The Home Buying Process, P6

I remember when I bought my first house being introduced to a title and escrow company. I understood that they process paperwork, but I nobody gave me any context as to why.

In this installment, we will help you understand the most important points of the title and escrow process.

If you want to see the previous installment in this series, see Part 5 at this link.

Part 6: The Escrow Period

A title and escrow company has two jobs:

- Ensure that the person selling the house has the right (through a title on the home) to sell it to you. This is the “title” part of the name.

- Track all of the money and paperwork so that there is transparency and certainty about who gets what at the end of the process. This is the “escrow” part of the name.

The escrow period begins when there is an agreement on the contract, or a “meeting of the minds.” It ends when the parties either cancel the contract (we will cover that later) or the escrow closes –as in a complete sale.

The first thing you will see happen is that a courier will come to pick up an earnest money deposit from you. This is a deposit, held by the title and escrow company, which shows that you are serious. If you back out of the contract for reasons not outlined in the contract, you can lose that money. It usually is about 1% of the total contract price. So, $3,000 for a $300,000 contract. You will get this back at the end, unless you breech the contract.

This check can be a personal check.

So, on to the concept of title and escrow, generally. You know when you buy a car, you get a copy of the title. Simple right? Well, with an auto title, the name of the current owner is written right there on the title. If they owe money on the car, that is noted.

The real estate, the same basic thing happens. However, because houses are around for so long and represent so much more money, somebody really needs to do a “title search” to make certain that nobody is going to come to your door in a year and tell you that the person who sold you the house never had the right to do that.

Seems crazy, but this stuff happens. Otherwise, we would not have these systems in place. Heck after the Great Recession, there were many properties with “clouds” on the title, meaning there was some question as to who owned it in the past. Perhaps a short sale or foreclosure clouded the title.

Anyway, unlike with auto titles, the title companies will offer insurance, of sorts. The seller pays for title insurance so that if anybody challenges the title, the title company will back you up with their lawyers, etc.

So, it is incumbent on the title company to do a good title search.

In that process, and within 5 days after the beginning of the escrow period, the title company will issue a title report. This is their report, which describes the property, previous ownership and will confirm that the current owner has the right to sell you the property.

Read it! Please!

If there is any place in this process where you could find something odd, this is one of them. If the city put an easement on the property, it will show here. If the is some question about the lot lines between this and the next property, you will see it here.

The “escrow” part of their work at this point entails holding on to your earnest money deposit, tracking the terms of the contract and preparing for you to take title in a way that you want, i.e., “Jane and John Doe, enjoying joint tenancy.”

They will have more to do at the close of escrow, and we will cover that later.

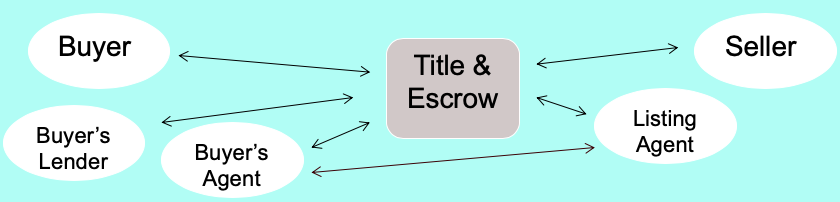

Finally, just so you know the players on the field and how we interact. We, the buyer’s agent will coordinate with you, your lender and the title company. We will also negotiate with the listing agent on your behalf.

That way, you don’t need to speak with the seller. All of the negotiation is done for you, at your direction.

You have the right to choose your title company. We may still have to negotiate with the seller to get them to use that company. While we can’t force you to use any particular company, we have had the best luck with Old Republic Title.