The Beginning of the Beginning

Remember Econ 101?

When the supply of something goes down, prices go up.

So we are sitting on the crest of a wave. It won’t be a massive wave, but this is where it turns around. Those who are fully employed are sitting on more savings than they have had in decades (about 6% versus 1%, usually). They are not spending because they are watching for good economic news, which is starting to trickle in.

These people have been very attracted to the market (lowest prices in decades and lowest interest rates in centuries), but they are just waiting for good news. Then they will act and act quickly.

The following is the news they are waiting for. Watch as people trying to get the best deals before prices go up actually help drive prices up.

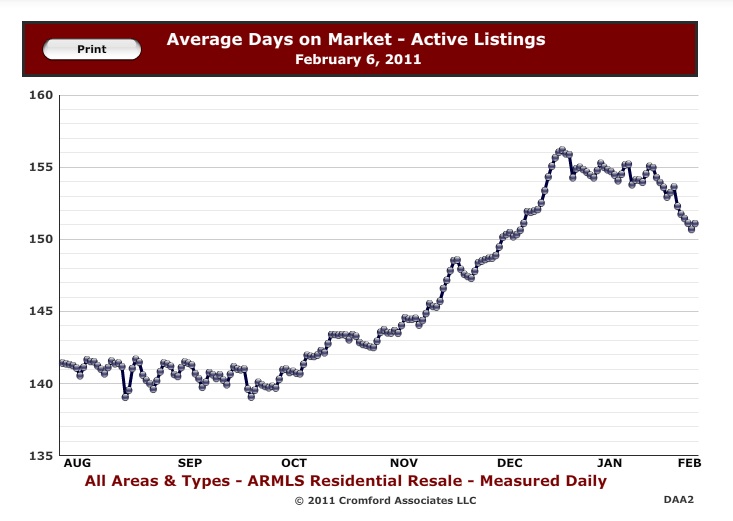

1) Days on Market. You are seeing here that homes are not staying on the market quite as long. In fact, quite dramatically. Just look at the drop since December. Simply put, as soon as the good homes come on, they are getting snapped up! The properties that need a little work or that are not priced right will stay on a little longer. This will drive down inventory.

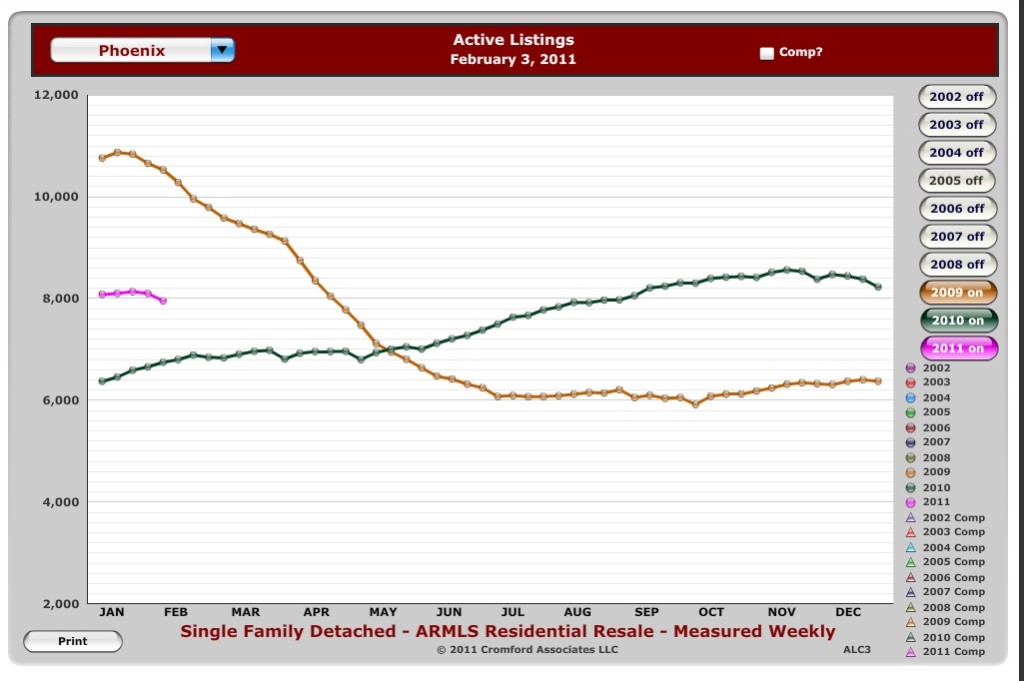

2) Active listings –watch that pink line! What you are seeing here is the number of active listings starting to shrink again. Two reasons, (1) people are already starting to snap up the best homes and (2) the foreclosures and short sales are going away. It won’t happen over night and it won’t be extreme. But prices will increase. An increase in prices by 10% combined with increased interest rates can mean over $100 per month more on a $150,000 home.

Leave a Comment