Market Conditions December 2009

It’s been a few months since I’ve just laid out the market conditions in the Phoenix market.

Overall:

1) Prices are still slowly increasing, probably because the tax credit was extended.

2) Sales volume is still high, even though volume typically falls off around the holidays.

3) Watch for prices to climb upward faster starting in January as people start looking in greater numbers.

Conclusion: Prices are going up, but we are still at the lowest point for picking up a property. If you are looking to sell, wait just a little longer or expect to price aggressively.

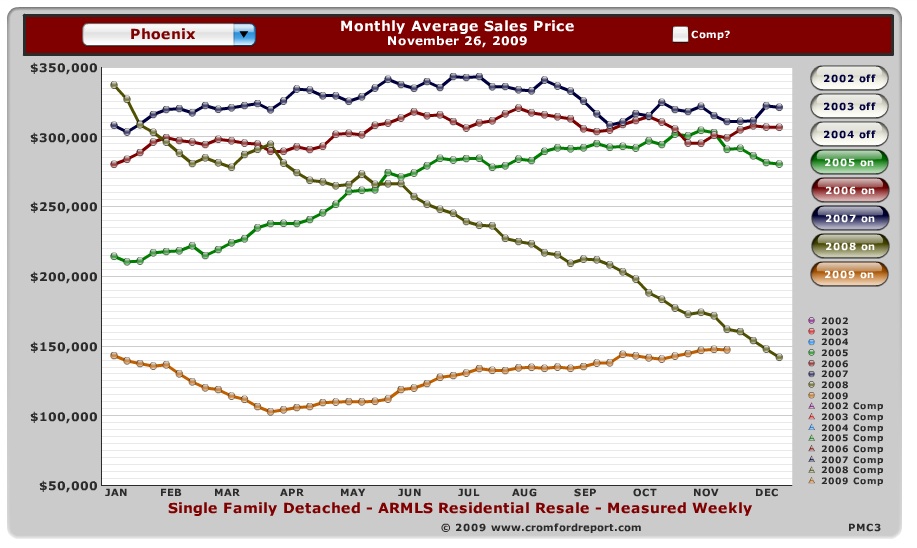

Exhibit A: Monthly average sales prices have been going up since April. We are now above the lowest point from 2008. While that was a harrowing year and nobody wants to be compared to it, we can at least feel like we are going the right direction. Prices will continue to climb as people take advantage of the extended tax credit.

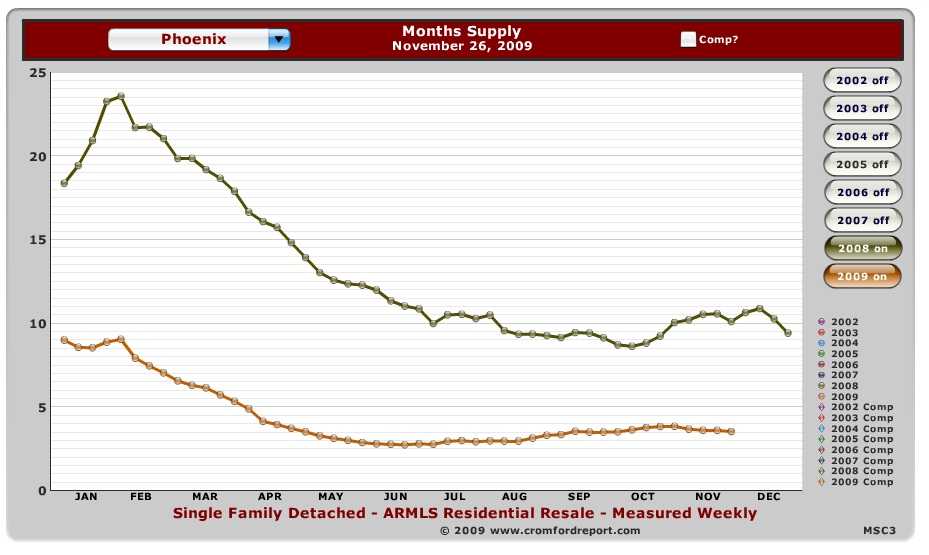

Exhibit B: Months Supply. This is a measure of how long it would take to sell the current homes on the market today at current monthly sales rates. This is very interesting. The months supply decreased near the beginning of the year as people started to scramble for the cheapest prices ever (April). But it has not gone down any further, I suspect because the banks have figured out how to slowly and methodically release foreclosed homes so that they don’t flood the market. I suspect that this will stay relatively the same through next summer.

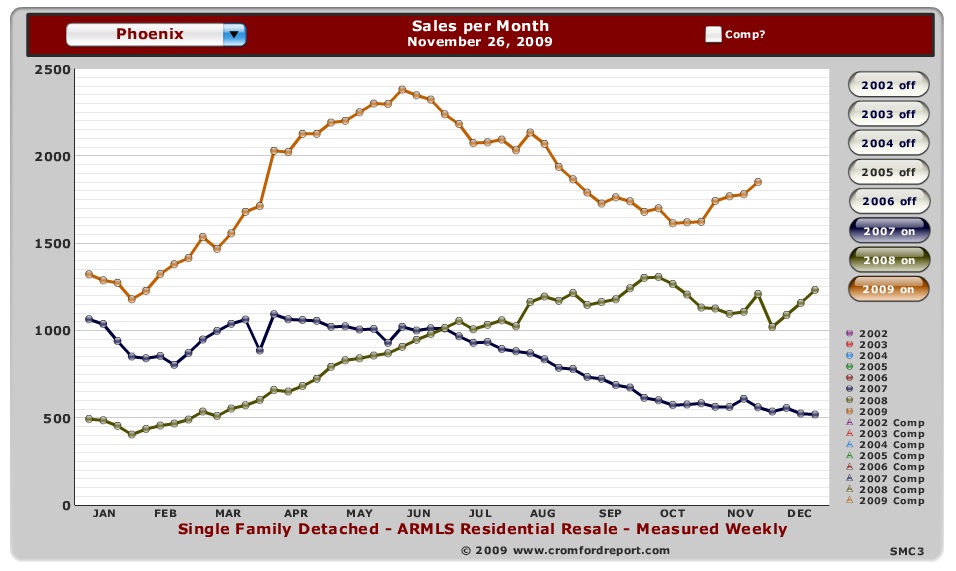

Exhibit C: Sales Per Month. Notice how the sales per month are higher than the last two years, still. So, fears that the market would be flooded with more foreclosures never materialized and we just keep selling at a good clip. Check out how sales volume goes up after October, when volume usually slows, thanks to the tax credit and low prices. Add to this that banks are getting better at processing short sales and people are closing quicker.

Leave a Comment