June Shortage Update

I’m still gonna call the market update a “June shortage update.” I think it’s going to be a shortage for a while, so maybe this will be the new normal and I’ll get tired of calling it a shortage update.

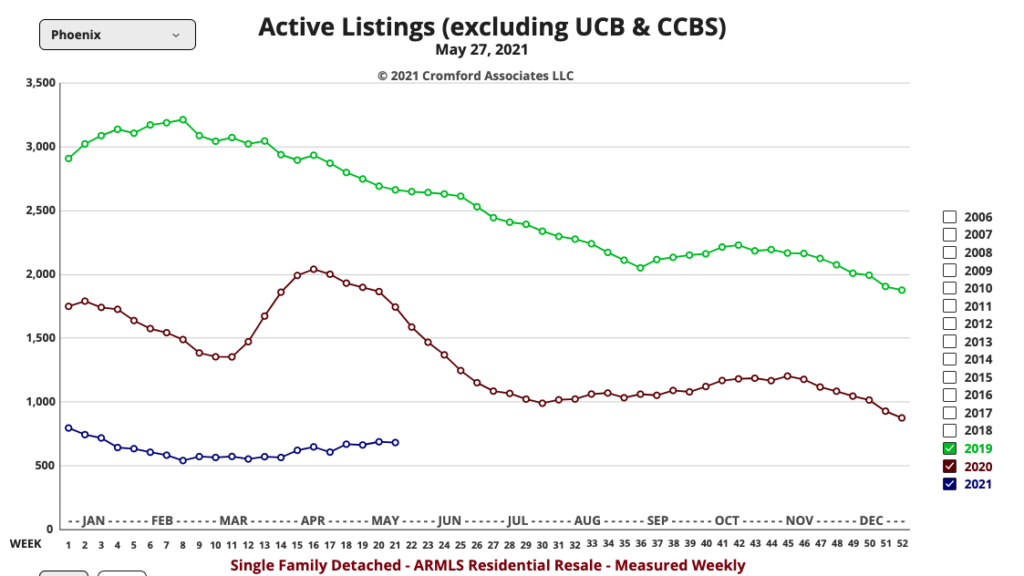

But for now, my friends, our situation is only marginally better. We’ve gone from about 600 listings in Phoenix to about 700 since last month. Maybe we will still be talking about a “June shortage” in June of 2022. I hope not.

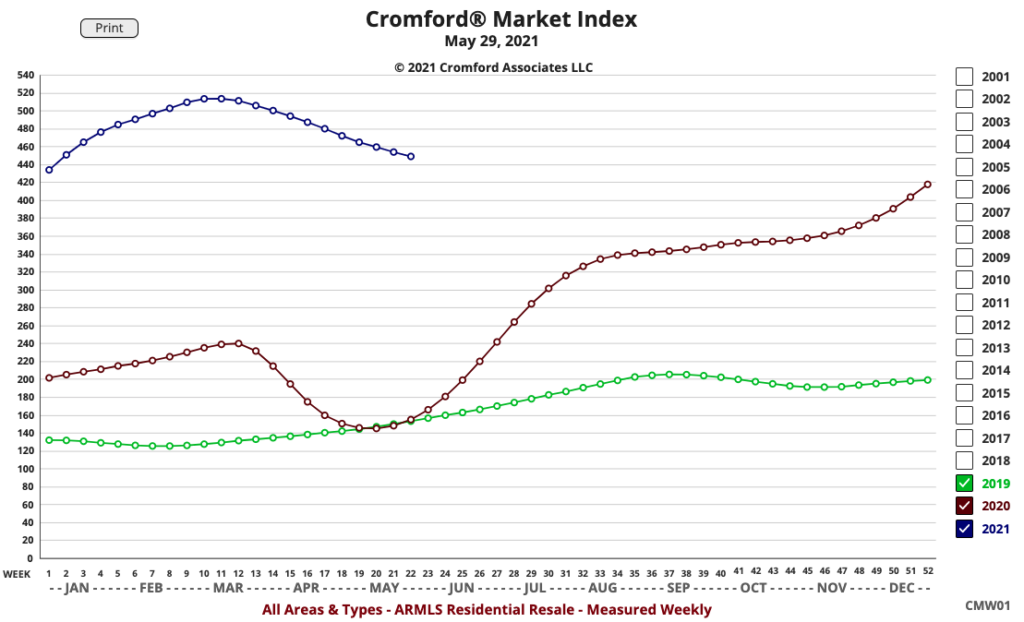

Here’s what the folks at the Cromford Report have to say about it.

Here are the basics – the ARMLS numbers for June 1, 2021 compared with June 1, 2020 the whole county:

- Active Listings (excluding UCB & CCBS): 4,917 versus 11,917 last year – down 68.7% – and down 3.2% from 5,080 last month

- Pending Listings: 7,873 versus 7,224 last year – up 9.0% – and up 0.6% from 7,829 last month

- Under Contract Listings (including Pending, CCBS & UCB): 12,317 versus 12,478 last year – down 1.3% – but up 1.1% from 12,187 last month

- Monthly Sales: 9,692 versus 7,045 last year – up 37.6% – but down 5.0% from 10,204 last month

- Monthly Average Sales Price per Sq. Ft.: $248.37 versus $179.79 last year – up 38.1% – and up 2.0% from $243.39 last month

- Monthly Median Sales Price: $390,000 versus $293,000 last year – up 33.1% – and up 4.6% from $373,000 last month

“We note that the number of active listings is slightly higher than last month. That is entirely because June 1 fell on a Tuesday while May 1 fell on a Saturday. Saturdays tends to have much higher counts because of all the new listings activated on Thursday and Friday. In contrast, Tuesdays and Wednesdays have the lowest counts every week. If we compare the same day of the week, the number of active listings is up from last month by about 7%.”

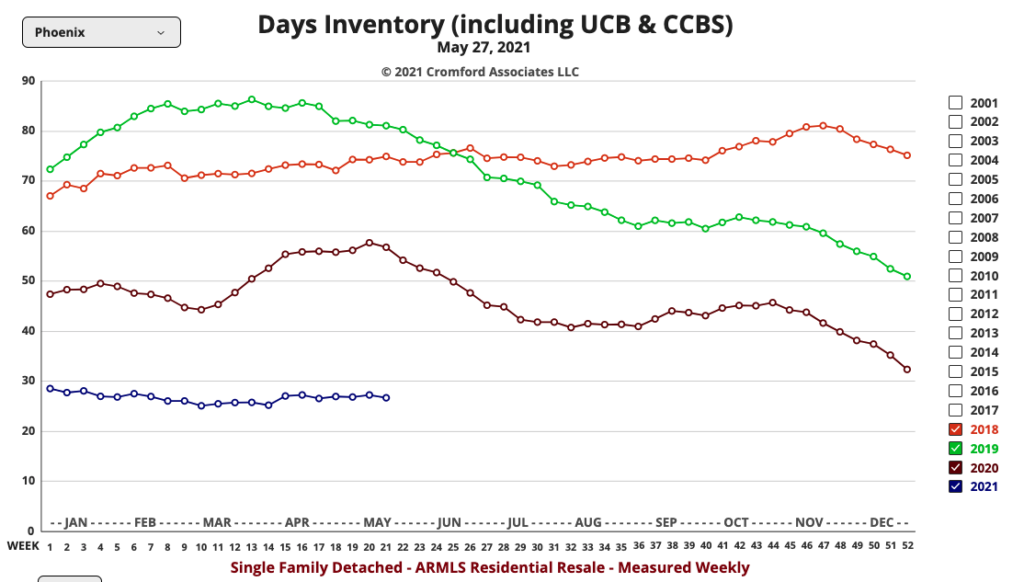

“Supply is definitely rising, but not at a rate to help buyers very much, or to raise an alarm. It is rising because new listings are coming along at a faster rate than normal. However most of them are getting offers in the first week and they do not last very long. The market remains very hot even though it has cooled since March.”

“The demand numbers are moderating, with monthly sales down 5% compared with last month. However listings under contract are up slightly which means the downward trend in demand has stalled for now.”

“The rate of change in both supply and demand are both now moderate, but the rate of change for prices remains very high. We are seeing appreciation rates of 38% if you use price per sq. ft. or 33% if you use monthly medians. Both of these are flattering because part of the rise is due to high end homes taking a larger share of the market than normal for June. But however you measure them, home prices are at nose-bleed levels and will continue to rise while supply remains dramatically below normal. It is 76% below normal at the moment.”

“The period since June 2020 has been a painful 12 months for buyers and many are likely to be feeling bruised and beaten up. It would not be surprising if demand weakened further because of this, but withdrawing from the market is unlikely to be wise from a financial perspective. Prices still have a quite a lot of upward momentum and mortgage rates could easily move higher than today. Local buyers need to remember that to a buyer from California or Washington, Phoenix still looks like amazingly good value for money, even after another 20% price hike.”

“And what is your alternative – rents continue to climb at a steep rate and are unlikely to stop rising. At least if you buy a pricey home today you will benefit from the price growth tomorrow in the form of home equity. None of your rent payment will do that.”

Not much I can add than that final thought to the June Shortage Update. We’ve had clients exit the market and I’m sad to say that things will only be higher when they come back in about a year to look again. It reminds me of people back in 2010 exiting the market because they thought it was too high. They’d be sitting on about 40% free equity right now had they bought.

Whether you are buying or selling, call us at 602-456-9388 and we can help you build a strategy.