October Shortage Update

This October Shortage Update continues to see an over-all shortage, but some movement in the market in a different direction, hopefully. Active Listings are lower than last year, but up 11% over last month. Monthly sales are down 2.7% from last year, but up 3.6% from last month.Monthly Average Sales Price per Sq. Ft. is $252.19 versus $198.80 last year – up 26.9% – and up 1.1% from $249.41 last month.

According to our friends at the Cromford Report, investor buyers are dominating the market, an issue that I’ve opined is causing dramatic problems for regular people. Hopefully soon we will see some limitations on how much investment can be done in our residential neighborhoods, which were never designed for this.

Quote follows:

“More short-term twists and turns in the market are creating a confused situation. Yes, we still have very much a seller’s market with supply inadequate to meet demand.

However, the demand is increasingly dictated by investors and iBuyers rather than traditional buyers – the owner-occupiers that make up the heart of the housing market. Demand from iBuyers surged dramatically in June, July and August, but not all iBuyers behaved the same.

Opendoor increased their purchases from 66 in August 2020 to 728 in August 2021, but their buying tailed off in the second half of September. Zillow went from 34 in August 2020 to 253 in August 2021. Their purchases peaked at 90 during the second week of September but have since dropped back a little. OfferPad has been less volatile with 82 purchases in August 2020 growing to 152 in August 2021.

All the iBuyers have sold far less than they have bought, meaning there are many properties in inventory. The could mean an increase in supply over the next several weeks.

Active listing counts (excluding UCB and CCBS) are moving higher again after a lull in August. There was a rise of almost 25% during July, so the September increase of just over 11% is not as dramatic. However, the underlying trend seems to be for buyers to find a few more homes for sale, which must be a relief for them.

Demand looked strong all the way through September, but not so much at the beginning of October. (emphasis added)

Under contract counts and sales numbers suggest we may have seen the best of 2021 demand. With supply rising and demand appearing to plateau, we could possibly be in for some cooling during 4Q. But do not expect prices to fall. Indeed September pricing was significantly higher than August and brings to an end the summer lull that started in June.”

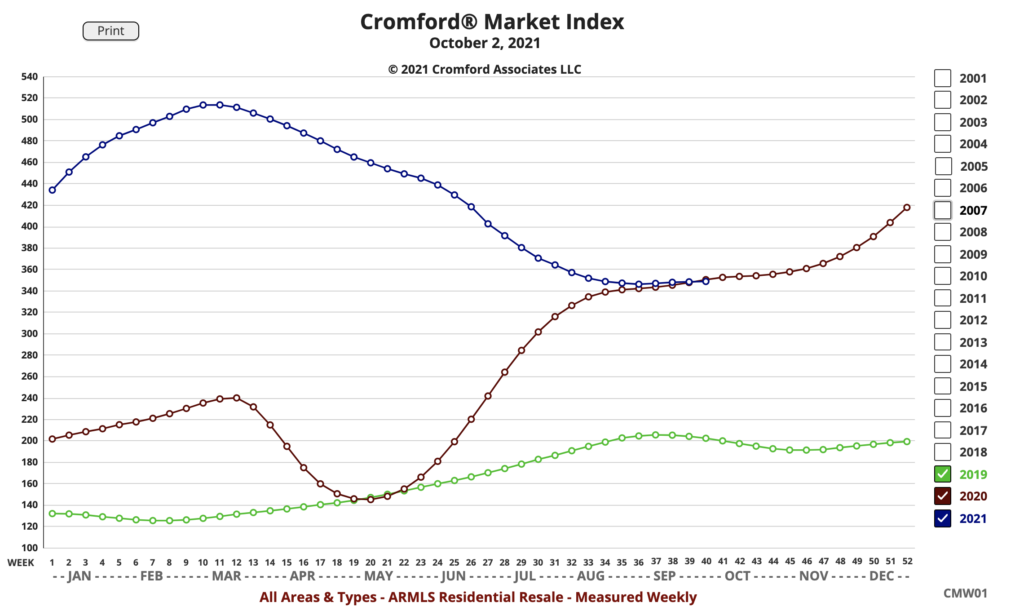

I added the emphasis above because it is clear to me, specifically from the Cromford Index, that if you are thinking to sell, we are pretty much at the high point of the market. We don’t know how long it will take to drop, but we are pretty certain things are changing.