Our five great listings from last month are now down to one active and two closing this month.

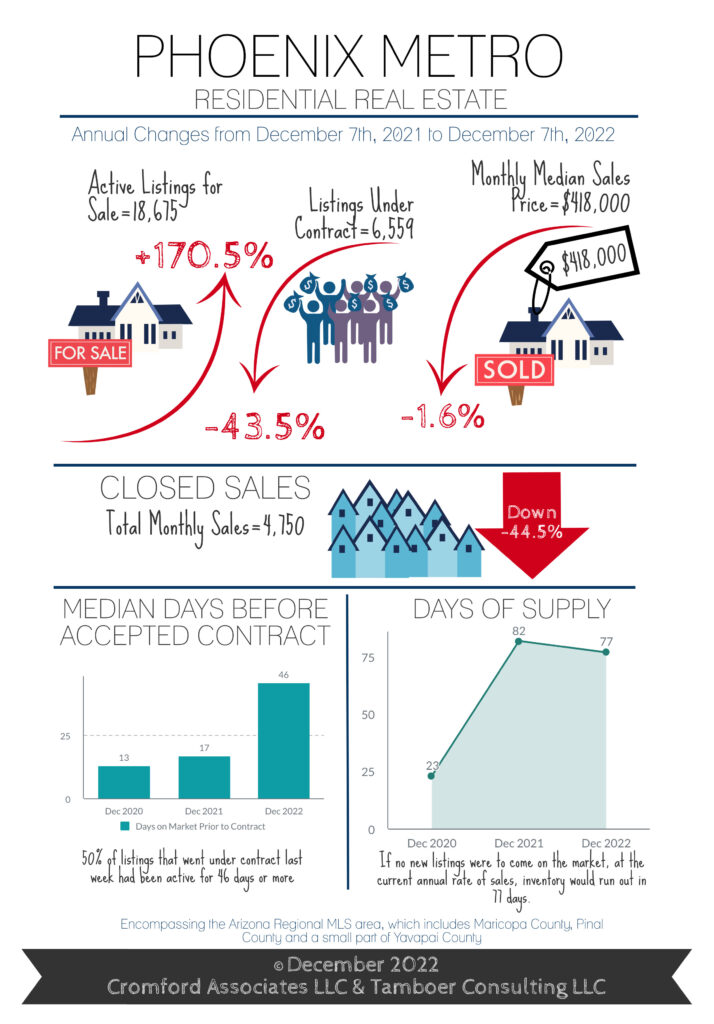

It is clear that buyers are making a move before interest rates go up again.

See our listings page directly for more information.

Price Drop! 10018 E Indigo St., Mesa. 4br/3ba, 3,000sf. NOW $915,000

If you want space for all your toys, your garden and all your things, this roomy home and huge lot will be great for you.

The owners updated the flooring, the kitchen, the back yard and added a huge, four-bay garage. This is perfect for the auto enthusiast, or for all the toys.

That’s in addition to the three-car garage that is attached to the home! The additional garage bays are 30 feet deep and the entire garage is 50 feet wide with 8 foot tall doors.

You will be able to sit out on the back patio with amazing views of the mountains, with Usery Mountain Regional park almost out your back door. Whether you are all about indoor or outdoors, you will love this one!

Closing this Month. 387 N. 2nd Ave, #2G. 2br/2.5ba, 1,803sf.

You can enjoy a roomy condominium in a cozy HOA in this beautiful historic building, which was renovated from its original state about 20 years ago. In that renovation, the developer added many modern conveniences, including gated, covered and garage parking for all owners.

While everybody else drives around looking for a space to park, you can pull right in to your own secure garage downtown. You are steps away from live music, the weekly farmer’s market, shows, restaurants and all the things anyone is looking for in downtown living.

Plus, you get a beautiful full kitchen, 2.5 bathrooms and the kind of open living space you’ve been looking for.

Closing this month. 1107 W. Osborn Rd., #101. 1br/1ba, 849sf

This is a rare condo in Central Phoenix for under $230,000 from a motivated seller.

Since it was last purchased, the owner has completely remodeled the bathroom and has updated the kitchen to complement the historic features.

Walk around the grounds and you will see why people love living here. The trees are big and offer plenty of shade.

This particular condo is in the center of a beautiful breezeway, which feels like a green jungle, even in summer.

The pool is sparkling and just around the corner from your front door. See it before it’s gone!

Closed in November. 1107 W. Osborn Rd., #219. 2br/1.75ba, 1,108sf

This affordable gem has a balcony that over-looks the beautiful acreage at Nonpareil Condos, with a massive tree shading from the west.

Sit out on the balcony and enjoy your morning coffee or read the paper, er, kindle, er, smart phone.

Aw, you get the picture!

You’ll love the original 1950’s kitchen. Still functional and cut.

Shopping at Sprouts and Safeway is just around the corner, with easy access to all of the fun of Central Phoenix.

You will be hard-pressed to find a value like this so close to everything, including Phoenix College, which is directly to the south of this property.

Closed in November. 18427 N 36th Ln, Glendale 85308. 2br/2ba, 1,283sf

Our sellers on this property updated the flooring and paint.

It boasts a large master suite with sliding doors leading to the large covered patio. The patio will make a shady space for relaxing or gardening.

The yard is landscaped, irrigated, and includes a sliding RV gate for your fun toys. The two-car attached garage includes a plethora of additional storage cabinets, and a workbench to fix the aforementioned toys.

The home includes a newer roof and security shutters. It is close enough to the I-17 and the loop 101 to be convenient, but far enough away so that you can enjoy a quiet neighborhood.