Thanks again to our friends at the Cromford Report for their excellent analysis on all things real estate.

Here are a few highlights:

“For the monthly period ending August 15, we are currently recording a sales $/SF of $132.74 averaged for all areas and types across the ARMLS database. This is 2.0% below the $135.42 we now measure for July 15. Our forecast range was $131.71 to $137.09 with a mid-point of $134.40. Last month’s mid-point forecast was $1.66 above the actual price per square foot measured, but the actual result was well within the 90% confidence interval.

On August 15 the pending listings for all areas & types showed an average list $/SF of $135.41, 0.5% below the reading for July 15. Among those pending listings we have 86.9% normal, 4.7% in REOs and 8.5% in short sales and pre-foreclosures. The average pricing for pending listings within Greater Phoenix on August 15 in each category was: $140.36 for normal, $98.69 for short sales & pre-foreclosures and $89.08 for REOs.

Our mid-point forecast for the average monthly sales $/SF on September 15 is $131.55, which is 0.9% lower than the August 15 reading. We have a 90% confidence that it will fall within ± 2% of this mid point, i.e. in the range $128.92 to $134.18. We have already experienced considerable seasonal price weakness this summer and our forecast this month is for this weakness to continue until mid September at least.”

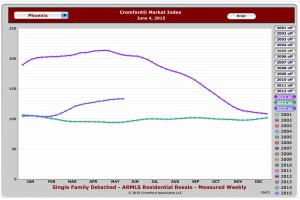

Single Family Homes and Condos

So, how does that translate in to the Cenpho and historic markets? Well, while we see higher prices than most areas, generally, and tighter supply, we have seen a similar dip in prices. Interestingly, though, we only see that dip when we include condos in the mix, along with single family residences. See below.

Single Family Homes and Condos

Condos typically take longer to sell, as people are weary to take on HOA dues. This could be part of it. It is certainly interesting news if you are in the condo market.

Watch for these prices to go up again after late September.

If you are looking for more information, please call me at 602-456-9388.

As if starting one restaurant wasn’t enough, this creative duo opened Be: Coffee + Food + Stuff in the space once occupied by Songbird Coffee. A rotating menu of open-faced sandwiches, infusion coffee and tea, plus pastries from local bakeries and even soft serve ice cream are fast-making loyal fans.

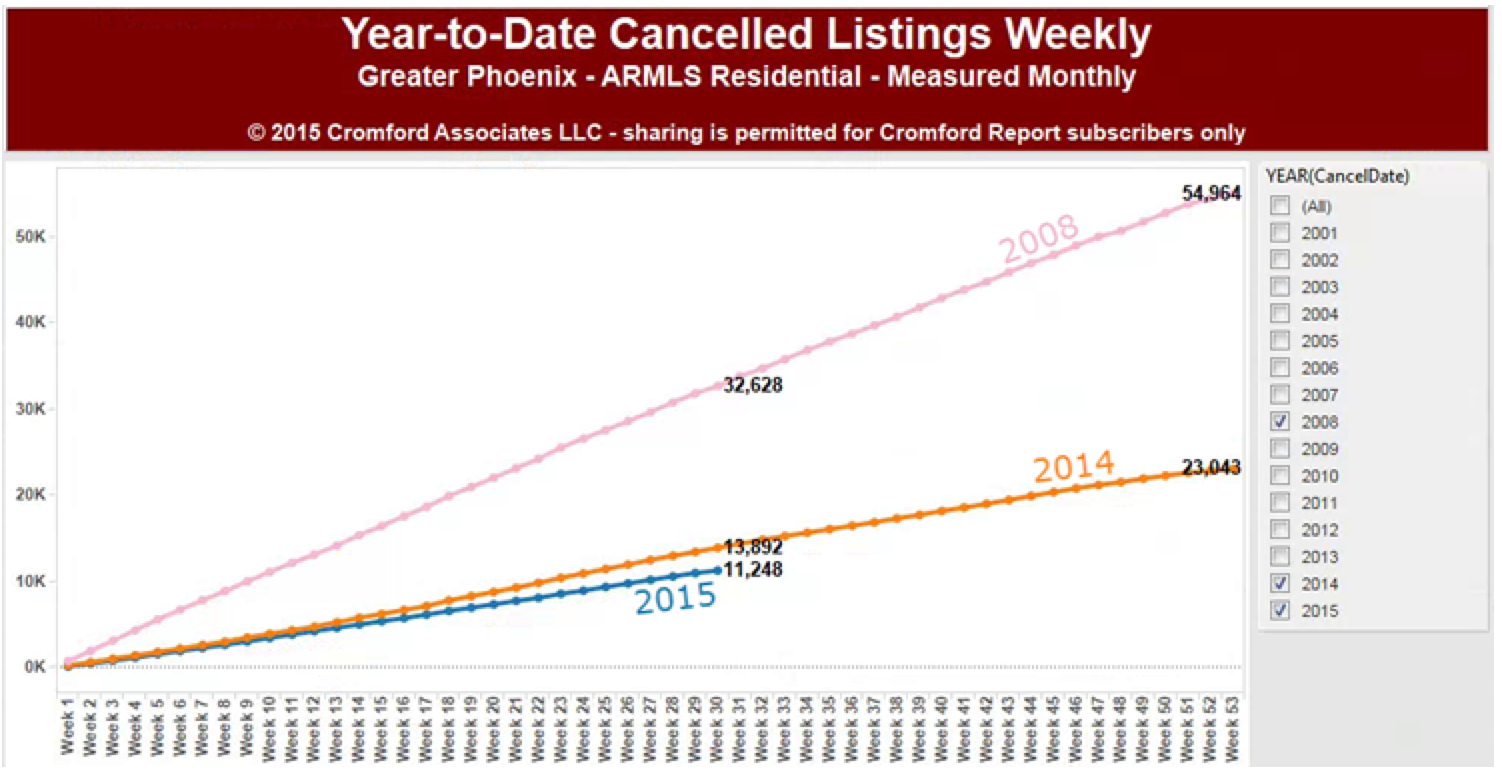

As if starting one restaurant wasn’t enough, this creative duo opened Be: Coffee + Food + Stuff in the space once occupied by Songbird Coffee. A rotating menu of open-faced sandwiches, infusion coffee and tea, plus pastries from local bakeries and even soft serve ice cream are fast-making loyal fans. ere’s another interesting indicator: how many listings are cancelled after being on the market for a while.

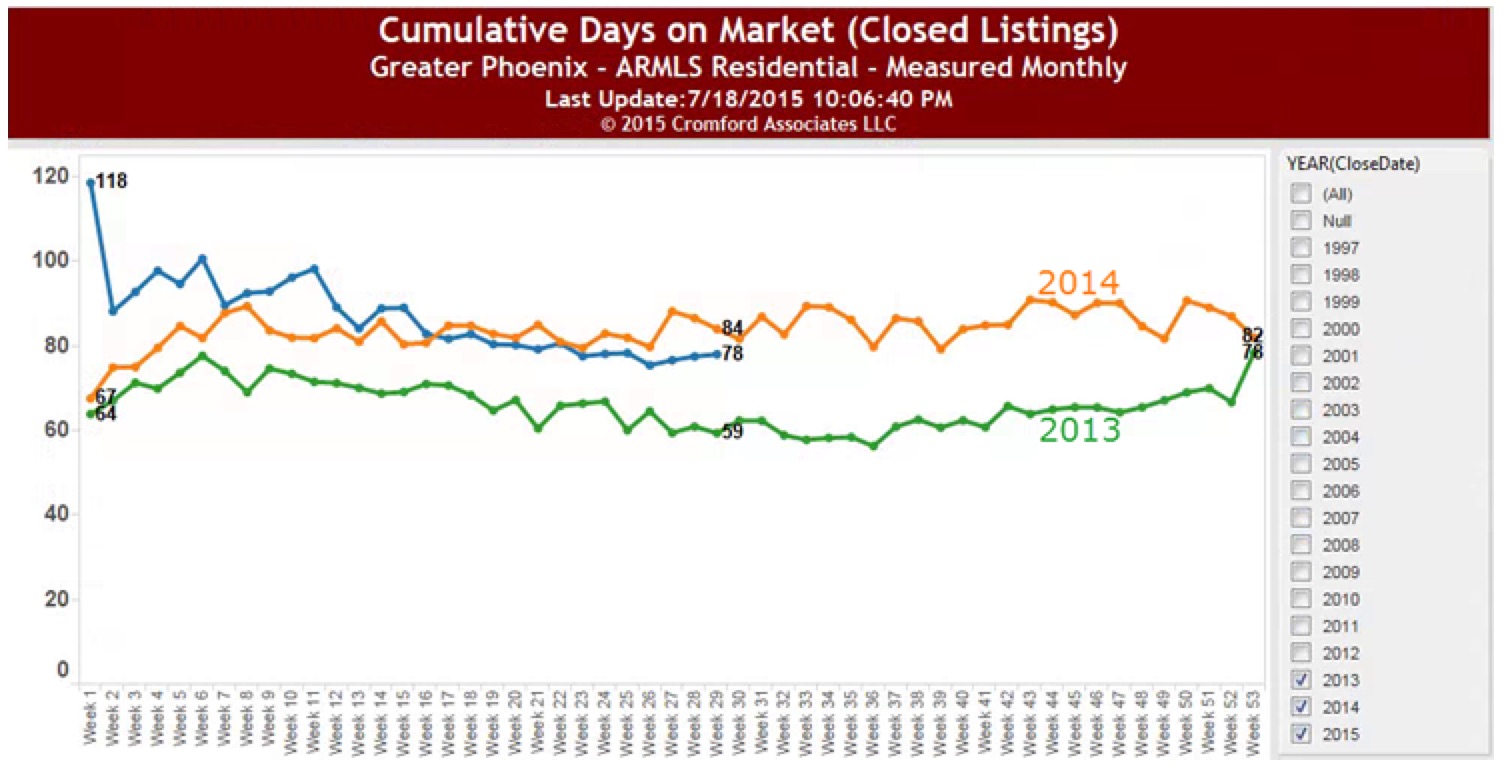

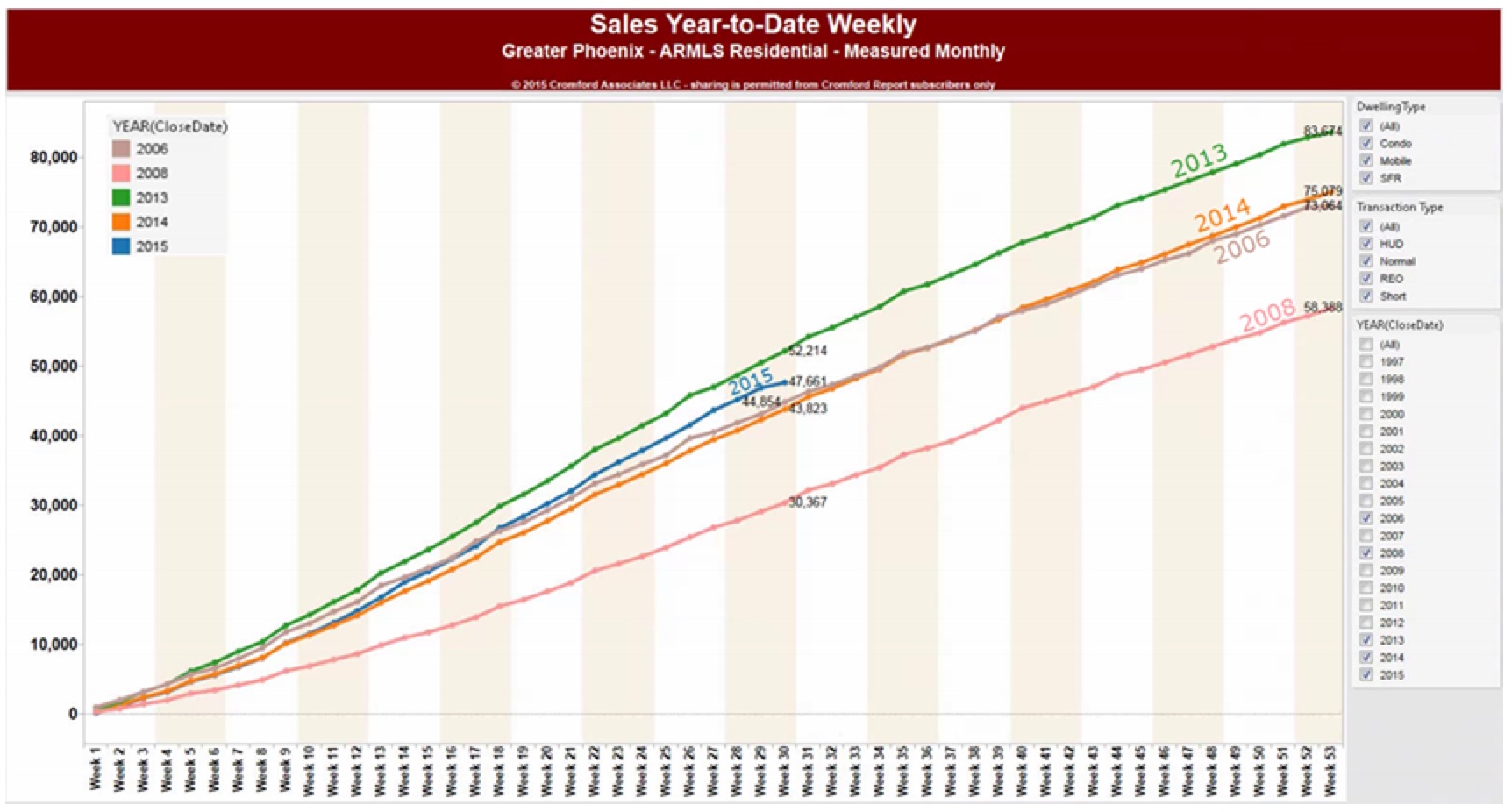

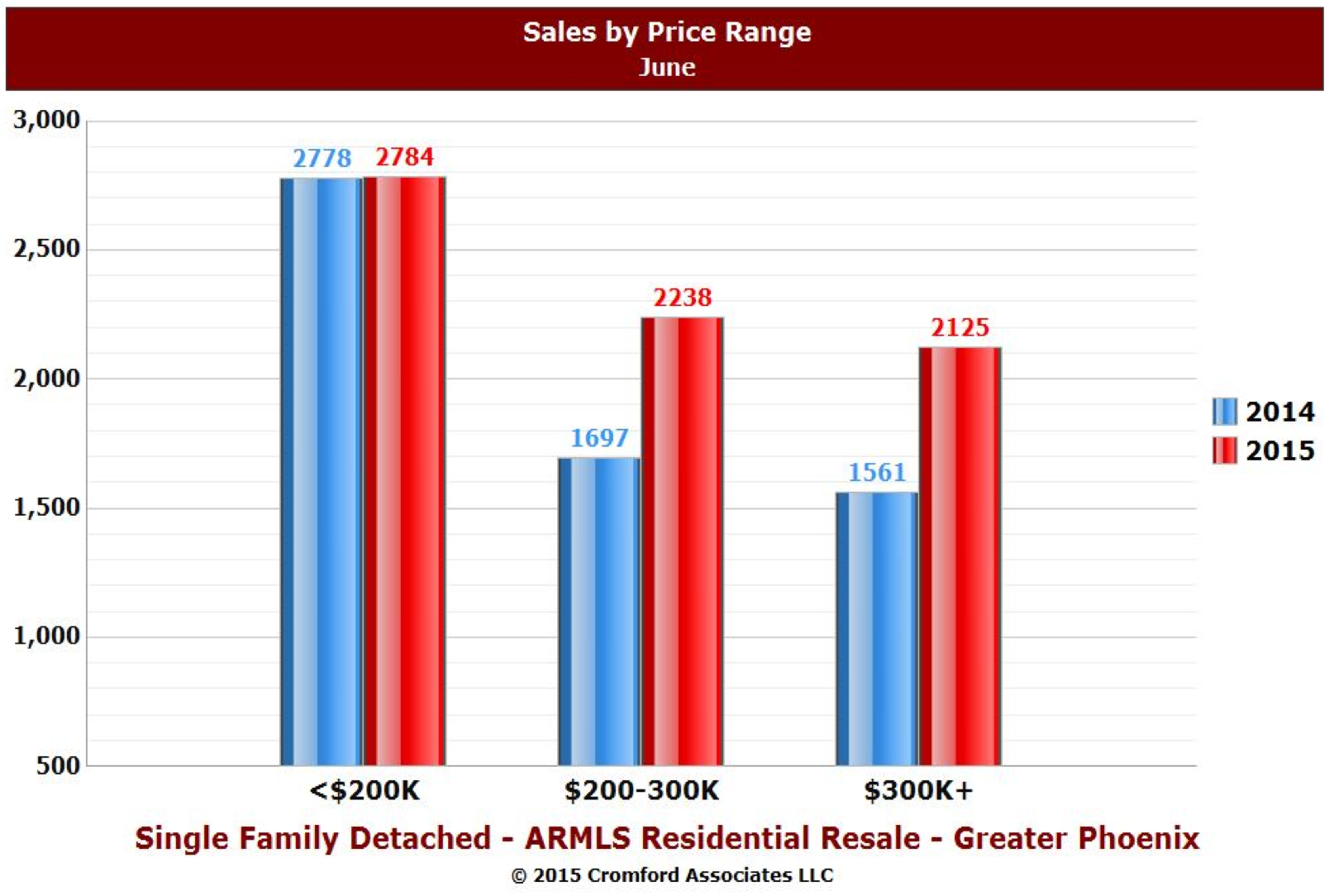

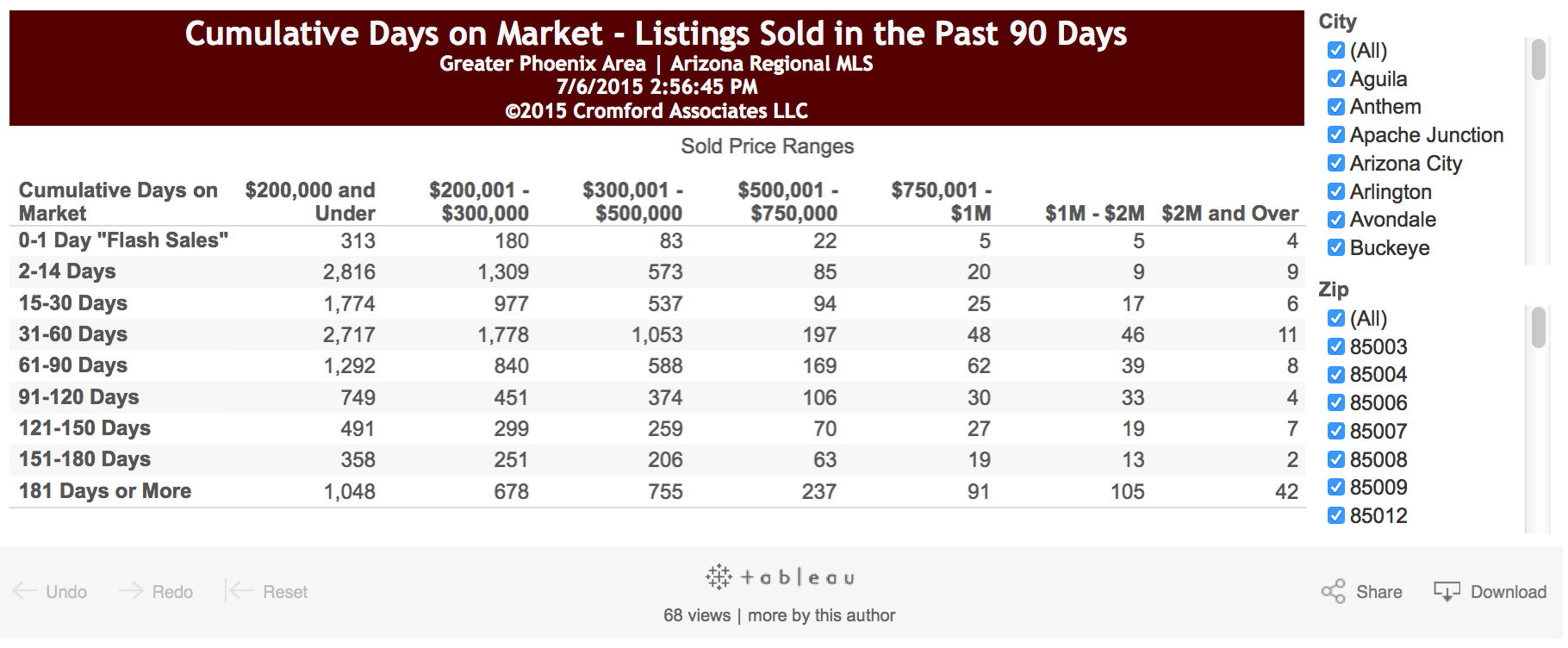

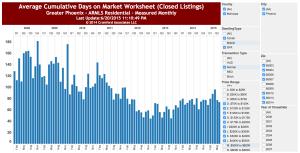

ere’s another interesting indicator: how many listings are cancelled after being on the market for a while. Also notice that the number of days on market (average) is a little lower than last year. So, this year they are selling. Prices are increasing slightly over last year and people are selling homes. I don’t see any indication that these price increases are irrational. However if interest rates rise later this year and buyers can’t get loans as easily, those prices may be forced to come down and this dynamic will change. If that happens, I don’t see major changes in 2015 –probably next year.

Also notice that the number of days on market (average) is a little lower than last year. So, this year they are selling. Prices are increasing slightly over last year and people are selling homes. I don’t see any indication that these price increases are irrational. However if interest rates rise later this year and buyers can’t get loans as easily, those prices may be forced to come down and this dynamic will change. If that happens, I don’t see major changes in 2015 –probably next year. Its mid-year and time to take stock of where the market stands.

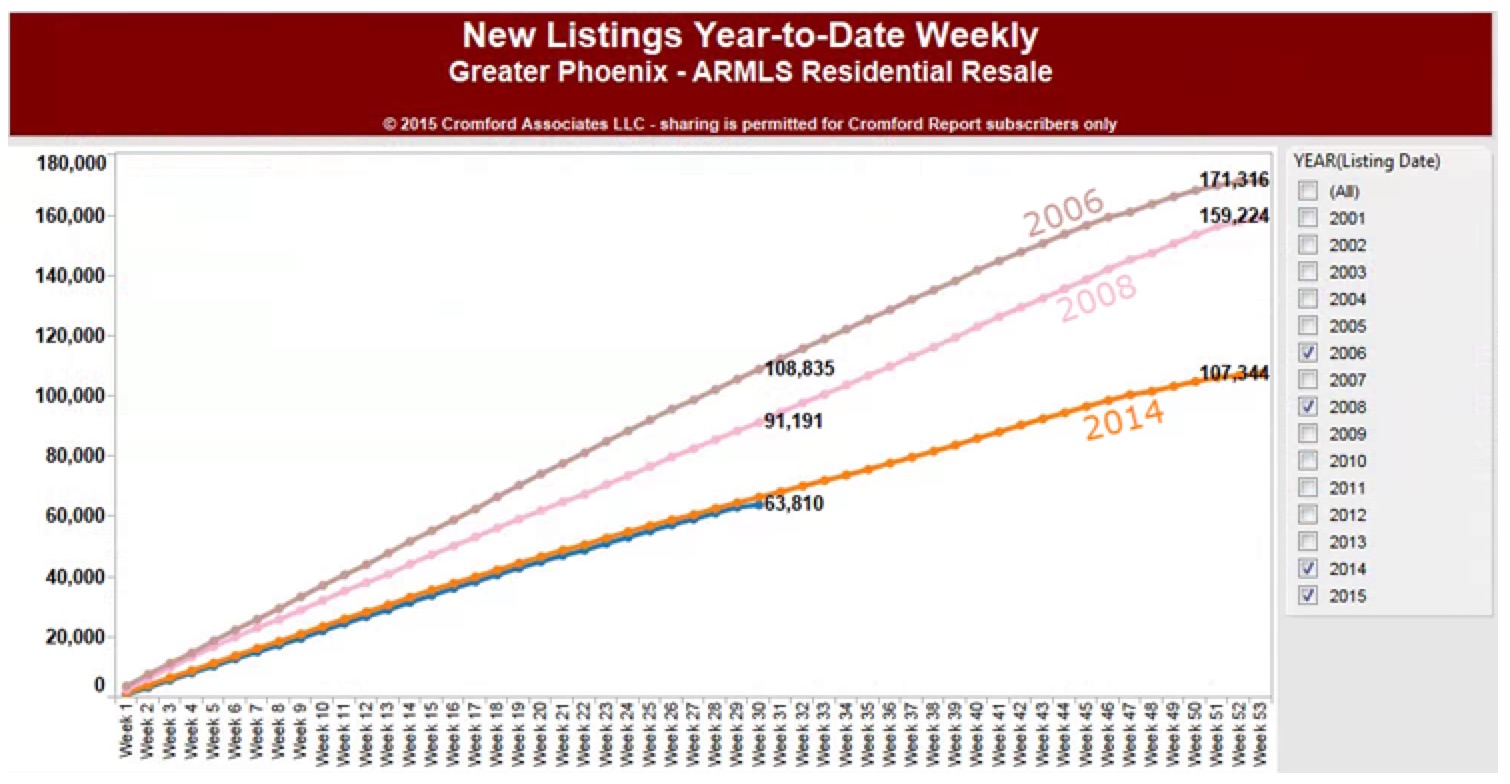

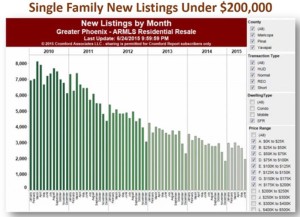

Its mid-year and time to take stock of where the market stands. That is why you saw 91,191 listings in July of 2008 but only 63,810 as of this month in 2015. I suspect if prices continue to rise, more folks will be inspired to list their homes. But, we don’t seem to see that kind of irrational upward pressure right now.

That is why you saw 91,191 listings in July of 2008 but only 63,810 as of this month in 2015. I suspect if prices continue to rise, more folks will be inspired to list their homes. But, we don’t seem to see that kind of irrational upward pressure right now.

While the number jumped in March, they are generally dropping and hovering around 80 days. Part of this is because, as Cromford said, the way agents classify UBC vs. Pending changes the count. But also I think it is true that homes even in the popular CenPho and historic areas are on the market for this long. Sometimes the sellers list too high, thinking they will get more than they can. Sometimes people over-value a home that needs renovation.

While the number jumped in March, they are generally dropping and hovering around 80 days. Part of this is because, as Cromford said, the way agents classify UBC vs. Pending changes the count. But also I think it is true that homes even in the popular CenPho and historic areas are on the market for this long. Sometimes the sellers list too high, thinking they will get more than they can. Sometimes people over-value a home that needs renovation. Well, according to our friends at the

Well, according to our friends at the