Investors & Home Prices, P. 2

In this part two of a multi-part series. I’m exploring at how investors and other factors drove driving up home prices and what we should do to keep it from happening again. See Part 1 here.

Let’s start with some perspective. There are about 86 million single family residences (SFRs) in the USA. About 16 million of those are rentals. (About 44 million households, total, are renters. That includes SFRs and apartments.

Really only about 400,000 of those are owned by private equity firms, according to this article, which seems to want to down-play the role of private equity firms.

The Marker Media article above is eye-opening in that it describes how state and university pension plans invested heavily in these equity firms. They are chasing profits to prop up often under-funded retirement funds, drained after years of growing numbers of state retirees and shrinking state budget contributions to those same plans.

But the author’s defense of equity buyers misses the point. The number of sales to equity firms has been increasing, according to the New York Times from the end of 2021. That trend has not slowed.

Equity firms are gobbling up single family residences are to private equity firms (anywhere from 1 in 6 to 1 in 4 sales, depending on who’s reporting). And, by the way, those same equity firms have been coming after apartment buildings, as well, for the last decade.

So, what’s the problem with that? Lots, actually. Don’t investors help infuse money in to fixing up properties?

Well, your run-of-the-mill pro-market economist would say so. But the reality –at least what I’ve seen in person– is entirely different. The investments in the properties tend to be more superficial, “lipstick on a pig” renovations. That’s true for both rentals via equity investment and the quick flips; aging A/Cs remain in place, construction errors are painted over and structural challenges ignored.

The reality is that investors are looking for steady profit every month and a hefty profit when it sells. Those desired profits tend to be higher when an equity firm is involved, as opposed to a smaller rental company that has a buy-and-hold strategy.

That dynamic disadvantages renters. “Well, I think that what we’re seeing is that these companies are acting in ways that are problematic for tenants in order to meet their investment goals.”

I’ve shared previously a great On the Media episode on eviction.

As opposed to nearly faceless equity firms, local landlords have more flexibility to work with tenants who miss a rent payment.

Further, equity investors are more likely to rely on management firms or on-line payment systems, which are less forgiving or willing to work out payment plans. So, renters are more likely to get a late payment or eviction history, which makes it harder for them to find a new place to live.

In this article, a former longtime housing director testified in congress that, “Unlike mom and pop landlords, large out-of-state investors typically don’t have much empathy for their tenants,” she said. “Residents can be a day late in paying rent and face an eviction notice.”

But, it does not stop there.

As you might guess, there is a clear harm to low income neighborhoods and communities of color.

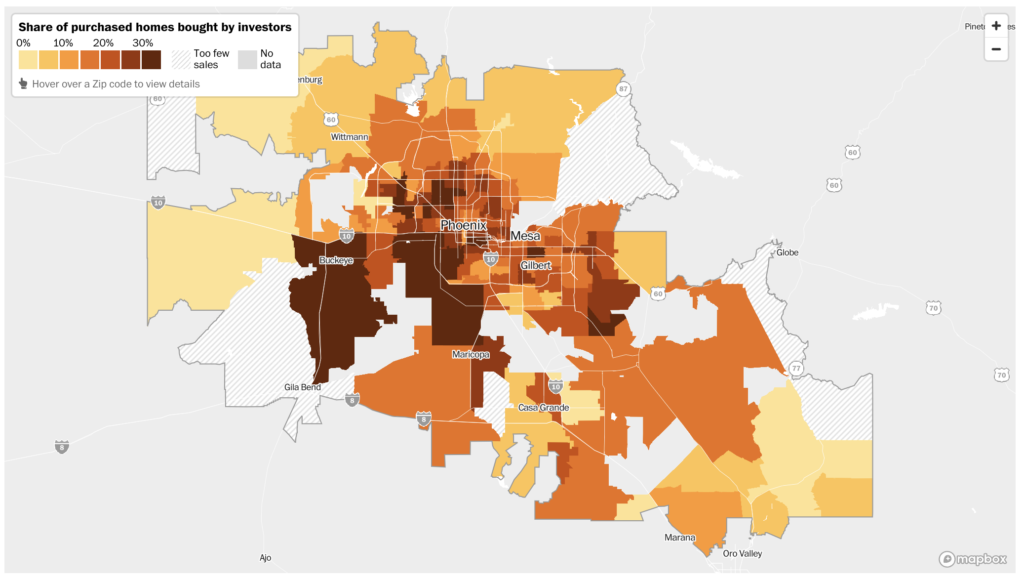

See this map of Phoenix, where homes in lower income areas are scooped up by investors in greater numbers by investors, leaving fewer affordable for new home buyers. Anecdotally, we’ve seen people being pushed out of neighborhoods that have been affordable for decades.

According to the Motley Fool investor website, SFR investors prefer lower-priced homes, which give them greater profit opportunity. The part of the picture they don’t share is that this strategy is specifically what deprives low-priced neighborhoods of low-priced homes.

So, investor share of the SFR market is increasing; whether that be equity firms or individual investors; short-term rentals, flips or flip-to-rent. Investors come in, pull a profit out of the home –either through a flip or a higher rent–, and the new home owner or new renter pays the bill. The neighborhood is deprived of affordable homes and the dominos fall from there.

In the next installment: The case for investors in neighborhoods.