Market trends are upon us again! Try to contain your excitement.

Our Friend Cynthia Lujan from Old Republic Title was nice e nough to send us new stats on the current market.

nough to send us new stats on the current market.

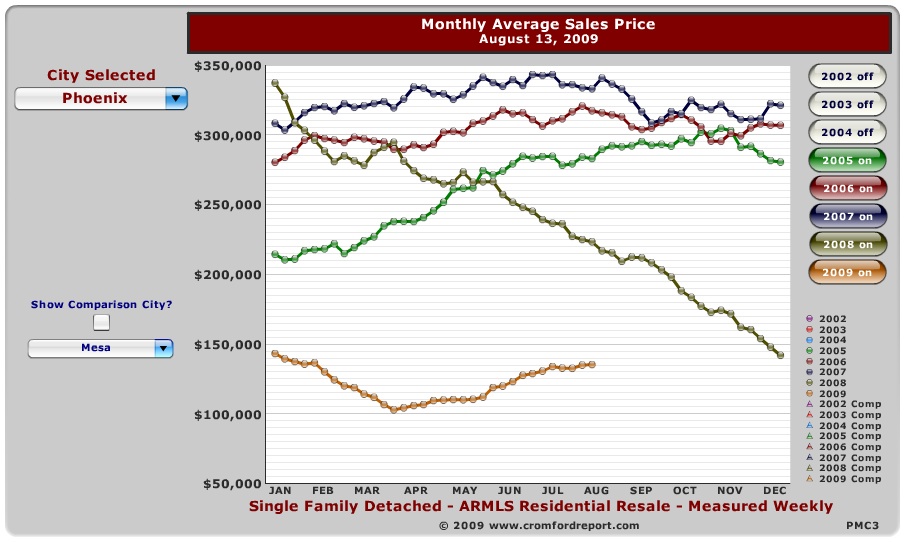

Between November and December supply was is once again on a downward trend for all price ranges. The strongest decline in supply is for homes under $100,000. Sales rates look better between$200,000 and $400,000 while above $400,000 demand is still a problem. Demand from owner occupiers remains subdued due to strict underwriting standards for “jumbo” loans, but cash buyers including landlords and other investors are quickly snapping up a large part of whatever comes onto the market.

The supply from foreclosures continues to fall with more pending foreclosures getting resolved by short sales. Lenders are receiving fewer homes into REO inventory as a higher percentage of trustee sales result in a sale to a third party. Despite public perception to the contrary, price per sq. ft. has gone up in the past year. (Do we hear that on the national news? Noooo!)

The strongest recent movement is for the price range below $100,000, where price per sq. ft. hit bottom in February and is now up nearly 7% over the last 12 months. With supply on a downward trend again we anticipate that the peak spring season will find most buyers frustrated by a lack of choice and fierce competition from other buyers.

So what does this mean for you? Buy now!

The inventory of houses between $100,000- 200,000 are down 46.6% and sales prices are now 6.9% higher than last year. Homes from 200,000-400,000 numbers aren’t as dramatic, with supply down 26% and prices up .3%. As all we all learned in our 10th Grade Economics class, as supply grows more limited, demand will drive prices up.

Need help finding a home? Call me today at 602-456-9388

I want to give a little shout-out to Tazmine and Paul over at

I want to give a little shout-out to Tazmine and Paul over at