August Market Preview

Who thinks about the housing market in August?

Who thinks about even going outside?

We do, and so do the folks at the Cromford Report.

Here are some of the basics – the ARMLS numbers for August 1, 2024 compared with August 1, 2023 for all areas & types:

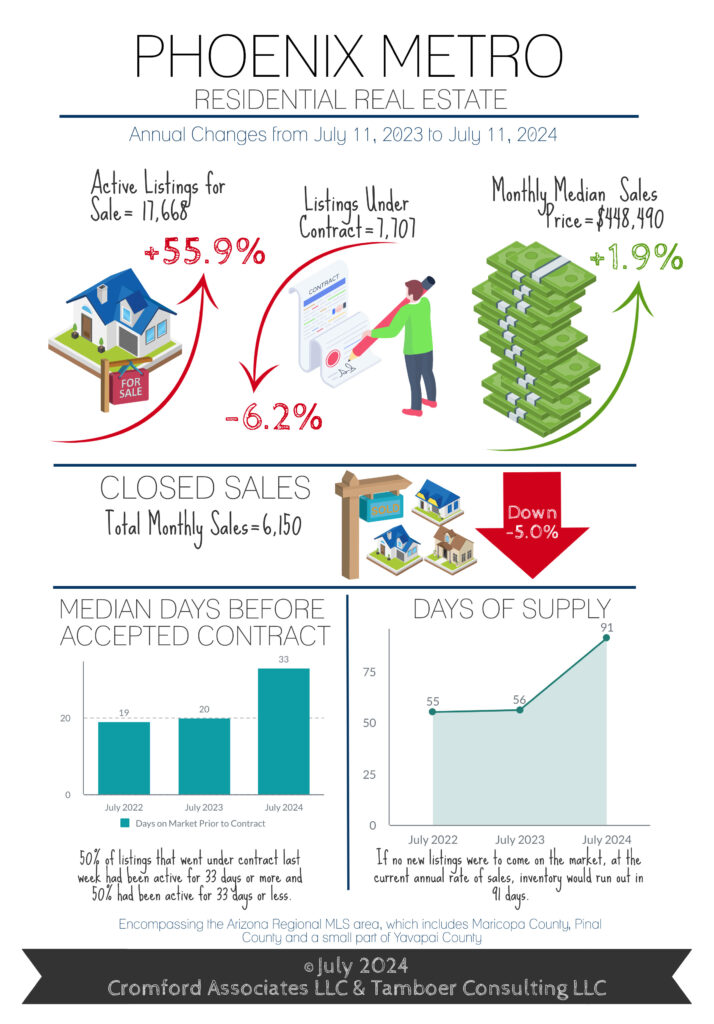

- Active Listings (excluding UCB & CCBS): 17,677 versus 11,241 last year – up 55% – but down 3.6% from 18,121 last month

- Active Listings (including UCB & CCBS): 20,320 versus 13,945 last year – up 46% – but down 3.8% compared with 21,116 last month

- Pending Listings: 4,441 versus 4,842 last year – down 8.3% – but up 0.8% from 4,407 last month

- Monthly Sales: 6,199 versus 5,915 last year – up 4.8% – but down 2.0% from 6,324 last month

- Monthly Average Sales Price per Sq. Ft.: $286.58 versus $281.97 last year – up 1.6% – but down 2.9% from $295.15 last month

- Monthly Median Sales Price: $440,000 versus $434,900 last year – up 1.2% – but down 2.2% from $450,000 last month

There is very little positive about these numbers as the Greater Phoenix housing market continues to suffer from weak demand and low volumes. However if you dig deeply you can find some excuses for mild optimism. The supply has fallen over the past month and although it remains significantly higher than last year, it is now on a downward trend, at least for the short term. We also see a very slight up-tick in pending listings from last month, though this positive sign is counterbalanced by a decline in listings under contract.

Though there are plenty of credit problems in other sectors (e.g. auto loans, credit cards), home loans are looking very healthy with delinquency stuck at low levels. This also means foreclosure volumes are very small and there is little sign of that changing in the near to medium term. You Tubers have been forecasting a new tsunami of foreclosures for over 5 years now and have managed to be 100% wrong. Those who would love to see more bank-owned homes enter the market are out of luck. There is also no sign of their luck changing in the near term.

Current pricing is only slightly ahead of this time last year, with the median sales price up only 1.2%. Most things have risen far more than 1.2% over the past 12 months, so homes are effectively cheaper in real terms than they were a year ago.

Mortgage rates have dropped hard over the last 3 days, with the average 30-year fixed rate down from 6.80% to 6.40%. They could drop further if the Federal Reserve do as expected and lower the base rate at their September meeting. Nothing is certain, but it would be a fair guess than demand would pick up significantly if rates get back around the 6% mark.

Overall, the market is balanced with a slow and gentle trend towards greater bargaining power for buyers. However, now that supply is falling, it would only take a small increase in demand to reverse that trend.