March Market Madness… or Not

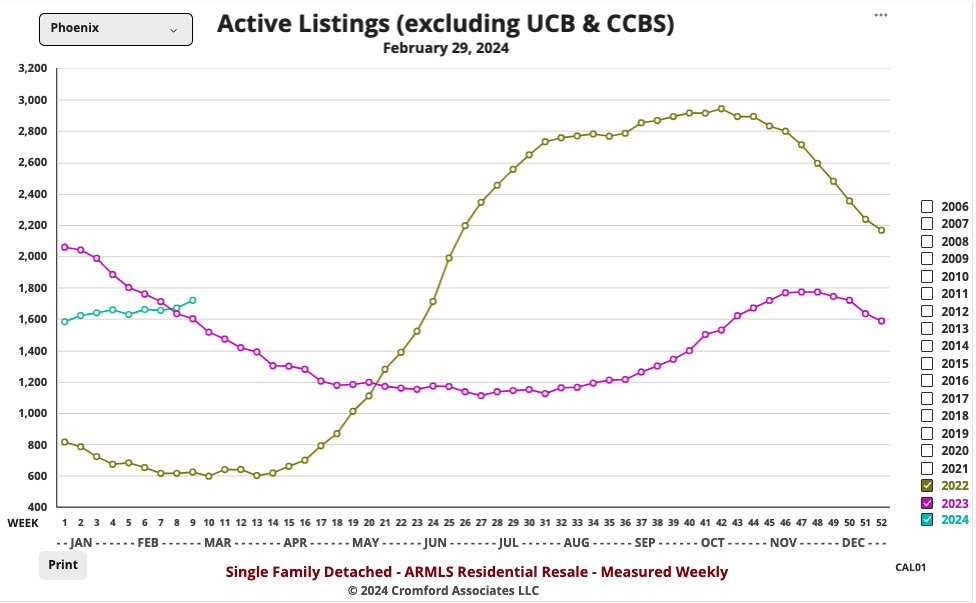

I think that, while we are not in recovery mode, we are starting to see the outlines of it on the horizon. Active listings are coming up, and hopefully that will slow price growth a little going forward. For now, though, listings under contract are not as high as we’d like them to be.

Here are the basics from The Cromford Report – “the ARMLS numbers for March 1, 2024 compared with March 1, 2023:

- Active Listings: 16,568 versus 14,739 last year – up 12% – and up 6.4% from 15,574 last month

- Monthly Sales: 5,720 versus 5,706 last year – up 0.2% – and up 29% from 4,435 last month

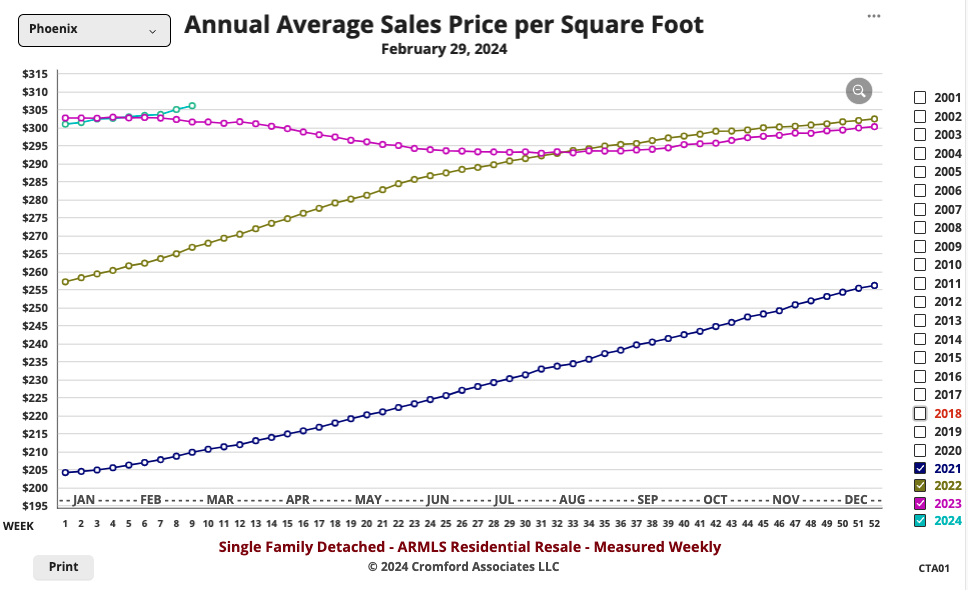

- Monthly Average Sales Price per Sq. Ft.: $293.70 versus $271.11 last year – up 8.3% – and up 1.7% from $288.74 last month

This set of numbers is a little disappointing, but by no means disastrous. On the bright side, closed listing counts for February 2024 managed to exceed February 2023, but only by 0.2%. This is not the recovery in volume that so many are impatiently hoping for. Also brighter, sales pricing performed better than anticipated and was up 1.7% from last month based on the monthly average sales price per square foot. The monthly median sale price rose by $10,000 too. However the rate at which contracts are getting signatures is lower than we expected and much lower than normal. We are starting March with only 8,693 listings under contract, down 4.6% from this time last year. And last year was well below normal.

The slow contract signing rate means active listing counts have continued to grow steadily, up by 2,000 since the start of the year. Last year we saw a fall of over 1,500 over the same period, because new supply was much scarcer then. It was the decline in supply that allowed us to scoff a year ago when Goldman Sachs published their ludicrous forecast that Arizona home prices would fall to 2008 levels in 2023. That certainly proved they had no idea what they were talking about. Prices are now up 8.3% from this time last year.

There is still no sign of a market crash in the short or medium term, but the market is struggling to gain traction. The healthy amount of incoming supply is not quite matched by a small improvement in demand and the balance between sellers and buyers only favors sellers by a small amount when considering the market as a whole. In many sectors of the market, buyers have more negotiating room, even though, judging by the recent price movements, most of them do not seem to realize this.

by homes under $1 million still have a tight supply and buyers outnumber sellers in most of these areas.

Market conditions are currently quite stable, so the idea that some sort of collapse is imminent is extremely far-fetched. However conditions can and often do change with little notice, so it is always worth to keeping a close eye on the key numbers.”