Two weeks ago, Lyssa Hall, Senior Landscape Architect for Parks Development at Parks and Recreation told me about the Final Report on Greening America’s Capitals: Lower Grand Avenue, Phoenix (PDF).

The report provides short, mid and long term strategies for the redevelopment of Lower Grand Avenue into a vibrant corridor.

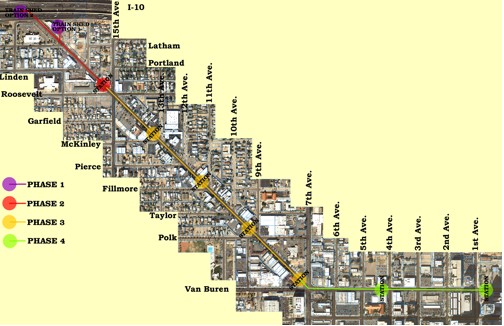

Here is a major development: it mentions a possible street car or trolley in the future. That is a HUGE win for the Grand Avenue Rail Project (GARP) which I wrote about a few weeks ago as being in danger of losing its Phoenix support when a neighboring city received a proposal to take our trollies and add them to their local museum.

The mention of the possible trolley in the Greening on Lower Grand report is not an endorsement by the city, but I believe that the city needs to get behind this economic development project.

I joined the non-profit Grand Avenue Rail Project (GARP) board shortly after it was first proposed and we are working to get recognition of what a great return on investment this represents. If funded, it would mean that you could ride the modern light rail in from the burbs, jump on the old Trolley and visit all the galleries and sites that will inevitably populate Grand Ave.

But, it is less about transportation than it is about what happens when you have a feature like this in an area like Grand. If you look at the buildings along Grand, most of them were built when Grand was THE shopping street in Phoenix. They are close to the road, the sidewalks are wide. Basically, the architectural environment is in place for new businesses to spring up. Behind those buildings are hundreds of old bungalows that have been largely neglected. A project like this will encourage historic renovation with the fervor that we saw around the light rail line recently.

That represents more dollars in the local economy, new businesses and higher value homes. All from a 1.5 mile trolley line.

And, who knows? That short trolley line could eventually make its way all the way around downtown. This is just a start.

Now, that’s economic development.

Now, as for the process:

It is the Parks and Recreation Department’s mission to be the best Parks Development Division in the nation. To this end, public meetings “community design workshops” were held over three days in Feb and March, put on by the Grand Avenue Merchant Association (GAMA) and the U.S. Environmental Protection Agency. The result of those meetings was finalized on September 10 by the Environmental Protection Agency and can be found in this Final Report:

The Streets Transportation Department will be presenting the findings from the workshop and report at the Parks, Arts, Families and Seniors Subcommittee on Oct 9th at 10am in Phoenix City Hall, assemble room A. If you are unable to attend the subcommittee meeting, they will be televised and archived for viewing.

The estimated cost to build the trolley infrastructure, outfit a new museum on grand and operate the system: $10 million. I’ve heard transportation planners say $50. I think that is high for 150 year old technology.

Regardless, believe that the resulting new home sales, infill development and business starts along grand will be worth ten times that. Please contact your city councilmen and let them know that you support the Grand Avenue Rail Project.