The Seller’s Market is Coming

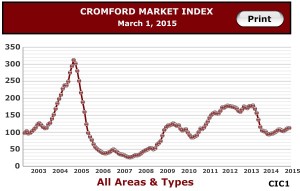

For those of you who are long-time readers, you know that I’m a fan of the Cromford Index. The index not only tells you whether we are in a seller’s market or a buyer’s market, but also by how much we are going one way or another.

If you are buying a home, you’ll want to watch this trend. If the Cromford Index is moving upward, you need to move before it goes too far in to the seller’s advantage.

If you are selling a home, you need to watch out for the opposite trend. If you see the index moving downward, then you want to be more aggressive in your pricing –get out ahead of the market so you are not chasing it downward.

So, where are we now? Check this out.

Remember, 100 is a balanced market. Over 100 is a seller’s market and under is a buyer’s market.

See how much of a buyer’s market it was during the Great Recession? Then see how the seller’s took over from 2010 to 2014? Those were the people who bought during the lowest of the crash and then sold once we started to recover.

Notice also that we’ve been mostly riding 100 for a little while. Well, it looks like we are moving up towards a seller’s market once again. What does that mean? It means that sellers have an advantage — no seller-paid closing costs, prices will go up if supply stays low.

Combine this with the possibility that interest rates may go up later this year and you will want to get on in to the hunt today if you are a buyer.

If you are a seller, those interest rates are mixed news. Yep, the market seems to favor you, but an increase in interest rates may deter buyers. Or, it may encourage buyers to get in the market. We will see.

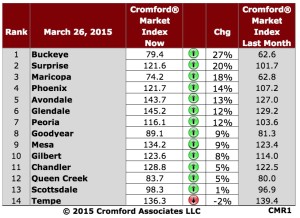

Check out this chart over just the last month. This market is definitely heating up.  Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

What this means for you also depends on your specific situation and the neighborhood in which you live.

No doubt, this is a shifting market.

If you need help navigating it, please give me a call at 602-456-9388 and let’s assess the situation.