I was driving down the road yesterday, minding my own business, when another ad for Zillow came on the radio.

They claimed that their service helps you compare prices, find rentals and maybe even train your cat to dance the polka. I might be wrong on that last point, but it sounded like he was saying that.

But, it brought me all back to the various reasons why Zillow is not necessarily your friend when it comes to buying or selling a home.

Here, here, here and here are four posts that I’ve done since 2011 which give you good details on what is wrong with this and other services like them. After hearing these ads, I feel obliged to educate the world.

1) Zillow and other services make money by selling ad space to realtors, to show up just at that moment you are looking at a nice home on their website. The agents who purchase your data may not be specialists in your area or the type of home you want. This is particularly important in historic areas.

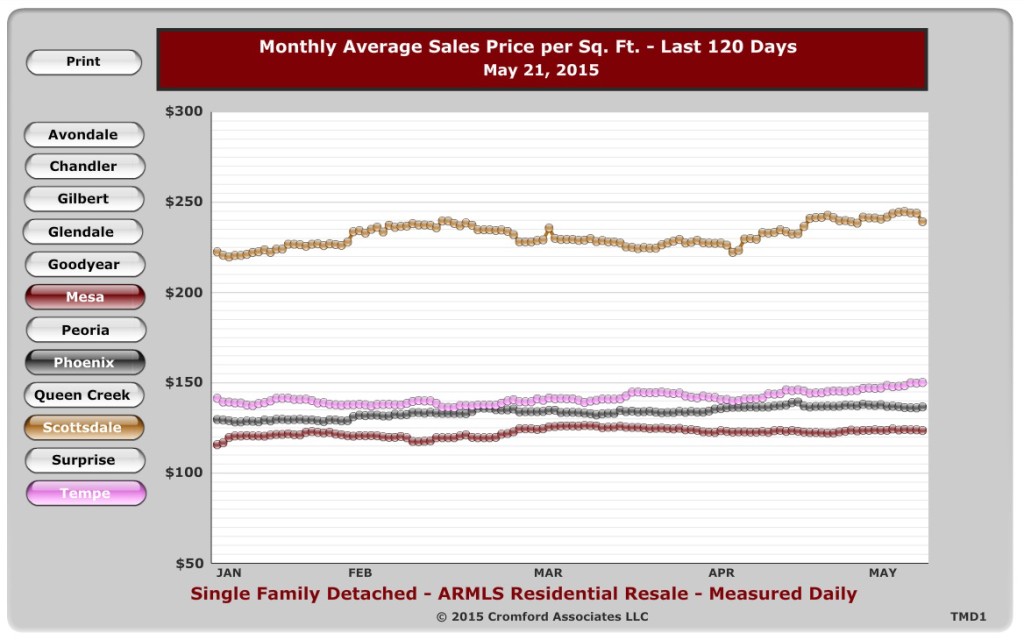

2) The data that these services use comes from the data that we agents update every day, but these services don’t get all of that data. We reserve the most important (and most private) for our professional industry and for our clients. So, you may log on to these services, give them your data to use, but you won’t necessarily get the most up-to-date information.

3) There is a time delay from when we agents update listings (active, pending, closed) and when the services see the change. So, if you need to react quickly to the market, you may not be able to.

4) The data also impacts the estimates that you get from these sites. These services don’t get the most accurate data, so they have to construct some other estimate using older information, extrapolations and duct tape. They often give you an inaccurate picture of your home value, or the home you are looking at. This is especially true with historic homes.

If you want accurate statistical market analysis, specialty in the market and personalized representation, just call and agent so that you can use his or her MLS portal.

I can help you, so call me at 602-456-9388.

e corner of Garfield and Second Streets sits a gray building surrounded by a wave of metal poles and a metal cyclist statue in the center. If it were not for the hoard of bikes parked out front, you might mistake it for an art gallery – an intentional move by owner Jason Boles who adds, “At the end of the day we’re near Roosevelt Row and we knew art had to be part of the experience.”

e corner of Garfield and Second Streets sits a gray building surrounded by a wave of metal poles and a metal cyclist statue in the center. If it were not for the hoard of bikes parked out front, you might mistake it for an art gallery – an intentional move by owner Jason Boles who adds, “At the end of the day we’re near Roosevelt Row and we knew art had to be part of the experience.”

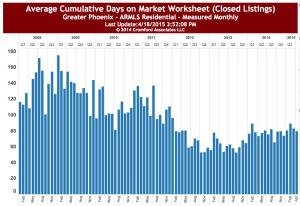

This post follows on a post that I did back in March, in which I discussed that there is such a tight rental market right now. Surprisingly enough, it was called “

This post follows on a post that I did back in March, in which I discussed that there is such a tight rental market right now. Surprisingly enough, it was called “

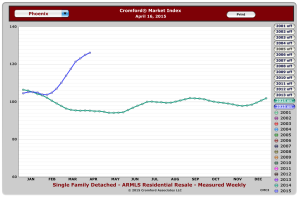

Our friends at the

Our friends at the

Index was showing that the market was turning toward a sellers’ advantage. I was shocked to see that trend taking an extreme swing upward.

Index was showing that the market was turning toward a sellers’ advantage. I was shocked to see that trend taking an extreme swing upward.