March Market Report

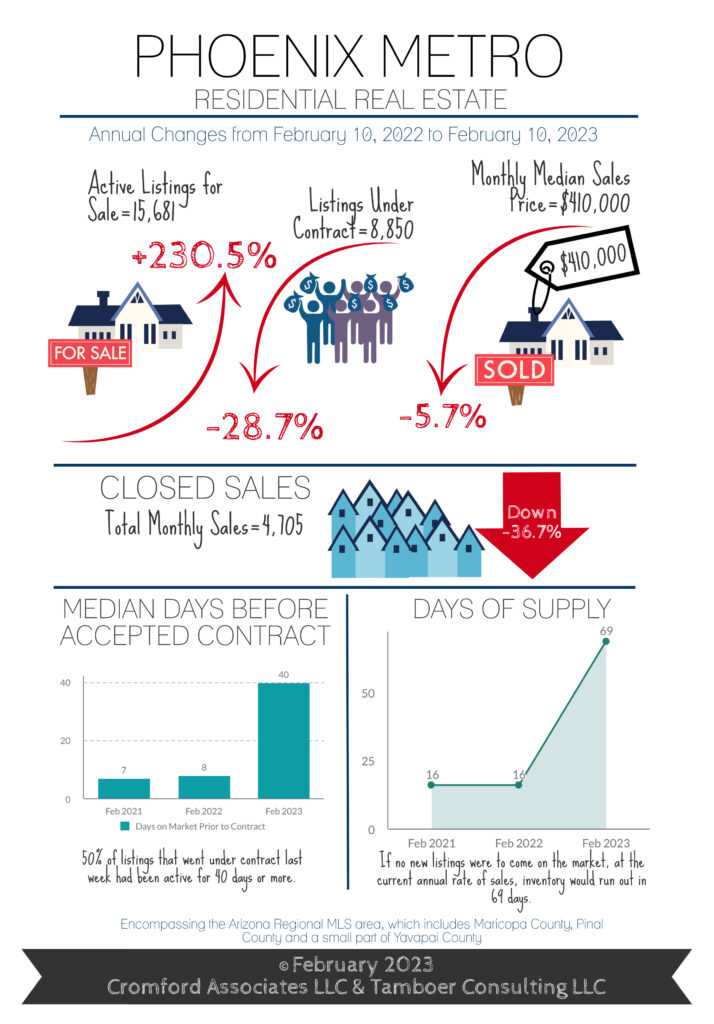

Our friends at the Cromford Report are confirming what we are seeing. There is an excess of supply and prices are down a little bit from last year.

If you are looking to buy, we suggest you get it done before the inventory is bought up and we return to increasing prices.

We don’t expect prices to drop significantly, a la 2008. There are just too many people moving to Arizona still for that to change.

So says Cromford…

“Here are the basics – the ARMLS numbers for March 1, 2023 compared with March 1, 2022 for all areas & types:

- Active Listings (excluding UCB & CCBS): 14,739 versus 4,588 last year – up 221% – but down 5.5% from 15,598 last month

- Pending Listings: 5,911 versus 8,333 last year – down 29% – but up 15.7% from 5,109 last month

- Monthly Sales: 5,693 versus 7,993 last year – down 29% – but up 31% from 4,357 last month

- Monthly Average Sales Price per Sq. Ft.: $271.14 versus $284.56 last year – down 4.7% – but up 1.2% from $267.83 last month

- Monthly Median Sales Price: $413,000 versus $445,000 last year – down 7.2% – but up 0.7% from $410,000 last month

Volumes remain much lower than a year ago, but they have recovered some ground. Monthly sales were down 29% compared with 2022, which is a major improvement on the 39% deficit last month.

Although the market remains unhealthy from a volume perspective, it is warming up from a supply versus demand point of view. The supply of active listings has been trending lower for several months, although this is not true of the luxury sector, and particularly Paradise Valley. You might expect demand to be very weak because mortgage rates have jumped back over 7% again. However buyers are not capitulating and the growth of listings under contract is much healthier than we expected under these circumstances. The 16.6% growth in listings under contract since the beginning of February, and the 31% increase in the monthly sales rate are surprisingly strong.

The balance between supply and demand has shifted significantly over the past 3 months and there is now upward pressure on pricing once more. We note that the monthly median sales price is up 0.7% over the last month while the average price per square foot for closed listings has risen by 1.2%. Pricing remains weaker than a year ago, when we were still in a boom period with exceptionally low supply. But the trend is now pointing higher, not lower. It is possible that the Federal Reserve may do more damage to interest rates, but the risk premium in mortgage rates is currently far above normal. This means there is plenty of scope for lower mortgage rates to be introduced if the risk abates.

The current pricing trend may contradict the claims by various amateur pundits and their daft YouTube channels, but there is almost no data that supports the theory that prices are going to collapse from this point. For this to happen we would need to have a wave of new supply creating problems for sellers. While this is always a remote possibility, there is very little foreclosure activity and low levels of mortgage delinquency. So where is this flood of homes for sale supposed to come from. The builders have cut back drastically on new home permits, so we are more likely to see a shortage of homes for sale than a glut. And rising mortgage rate discourage homeowners with mortgages from selling because that would mean the loss of their cheap loan and the acquisition of a much more expensive one.

Even though buyers are scarce, homes for sale remain stubbornly hard to find. It is always good for sellers when they have less competition from other sellers. This means much less need to cut their asking price, especially if the are patient and present their property well.”