You are back from Memorial Day weekend and are looking for some June events and good reads to help you transition slowly in to the actual work you are being asked to do again.

I see you.

We’ve been there.

You can’t just jump directly in to reading that dry report that’s been sitting in your inbox for a week.

We’ve got your back. Read, plan, procrastinate.

—–

An Electrifying Proposition. Solar United Neighbors came up with a creative way to lower the cost of solar panels and batteries. They build a co-op of home owners who get together and negotiate as a group for lower prices. They are taking that to the next step with a webinar on “electrification“, or ridding your home of dirty fossil fuel, such as methane gas. “Electrification is yet another way to divest ourselves from world energy markets. The path to true energy independence starts with solar panels, but ends with full electrification powered by renewable energy. Joel Rosenberg from the Special Projects team at Rewiring America will explain why this matters and what steps you can take to electrify everything in your home.

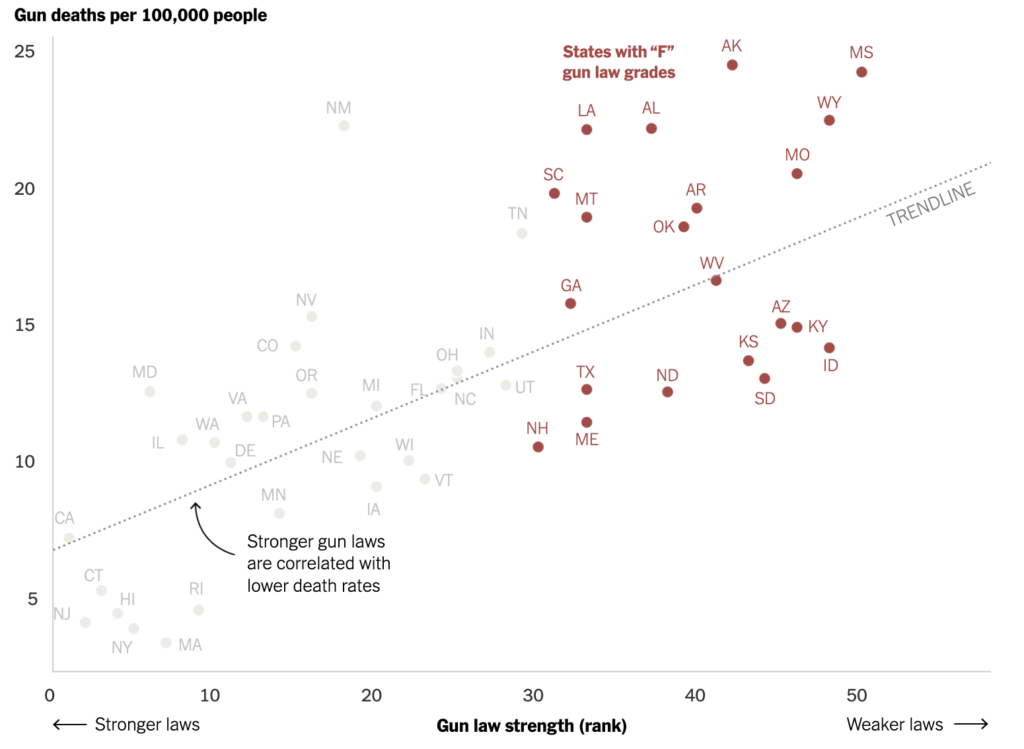

Common Ground on Guns. Surprised to see guns mentioned in a real estate newsletter? Well, you know me. I’m a policy dork who is always looking for solutions to problems that plague our neighborhoods. But I’m also an American who sees that there is room for common ground on guns. And this article points to where that common ground could be –treating guns like we treat cars will preserve gun rights, but also increase safety. (The article is behind a paywall. But, you may be able to access a few free articles. And, of course, good journalism costs money.)

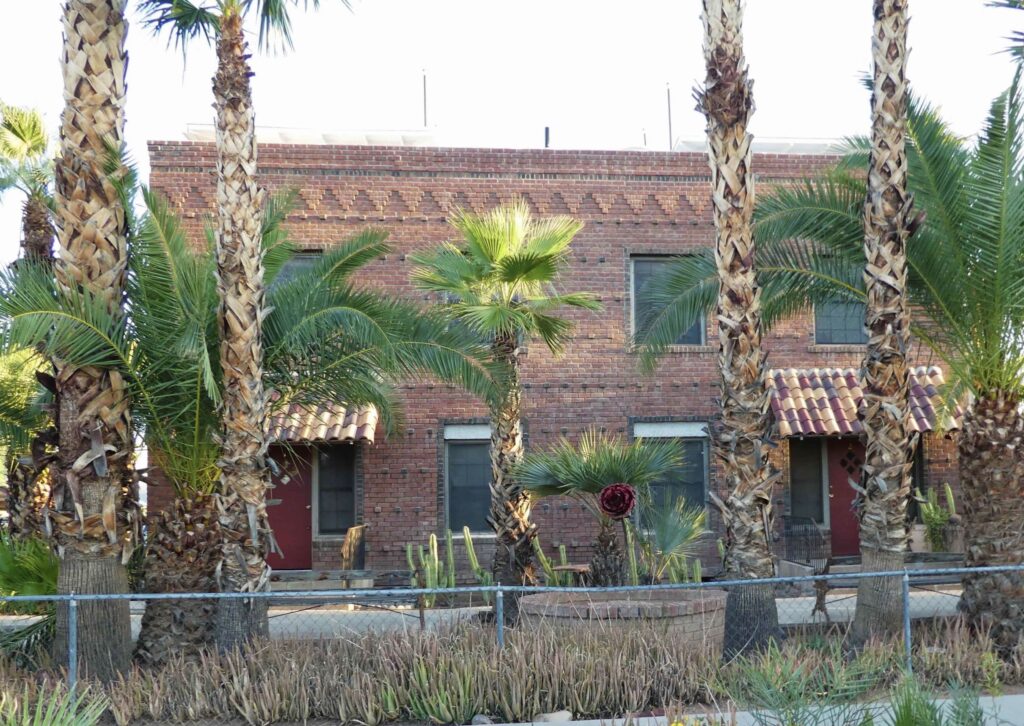

First Friday at the Heard Museum. When people visiting Phoenix ask me what to see, I almost always point them to the Heard Museum. But many people who have been here for years have either never been or might like to re-visit. First Friday is great for that, since it is free on that day. Dedicated to the sensitive and accurate portrayal of Native arts and cultures, the Heard is an institution that successfully combines the personal stories of American Indians with the beauty of art. M-Sat 9:30am-5pm; Sun 11am-5pm.

Basement Tapes. In memory Maurice ‘VEX’ Brown… Basement Tapes is a mix show featuring the best in independent music from the soulful side of the spectrum. Come out to be immersed in African American Culture and hear classic & contemporary HIP HOP, SOUL, FUNK, AFROBEAT, R&B, rare groove & dusty beats straight from the crates. Hosted by DJ Rikkie Tee + MyGodComplex + featuring guest artists & selectors! Free in the music hall.

Girls In STEM. Explore the ‘E’ in STEM with an engaging half-day #GirlsInSTEM event, Tech N’ Tinker: Inspiring Tomorrow’s Engineers! Using the six-step engineering design process, participants will build, test and tinker their way through engaging engineering challenges. Presented in a trial-and-error-positive environment, participants will learn the benefits of “failing” in order to create a stronger end-result. With the help and mentorship of #WomenInEngineering from WiMCO, these #GirlsInSTEM are sure to leave inspired to take on the world of engineering. $5.

Ideation Part 2 – Thursday Gathering, June 9th. Meaningful ideas and big changes are sparked when serendipitous connection collides with intention.

Every week at their flagship program, the Thursday Gathering, they connect creators, entrepreneurs, investors, coworkers, students and visionaries to build strong, inclusive and equitable innovation ecosystem. Free.

Building Community with Entrepreneurs. Join Local First Arizona and State Forty Eight Foundation on June 8th for a collaborative evening to hear stories, inspiration and ideas for building a better Arizona. Featuring 4 entrepreneurs and business owners sharing their unique journeys and experiences. Admission is free. Small appetizers will be served and an open bar available.

Something Rotten! Not content to let William Shakespeare get all the attention, the conniving but clueless Bottom brothers hatch a plan to cook up the next big stage hit. After an ill-advised trip to see Nostradamus’s food-obsessed nephew, they risk everything to produce what they believe will be the show of the future: the musical! Combining everything you love about Broadway—big dance numbers, bold costumes, and eye-rolling off-stage antics! Through June 18th.

Carnival of Illusion presents SKULLDUGGERY! STEP RIGHT UP as Carnival of Illusion shares a Magical Night Out of devious deceptions and lovely lies with SKULLDUGGERY! This top-rated show is “Revitalizing Magic” by blending old-world prestidigitation with all the charm of a Vaudeville-inspired roadshow. Travel up-close with the national recipients for “Excellence in Magic” and catch a lively slice of magical history!