May Market Update

For the May Market Update we continue to watch the affects of the pandemic.

People always ask me when home prices will be slashed, like they were in 2008. I continue to say that, while that may happen many months from now if the economy does not recover, that is not likely to happen any time soon.

Yeah, that seems counter-intuitive, right? I’m not just being one of those agents who is trying to “wish” the market higher. Michelle and I work just as hard when prices are low as when they are high.

So, let’s look at why prices are this way, with the help of our friends at the Cromford Report. Here are the several points to keep in mind.

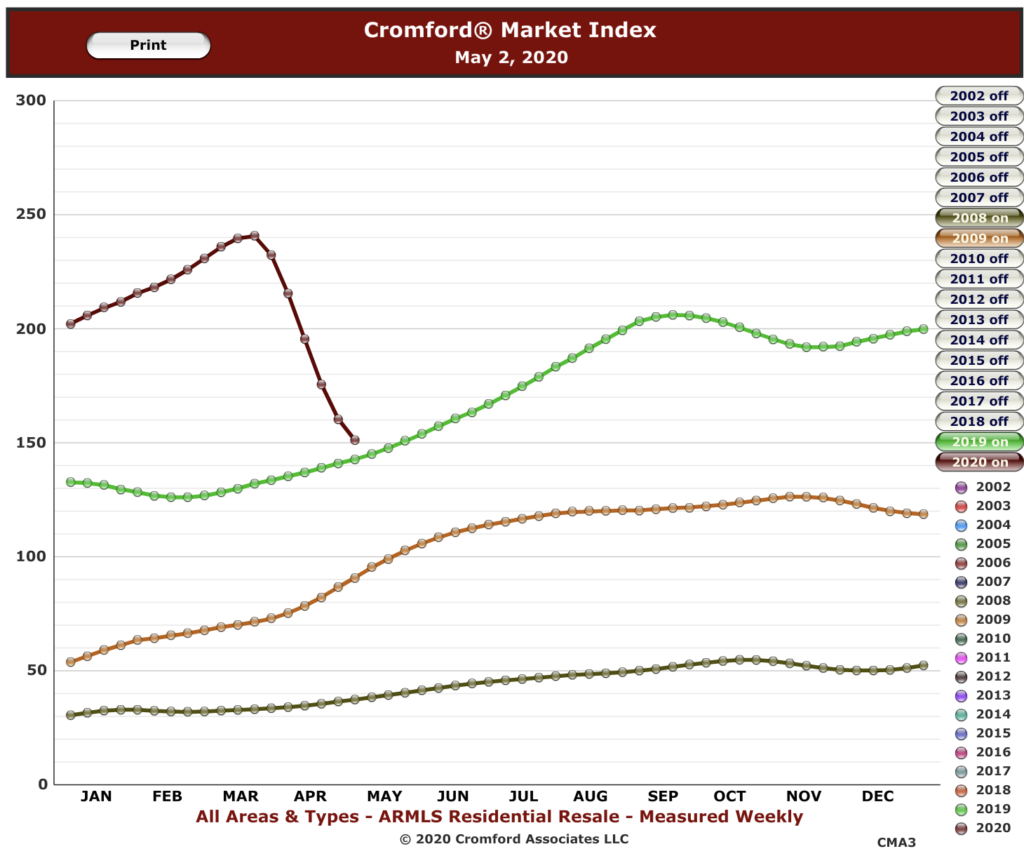

1) While the Cromford Index is taking a steep dive, it is still above where it was last year, this time.

Also look at this graph. I turned on the lines for 2008 and 2009, when the Cromford Index was at its lowest point during the Great Recession.

While this current drop is dramatic, we have a long way to go before we see a buyer’s market, due to the huge shortage that we had last year.

Remember, the Cromford Index needs to drop below 100 for depreciation to begin. Between here and there, appreciation may slow, but prices will still increase at a rate greater than inflation.

The Cromford Index is a measure of advantage. Above 100 is seller advantage. Below 100 is buyer advantage. Between 90 and 110 is equilibrium. So this means specifically that, while prices may be coming down for current listings, as long as the Cromford Index is above 110, average prices will increase greater than inflation.

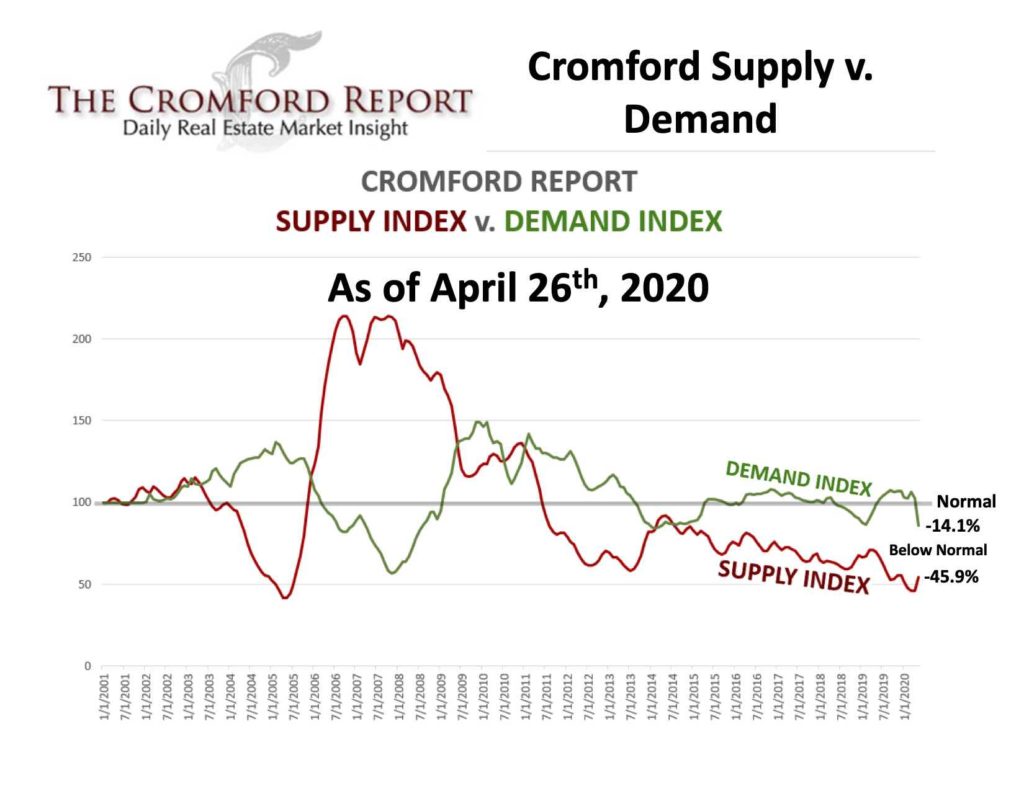

2) Even though demand has gone down the last month, so has supply.

So, that relative imbalance between supply and demand is certainly moving in the right direction for prices to eventually reach equilibrium, they won’t as long as there is a shortage of supply.

Every indication we have now is that supply is not going to increase any time soon. If buyers re-enter the market later this year if the economy starts to recover, that lack of supply will still be a problem until sellers decide to begin listing their properties in pretty significant numbers.

Buyers are taking a pause, worrying about the economy, and so are sellers.

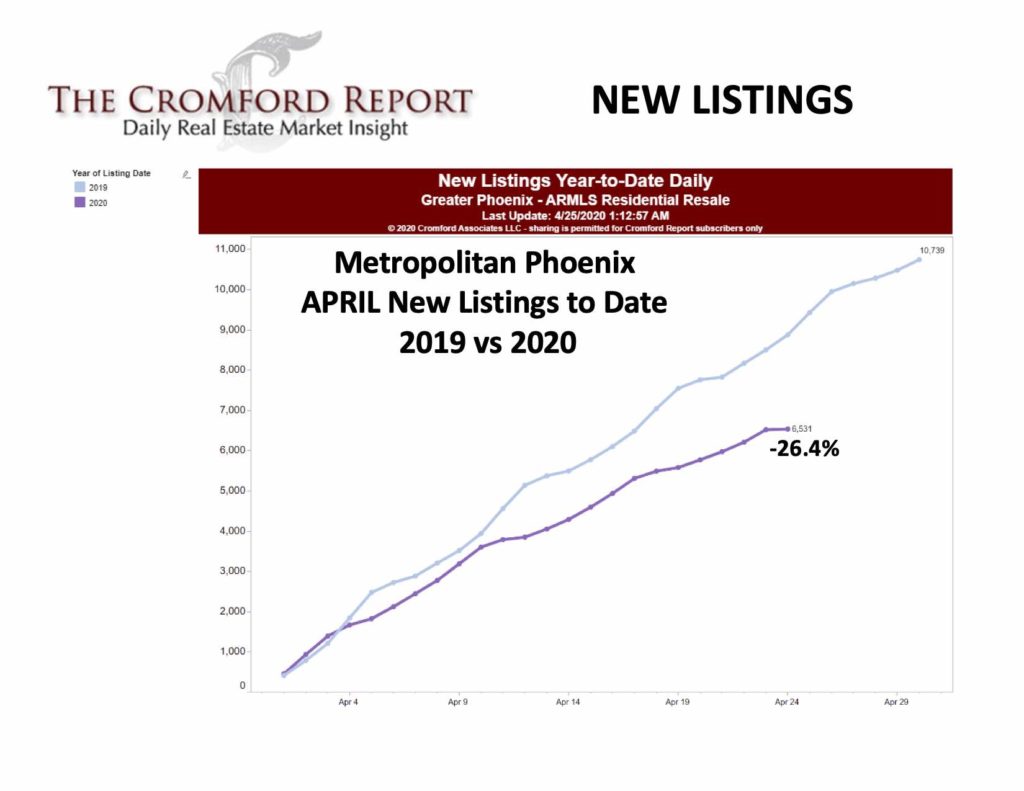

The number of new listings has plateaued. So, again, if the number of listings coming on has slowed at the same time that the number of buyers has slowed, then the supply/demand curve will keep prices relatively where they are now.

We are seeing this playing out anecdotally on our listings. Two out of three of the new listings that we’ve listed since the start of the pandemic went under contract within a few days. They did not have to drop their prices and there were multiple offers.

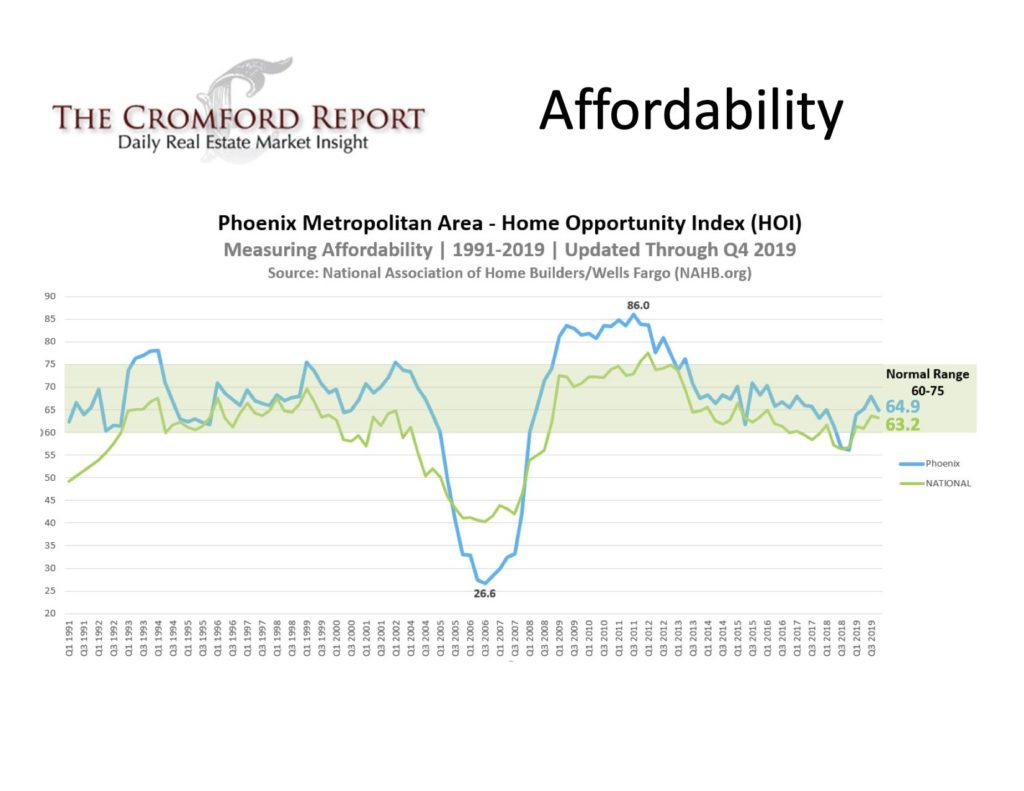

3) Affordability is still at normal levels.

It is important to note that, even with this odd space we are in, houses are still within the normal range of affordability, at least valley-wide.

So, what does this mean? It means, as we often say, if you need a house buy a house. If you need to sell a house, sell a house. The real estate market is not the stock market and it does not behave the same way.

The governor is opening up some social distancing rules, and I predict that there will be some pent-up demand as people get back to normal.

As we go in to the summer and people adapt more to social distancing rules, etc., we will see more (but not all) sectors of the economy regain at least some activity.

I believe very strongly that, as the economy begins to recover, and as people act on their pent-up energy, we will see the same scarcity in the Central Phoenix area that we were dealing with before the pandemic.

We just need to get through this together. Stay safe. Stay at a distance. Listen to scientists and doctors.

And, of course, call us if you have questions about how this may affect your particular plans. 602-456-9388.