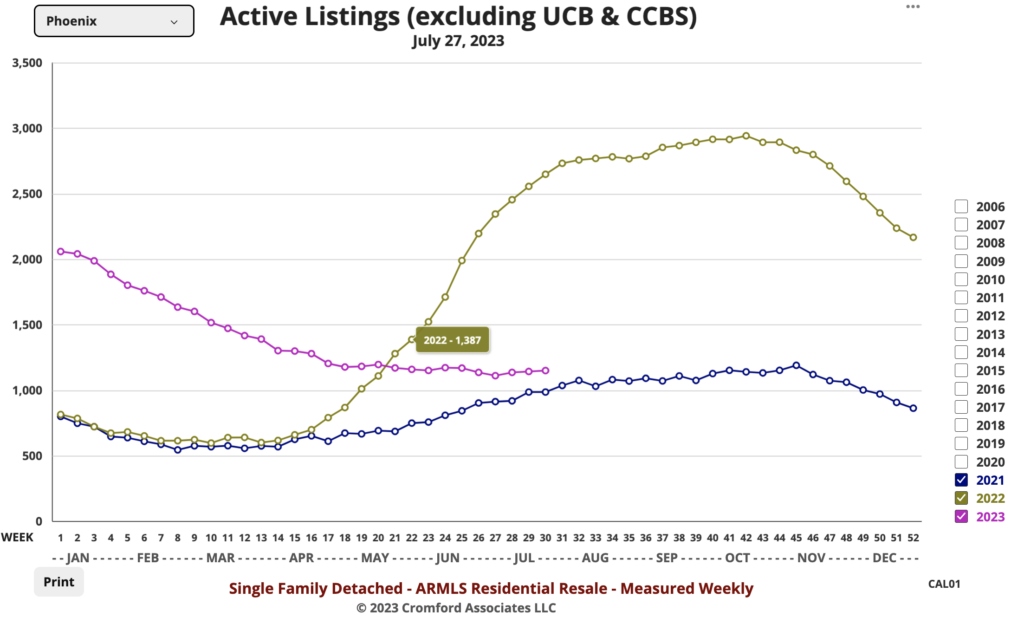

Clean Energy Jobs in AZ To Date. Expect the Arizona economy to grow and people to continue to want to move here, as Arizona is now an EV manufacturing state and clean energy jobs are growing. Since the passage of the Inflation Reduction Act (IRA), we’ve seen more than 13,000 new jobs in Arizona, from about $12 billion in investment. As you can see in this data, Arizona is becoming a battery manufacturing powerhouse, according to the latest report from Climate Power. As you think about whether to buy or hold in Arizona, this lends support to long-term investment.

How to Shop Local with Ease. Local First Arizona has a great online shopping portal so that you can support local businesses with a click of a few buttons. Many Phoestivus vendors are on the portal, as well. So, if you don’t feel comfortable in the crowd, you can still delight your friends and family with original gifts. 30% more of your dollar goes to support local police, fire and community services when you shop local.

Southwest Gas is the new Marlboro Man. Well, more specifically, the methane gas industry is the new version of that 1960s doctor telling you smoking is good for you. Recent reporting from NPR revealed that the “natural” gas industry quite literally used the Tobacco industry playbook to mislead the public about the health threat of gas stoves. The American Gas Association (AGA) hired the Tobacco industry’s go-to public relations firm and the same industry-friendly researchers to deploy the same tactics to cast doubt on the science. These tactics continue to this day — the AGA hired a Tobacco-linked consultant to sow doubt about the science earlier this year.

Why aren’t we Recycling Lithium Batteries? The best way to avoid opening more lithium mines is to recycle more. After all, we recylce 99% of lead-acid batteries from cars. Why is less than 5% of all lithium recycled? Is it because the government started requiring car batteries be recycled back in the 1960s, but now anybody can sell lithium batteries and leave society with the cost of finding more? Here’s an informative treatment on what’s going on. The EPA has a nice primer on lithium mining here, too.

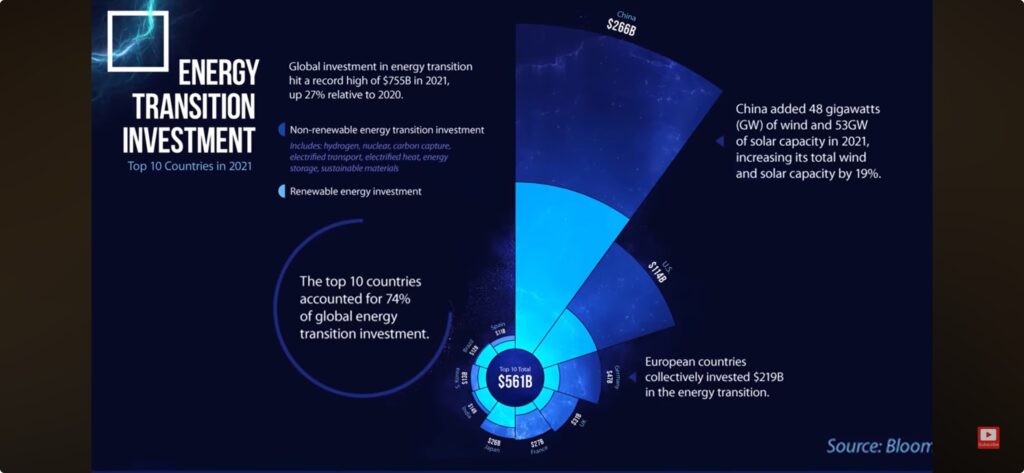

I’ll leave you with this thought. Critics of climate change policy claim that China pollutes more, so they should fix the problem first. Set aside that this is only true if you look at today. Over the last 150 years, the US has added about 4 times as much carbon to the atmosphere as China. Once we look at current investment in renewables –and the potential to capture more global market share in clean energy manufacturing and technology–, you can see that the US is giving up its leadership position to China. China invests about $266 billion per year in renewables. The US sits at about $115B, with a much larger economy. Who’s winning that space race now and who is ceding leadership? (Source: Bloomberg)