Geekin’ out With Cynthia Lujan

Admit it, you’ve missed my usual fun-lovin’ and humorous market analysis over the last month. “What will I do with my time without Ken’s market analysis now that Modern Family is on summer break?”, you say.

My apologies. It’s been a nutty month. Between closing properties, showing new ones and the Independent Redistricting Commission, I’ve been running around like a blue-arsed fly (ask your Australian friends).

But, Cynthia Lujan from Old Republic Title Company delivers with a really handy June month-in-review.

Executive Summary: “If you are still waiting for that mythical second wave of foreclosures, you are more likely to see Snookie settle down in a commune of vegetarian, celibate, palm readers before that will happen.”

Market Headlines

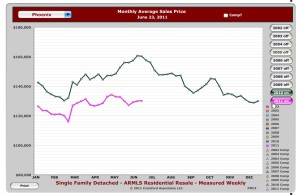

· Supply continues to fall, though rather more slowly in the ranges between $200,000 and $800,000.

· Demand very strong below $200,000 but showing seasonal weakness above $200,000.

· Average sales price per sq. ft. is stable below $300,000 and increasing above $300,000.

· A change in the sales mix could adversely affect overall market average prices and medians.

· Foreclosure activity declining and active REO inventory is at the lowest level for several years.

Homes under $100,000

· Demand remains strong while supply is still declining. Prices now stable for 7 months.

· Demand normally falls off during the summer but the demand in this price range is dominated by intense buying by investors who are only slightly affected by the seasons.

· Active listings are now 7.8% below this time last year.

· This supply continues to gradually shift away from REOs (down 15.7% in the last month) towards short sales and pre-foreclosures.

Homes Between $100,000 and $200,000

· Supply down and demand fading slightly. Pricing remains very stable.

· Having peaked in October, supply has fallen another 6.8% in the past month and is down 23.4% when compared with March.

· Demand has faded a little, but this is in line with normal seasonal patterns.

· REOs dropped to 38% of monthly sales while normal listings also fell to 38%. Short sales and pre-foreclosures increased from 21% to 24% of sales.

Homes Between $200,000 and $400,000

· Buying interest falters a little although supply continues to decline. Pricing remains very stable.

· The supply of single family homes dropped by another 4.1% between May 26 and June 26, and is now down 17.0% over the last three months and 29.2% over the last year.

· Over the last month REO supply actually rose by 2.4% reversing an 8 month trend, while short sales and pre-foreclosures fell by 3.0% and normal listings fell 5.5%.

Homes Between $400,000 and $800,000

· Supply falling but demand continues to weaken. Nevertheless sales prices remain on an upward trend.

· Single family homes between $400,000 and $800,000 have experienced a 6.4% fall in active listings in the last month.

· The sales volume strengthened slightly in June, with monthly sales up 7.0%.

· REO supply didn’t change during June at 84 homes, but this is down 10.6% over the last 3 months.

Homes over $800,000

· Demand weakens for the summer months but supply is down again. Sales prices continue to climb.

· We see the first sign of the spring season turning to summer as pending sales start to fade.

· The good news is that the supply of homes above $800,000 fell 8.5% in one month, 18.9% over three months and 29.2% since June 2010.

· Active REOs rose 18.4% from 38 to 45 over the last month but these represent only 2.9% of total active listings.

Leave a Comment