The Home Buying Process, P2

When we meet a new client, especially a first time home buyer, we grab a cup of coffee and preview the home buying process.

Nobody explained the process for me when I bought my first house and I paid for it. It makes a huge difference to know what to expect next in the process; what to be ready for.

You deserve better, and we deliver.

So, it’s high time that I put the home buying process in writing so you can read about it in the comfort of your home, in your jammies with a cup of your favorite beverage.

If you want to start at the beginning, see Part 1 at this link.

Part 2: Agency Disclosures and Buyer/Broker Agreements

A lot of people think that agents just sell you a house and run off to buy a new Mercedes. As we explained in the last installment, there are a lot of responsibilities expected of agents.

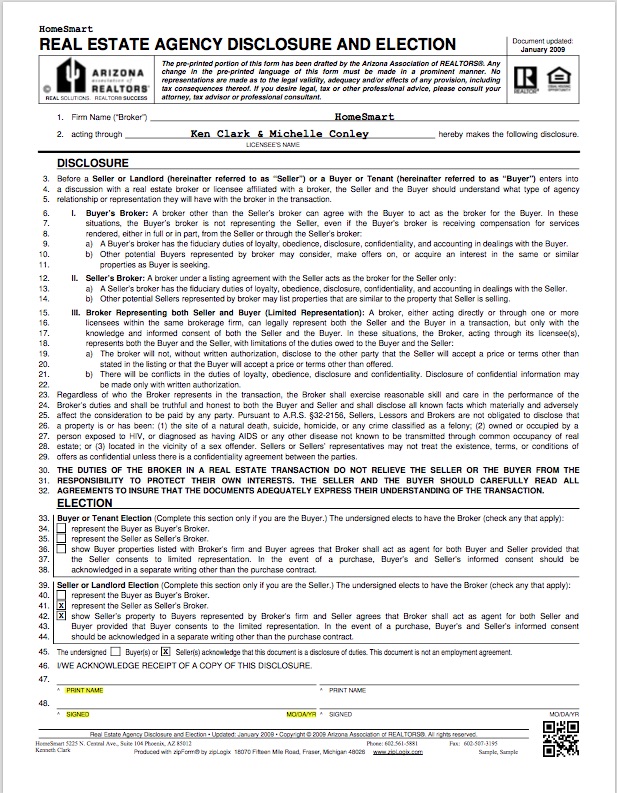

A good agent will ask you to sign two documents when you get started with the home buying process: the agency disclosure and the buyer broker agreement.

The Agency Disclosure

This really boils down to disclosing that we have a fiduciary responsibility to you, as our clients. It also describes that, in Arizona, there are buyer’s agents and listing agents. While most agents do both, the disclosure lets you know each agent’s role.

More importantly, it discloses that agents are allowed to represent both sides of the transaction during this process only with your written permission.

So, is it a danger to your interests to have one agent on both sides?

Well, the agent still has fiduciary responsibility to their clients. So, they can’t run off and tell one side what the other side is willing to take for a property, for instance.

The agents in this role really becomes like a courier of messages. They can still advise each side on strategy and approach, but they can’t reveal private or confidential information.

Not comfy with this? That’s okay. You don’t have to do it. We are happy to refer one side of the transaction out to another agent.

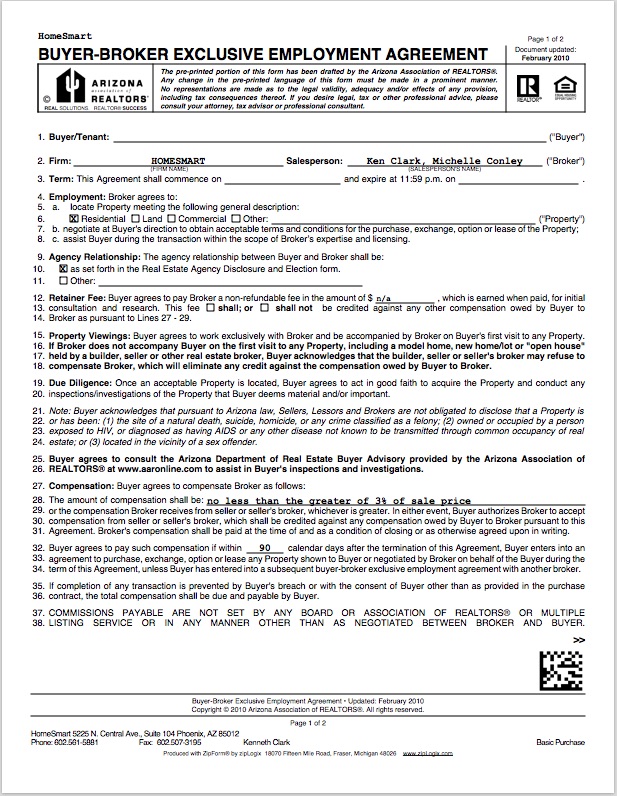

The Buyer/Broker Agreement

It is always better and safer for you and for us to have an agreement for employment.

Yes, employment.

Under this agreement you are employing us to do a job for you. The only difference is that the seller is paying our commission.

It is important for you because you have assurance that we officially have a fiduciary responsibility to you. If it is unclear whether you are our client, where does our responsibility lie?

It protects us because it gives us certainty that you are serious about buying a house. We need to allocate our time to respect all of our clients, and ourselves.

Some people get hung up on the language in here that says you must be accompanied by your agent if you want to see an open house. We don’t worry about that. Just let the agent at the open house know that you have a realtor. Easy peasy.

The buyer/broker agreement also outlines how much you are allowing us to be paid. There is no industry standard. You most often see 3%, but be aware that agents, as an industry, cannot get together and agree to all ask for the same commission. That would be anti-trust activity.

You have the right to negotiate whatever commission that you want.

Another thing to bear in mind is that sometimes the seller may only offer us a 2.5% commission, rather than three, for instance. We write in to our buyer/broker agreements that we reserve the right to ask the buyer to make up the balance in this case. We do it because we work very hard and we are worth it.

However, we seldom do apply it –only for really complicated transactions that take more time. For a smooth transaction, we would rather you be happy and tell all your friends about just what wonderful agents we are.

By the way, you might also like to know that you can look up any licensed agent to see if they have any formal complaints against them at this link.

Next month: prequalifying for a loan.