When it feels like your only choices are to hide from the brutal heat inside your house while looking at your dog who’s wondering why you can’t go outside, or getting on the hundred-mile long parking lots that are the I-17, I-10 or SR87, it’s good to know that there are some other choices.

Here are a few.

Go to The Prom Again. I saw this show last month and it was a total delight. It’s worth it at full price, but you can see it for half price. When Emma wants to take her girlfriend to the prom, the PTA cancels the dance and her story goes viral on social media. Little does she know, four faded and eccentric Broadway performers are on their way to transform her small town of Indiana and throw her the prom of her dreams – albeit in an attempt to improve their own PR. What begins as selfish insincerity results in a fabulous story of growth and a whole lot of zazz!

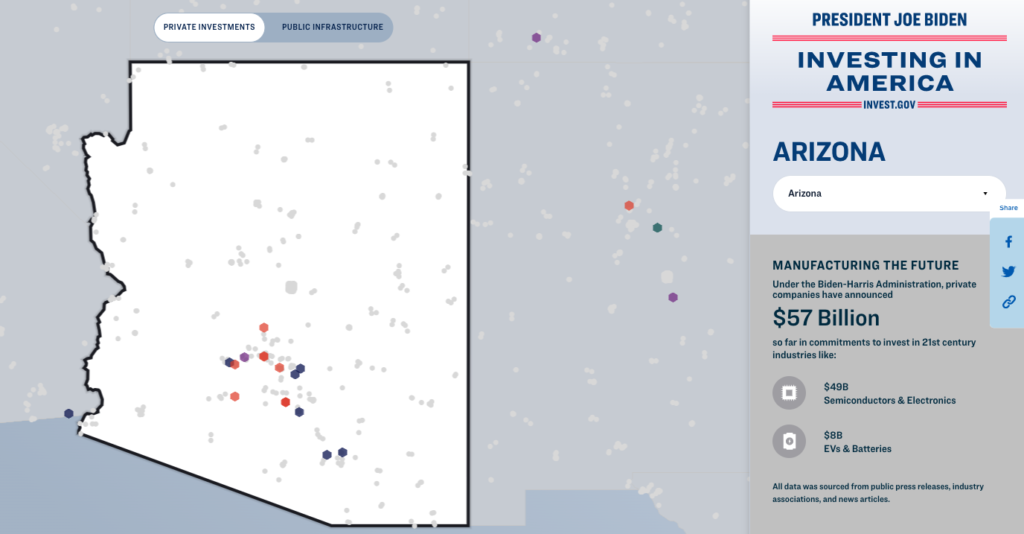

State EV Fleets Save Hundreds of Millions of Dollars. Politicians talk all the time about saving taxpayer money, but I don’t see many of them really getting behind EVs for state fleet vehicles. Consider that charging costs for EVs amounts to about 30% of the cost of fossil fuel gas, and that maintenance costs are significantly lower. Check out this article and this column to learn more, then call your state representative and ask them what they are doing to make this a reality.

Cabaret is back in the valley. I’ve not seen a cabaret show since before covid raised its putrid head. I love the thought and artistry that goes in to most cabaret shows, with singing, magic, jokes and of course a little tasteful tease. It’s certainly NOT fun for the whole family, unless your whole family is over 21. So, there is a better than even chance you may catch me at one of the upcoming shows at Stand Up Live.

Drunk Shakespeare. I’m not going to say that I excelled in Shakespearean studies in my formative years, let alone showed an ability to remember more than a few lines. But I can say that I’m a huge fan of the show Drunk History. And, you know, that’s all you need, really. I went to one of these Drunk Shakespeare shows and I was very impressed with their knowledge of the Bard. Then again, who am I to judge. They could have been filling in the plot of Desperate Housewives of the Globe Theater, as far as I know. But after the actor has been given 5 shots, who really cares? This is an experience I recommend. The audience files in to a small theatre-in-the-round set-up with your own drinks and the fun begins right away. All bets are off after that.

The Future, My Boy, is in Batteries. Only about 5% of lithium batteries are recycled. This abysmally low amount means we have to mine more lithium and cause more environmental damage. So, it’s heartening to see that Governor Hobbs visited this battery recycling facility being built and expanded by Li-Cycle, one of two major battery manufacturers that have moved in to Arizona recently. For much less cost than tearing up mountain sides for lithium, our city and state governments could invest in capturing post-consumer batteries. After all, 95% of all lead batteries from regular cards are recycled? Why do you think that is? It’s because we require anybody who sells them to help collect them. Imagine telling Amazon to help us recycle all the batteries in all the gadgets they sell every year!

Camp Innovation. Speaking of cool innovations, the Arizona Science Center has something for you 5-9 year olds coming on July 17th. Inspired by the designer Anouk Wipprecht, this camp is for gadget-lovers. Campers will have the opportunity to combine fashion, function and innovation in this hands-on camp. Everything from lights, prosthetics and hydraulics can be explored throughout the week, pushing imagination, innovation and design to the limit! At the end of the week, campers will show off their creations with a parent showcase. Free.