Here’s something new for you in Downtown Phoenix: Milk Bar. Remember that cream colored building on the corner of McKinley and 3rd St.? The one that sat empty for so long?

Here’s something new for you in Downtown Phoenix: Milk Bar. Remember that cream colored building on the corner of McKinley and 3rd St.? The one that sat empty for so long?

Well Darek Pasieka has redeveloped the space into an incredible bar and restaurant celebrating Polish culture with a modern twist.

Built in 1909, the Western colonial/modern style house, (historically named the Marsh Arnott House), has changed over the years, a reflection of its diverse tenants. The structure has served as a residence, law office, art space, and hair salon before becoming a European bar.

When Pasieka’s company, Studio Darek, took on the adaptive reuse project, there was a lot of speculation from the neighborhood about what was in the works. Some thought a cult while others thought it a tribute to Anthony Burgess’ Clockwork Orange. Alas, neither is true. But Darek’s a good sport and has added a drink onto the menu called Clockwork, which is made with Zolta Gorbka Orange and Clove Vodka and is utterly delicious.

Since 1896, Milk Bars, or Bar Mleczny, have been a staple of Poland and Eastern Europe, especially for the working class during the Soviet Era. As the name entails, it was here that traditional milk-based dishes were served at a reasonable cost. After communism fell, Milk Bars remained popular hangouts because of the warm and welcoming atmosphere.

Since 1896, Milk Bars, or Bar Mleczny, have been a staple of Poland and Eastern Europe, especially for the working class during the Soviet Era. As the name entails, it was here that traditional milk-based dishes were served at a reasonable cost. After communism fell, Milk Bars remained popular hangouts because of the warm and welcoming atmosphere.

“These Milk Bars – known for affordable food but high quality—would survive as nostalgic relics. Milk Bars to this day have stayed popular as a meeting place for people of all walks of life,” says Darek.

At Milk Bar, the potato is king. Lining the menu are euro posh vodka drinks and pierogi stuffed with combinations of cheese, spinach, mushroom, and meat.

As an accomplished architect, and now restaurant/bar owner, Darek Pasieka continues to turn heads with his ‘past meets present’ ideas. As he puts it, “Respecting the past, celebrating the present, and looking into the future. This is my architecture.”

Join us this month for an unforgettable Get Your PHX as we head to Phoenix’s Milk Bar. Pierogi provided courtesy of our host, Darek Pasieka, and cash bar for drinks. Bonus points for anyone that dons a bowler hat, eyelash embellishment or white suit!

As always, please RSVP below. “Na zdrowie!”

(Cheers!)

Where: Milk Bar: 801 N. 3rd St.

Date: Thursday, April 23rd

Time: 6:00PM – 8:00PM

Bonus: Pierogi and prizes! Don’t forget your raffle ticket at the door!

RSVP: April Get Your PHX: Milk Bar

Like us on Facebook!

Congratulations to our friends Abraham James and Patrick Hallman at C&H and Associates are announcing that they received a $35,000 Community Development Block Grant for the third year in a row.

Congratulations to our friends Abraham James and Patrick Hallman at C&H and Associates are announcing that they received a $35,000 Community Development Block Grant for the third year in a row.![]() Some examples of previous grants that worked with C&H and Associates include JoBot Coffee, Core Crossfit, Karl’s Bakery, the Canvass corner at 3rd St. and Roosevelt.

Some examples of previous grants that worked with C&H and Associates include JoBot Coffee, Core Crossfit, Karl’s Bakery, the Canvass corner at 3rd St. and Roosevelt.

Here’s something new for you in Downtown Phoenix:

Here’s something new for you in Downtown Phoenix:  Since 1896, Milk Bars, or Bar Mleczny, have been a staple of Poland and Eastern Europe, especially for the working class during the Soviet Era. As the name entails, it was here that traditional milk-based dishes were served at a reasonable cost. After communism fell, Milk Bars remained popular hangouts because of the warm and welcoming atmosphere.

Since 1896, Milk Bars, or Bar Mleczny, have been a staple of Poland and Eastern Europe, especially for the working class during the Soviet Era. As the name entails, it was here that traditional milk-based dishes were served at a reasonable cost. After communism fell, Milk Bars remained popular hangouts because of the warm and welcoming atmosphere. I’m sure you’ve heard of home buyer programs over the years, programs that are funded by cities or counties and which help you buy your first home, if you qualify.

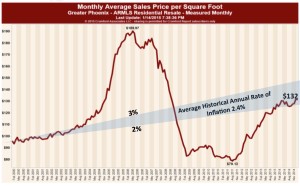

I’m sure you’ve heard of home buyer programs over the years, programs that are funded by cities or counties and which help you buy your first home, if you qualify. The following is an excerpt from the Cromford Report’s comments from March 30th on the state of rentals in the Valley.

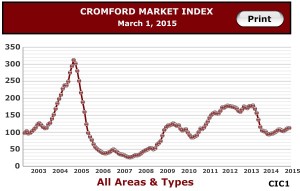

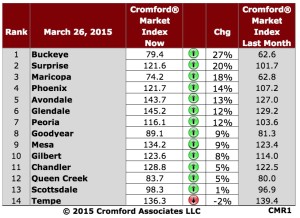

The following is an excerpt from the Cromford Report’s comments from March 30th on the state of rentals in the Valley.

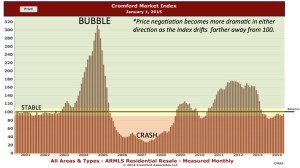

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

You’ve probably heard me lament about the fact that Generation Y home buyers are not coming in to the housing market as quickly as we had hoped.

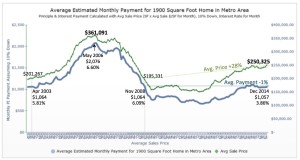

You’ve probably heard me lament about the fact that Generation Y home buyers are not coming in to the housing market as quickly as we had hoped. I don’t want to give you heart palpitations, but if you are planning to purchase a home, you might want to do it sooner this year, rather than later.

I don’t want to give you heart palpitations, but if you are planning to purchase a home, you might want to do it sooner this year, rather than later.