May Market Update

Our friends at the Cromford Report supply us with great data for our May Market Update, which we use to help our clients. Here’s a summary of the data as of the middle of April, in time for this month’s Clark Report.

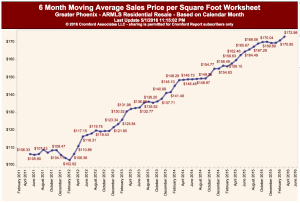

For the monthly period ending April 15, we are currently recording a sales $/SF of $140.06 averaged for all areas and types across the ARMLS database. This is virtually unchanged (up just 7c) from the $139.99 we now measure for March 15.

Sales pricing over the last 31 days has been considerably weaker than expected but stayed within the lower bound of our 90% confidence range.

In most years, prices make strong progress between March and June so we felt confident that last month’s forecast was reasonable. Only adding 7c to the average price per sq. ft. between March 15 and April 15 is pretty underwhelming. We are forecasting a more impressive advance for May 15, but we could again be confounded by a negative change in the sales mix.

Normally prices decline between June and September each year, so sellers will be hoping for a stronger pricing trend during the next 2 months than we saw during the last 2 months.

This is reflected in the CenPho and historic markets, although the data seems to contradict itself. In short, while the sales prices seem to be going up, the average days on market are increasing and the active listing count seems to be going up.

What does this tell us?

First, the central Phoenix and historic property areas continue to be popular, and steadily increase in price. See here how the prices continue to move upward steadily (unlike the valley as a whole) and consistently.

So, if you are pricing your property in line with the market, then you will sell quickly. Anecdotally, we also see properties move quickly if they are priced right.

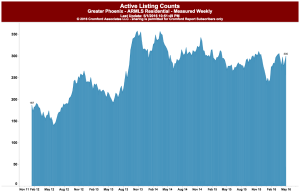

However, notice in this next chart how then number of homes on the CenPho market seem to be increasing. Perhaps more homes come on the market as people see those higher prices.

However, notice in this next chart how then number of homes on the CenPho market seem to be increasing. Perhaps more homes come on the market as people see those higher prices.

But those new homes are creating more competition for themselves, which may begin to stagnate some sales –especially if they are listed above market.

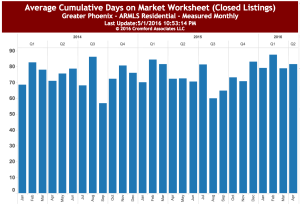

What makes me think that? Well, the cumulative days on market seems to be moving up a little bit. Watch this data over the next month or so. If prices come down and active listings and days on market go up, it is a small market correction.

What makes me think that? Well, the cumulative days on market seems to be moving up a little bit. Watch this data over the next month or so. If prices come down and active listings and days on market go up, it is a small market correction.

So, what does this mean for you? Well, if you are selling, then the market may begin to look a little flatter than we anticipated. You will want to be more aggressive on your pricing.

If you are buying, then you might have a little more confidence that you can offer around the asking price. Notice that I did not use the term “leverage”, since this is still a strong seller’s market and the prices between March and April did not drop, so much as they did not really increase.

If there is one thing I am concerned about, its the over-build apartment market in downtown and Central Phoenix. Even after projects like the Edison Condos come on line, there will be a vast difference the number of condos versus apartments.

This means that home owners will be less likely to own downtown. Further, not that apartment dwellers are by definition less likely to care about their neighborhoods, but they tend to stay for less time. To preserve all of the hard work we’ve done over the years to build up downtown, we need to encourage more ownership there.

If you want to look in to the tea leaves of the Cromford Report in a little more depth, please call us at 602-456-9388.