May Shortage Update

I’ve decided to call this monthly check-in a “shortage update”, although, we are already getting signs that inventory is increasing and prices may begin to level off.

The headlines for this shortage update are:

If you gave up looking, you might want to start again, as many people have dropped out of the market, thus allowing inventory to increase a bit.

If you are thinking of selling, finish those renovations and final touches, and put that property on the market before prices begin to flatten or drop.

Here’s some context to the headlines.

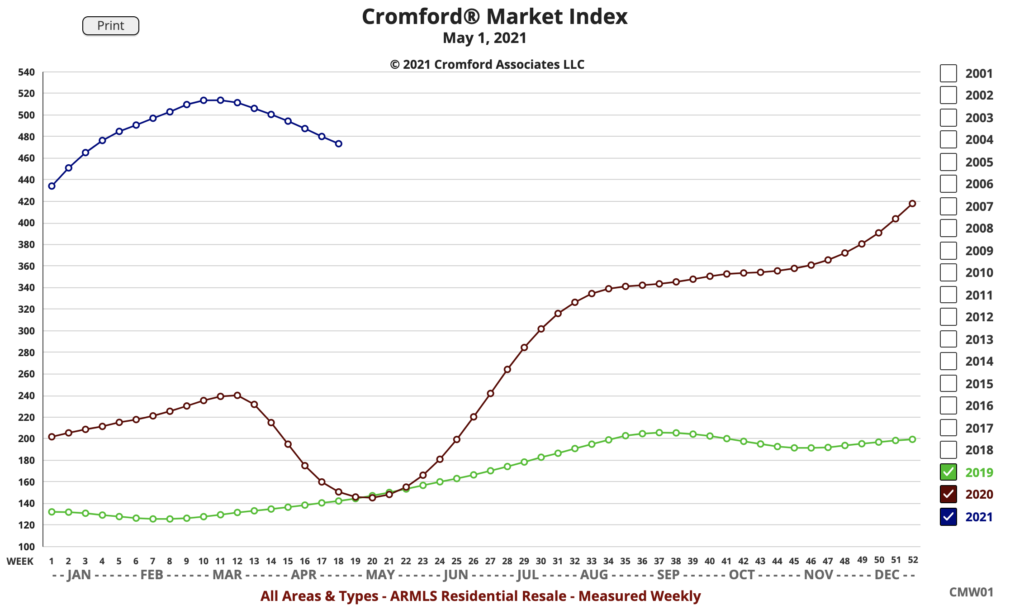

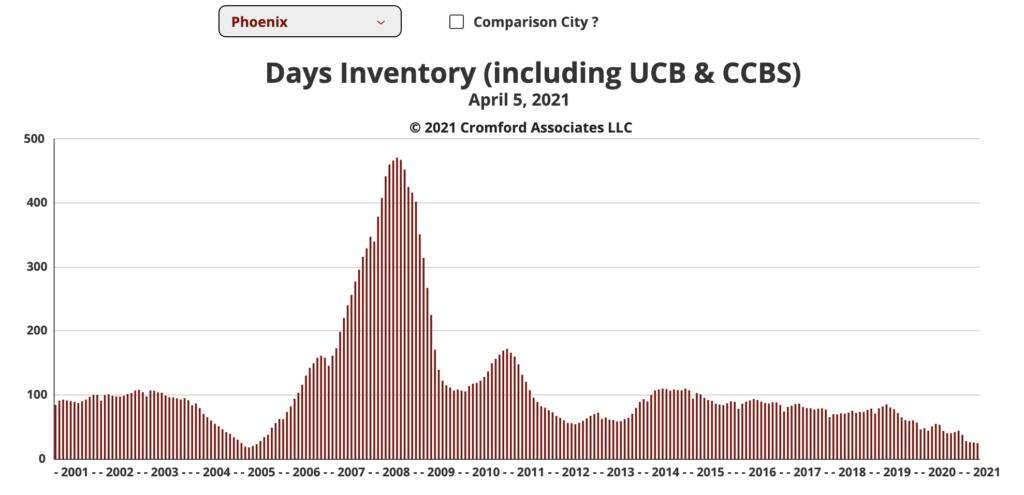

According to the fine folks at the Cromford Report, we are starting to change direction, but don’t expect this shortage to go away completely for at least a few quarters, if not more than a year: “Even though we have entered a cooling phase, it will probably take several quarters (if not years) to cool down to normal and prices will continue to rise at a brisk pace for quite some time.”

Here are some important data points for the May shortage update, for May 1, 2021 compared with May 1, 2020.

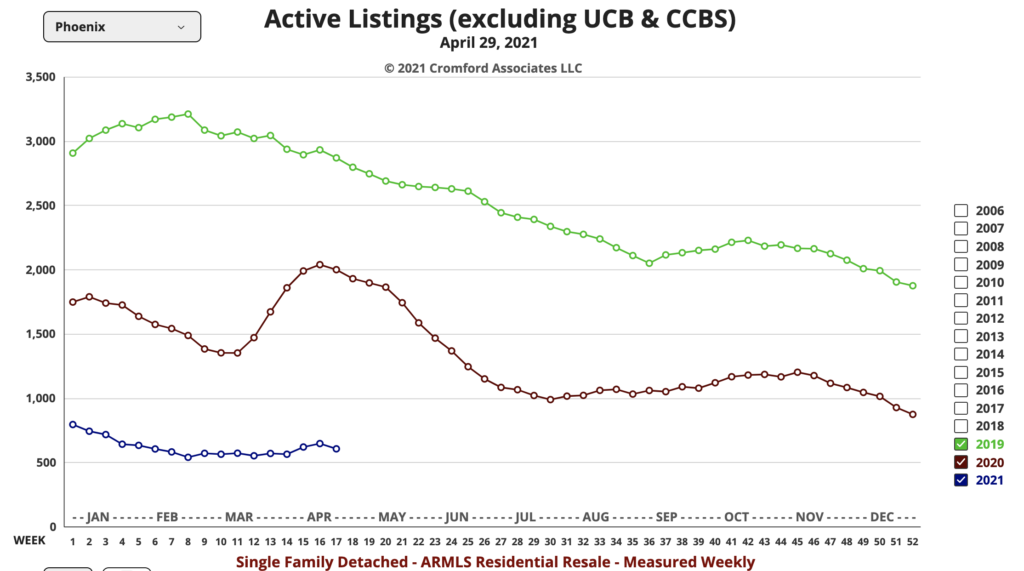

- Active Listings: 5,080 versus 14,051 last year – down 63.8% – but up 24.2% from 4,089 last month

- Pending Listings: 7,829 versus 5,676 last year – up 37.9% – but down 1.7% from 7,964 last month

- Under Contract Listings: 12,187 versus 9,512 last year – up 28.1% – but down 3.1% from 12,575 last month

- Monthly Sales: 10,172 versus 7,174 last year – up 41.8% – but down 2.2% from 10,396 last month

- Monthly Average Sales Price per Sq. Ft.: $243.50 versus $183.96 last year – up 32.41% – and up 5.1% from $231.75 last month

“These numbers are the most interesting we have seen for a long time. They show a very hot market with supply dramatically mismatched to demand. However they also confirm a cooling trend that has been developing over the last 7 weeks. This was first reported by the Cromford® Market Index, but is now being confirmed by a number of other metrics.

- active listings are UP significantly from the beginning of April, though admittedly from a very tiny number

- under contract counts are DOWN for the second month in a row

- sales counts are down compared with March

Markets do not get hotter indefinitely. The primary mechanism by which they cool down is through prices. In hot markets pricing goes up which causes demand to weaken, which means the supply gets a chance to recover. When prices go up, some buyers can no longer afford to buy and drop out. The faster that pricing goes up, the more buyers tend to drop out, at least in a healthy market. If this is not happening then you probably have a bubble where pure speculation has taken over and demand grows when prices rise. We are not seeing this.”

We’ve seen this anecdotally. A few of our clients who were looking for a while and making multiple offers, simply gave up out of frustration. We couldn’t blame them. Still, others who stuck with it were able to find a property. So, we’ve seen that dynamic that Cromford talks about, which allows the market to recover.

One note of caution, too: “12 months ago we were in the early stages of adjusting to COVID-19 so the year over year comparisons are not very meaningful. Demand dropped sharply in April 2020 only to recover quickly by June.”

“All changes tend to start small and then grow. The current market cooling is like that. We now have supply increasing and demand falling. This will gradually release some of the steam from the over-heating engine and the market can trend back towards normality. In a normal market prices still tend to rise, but in our current market, prices are rising at an unsustainable pace – the monthly average $/SF soared by over 5% in a single month. If the next 8 months behaved like April 2021, we would see the median sale price rise to $514,000 by the end of the year. I doubt that will happen.”

Call us. We are happy to help. And, don’t forget our Charity Referral Network.