January Balanced Market Activity

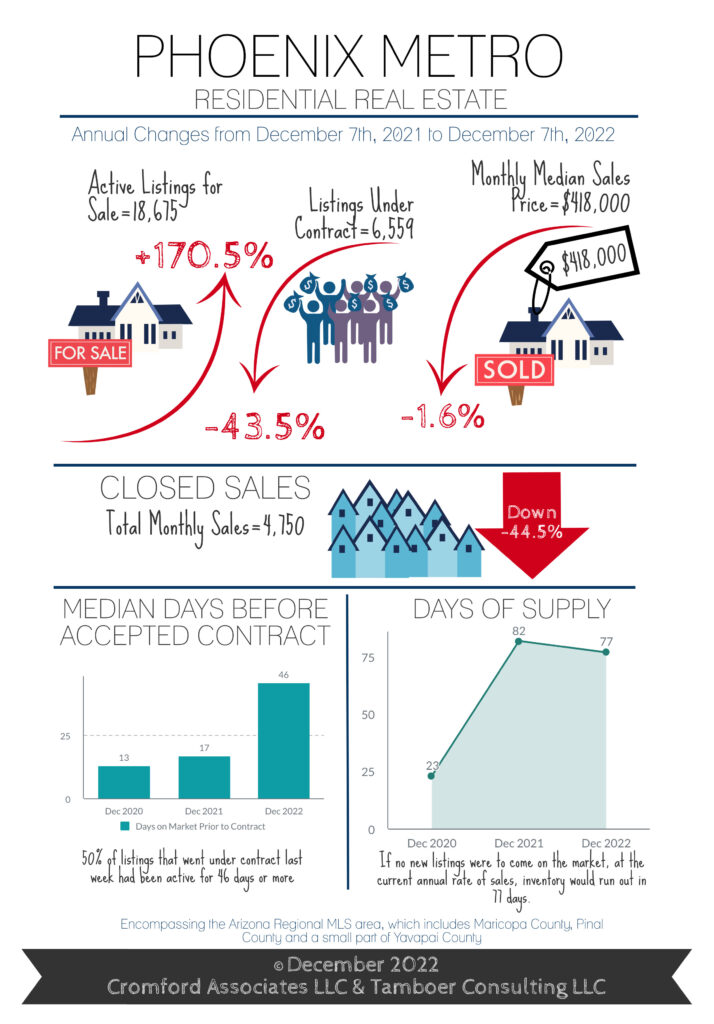

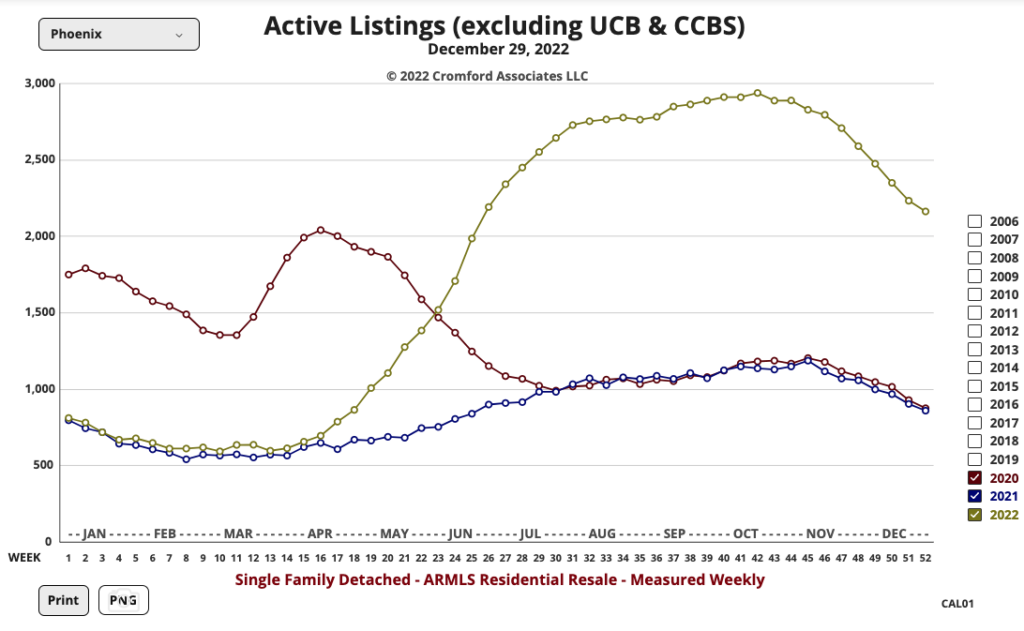

Believe it or not, the market is balancing again. Well, it’s moving in that direction. It seems crazy to say since active listings are up 182% since this time last year, according to the Cromford Report.

If you are a buyer, this is good news. But see the note in bold below. The market is creeping back to seller advantage. Buy now if you are in need of a home. I think that as soon as the FED announces that they will not raise interest rates again, buyers will flood back in to the market.

“Here are the basics – the ARMLS numbers for January 1, 2023 compared with January 1, 2022 for all areas & types:

- Active Listings (excluding UCB & CCBS): 16,298 versus 5,776 last year – up 182% – but down 14.9% from 19,155 last month

- Active Listings (including UCB & CCBS): 18,097 versus 8,630 last year – up 110% – but down 14.7% compared with 21,206 last month

- Pending Listings: 3,657 versus 6,539 last year – down 44.1% – and down 15.0% from 4,301 last month

- Monthly Sales: 5,132 versus 9,265 last year – down 44.6% – but up 4.1% from 4,931 last month

- Monthly Average Sales Price per Sq. Ft.: $265.58 versus $267.92 last year – down 0.9% – and down 2.5% from $272.30 last month

There are lots of small numbers in December’s totals. We have very low volumes of closings because both buyers and sellers are discouraged. Monthly sales are down almost 45% from this time last year, and listings under contract are down nearly 42%. The numbers confirm that demand is very weak compared to normal for the time of year, and even weaker compared to the strong demand 12 months ago. However weak demand does not necessarily make a market crash. Excess supply is what really drives prices down hard. This is what we saw in 2006 through 2008. But in 2023 supply is low and getting lower. It is much higher than this time last year, when it was abnormally low, but it is still a long way below normal.

Activity is very low across the board, but the market balance is normal. By that we mean we have equal balance between buyers and sellers. The trend is now moving in favor of sellers, having been favorable to buyers a month ago. So although there is gloom and despondency almost everywhere, amid the murk there are clear signs of improvement. Because sentiment is so poor, there is psychological pressure to lower prices. However there is no such downward pressure coming from the market. If all trading was done by unemotional computers, prices should be stabilizing right now.

In the real world, strongly influenced by human emotions, prices fell sharply last month, losing 3.5% in the monthly median and 2.5% based on the average price per square foot. However sales prices are a trailing indicator and these moves reflect the balance in the market in November, when we experienced a clear advantage for buyers. Leading indicators are looking more positive. This probably stems from interest rates being less horrible than they were six weeks ago. Demand is starting to stabilize and even showing a few signs of a slow recovery. With new supply very weak, we are not witnessing a market crash. This is merely a correction, with prices now just a tad lower than a year ago – the monthly average $/SF is down 0.9%.

We are still dependent on the whims of the Federal Reserve. If they continue to push the Federal Funds Rate higher in an attempt to curb inflation, then mortgage rates could move higher too, putting a quick damper on any recovery in demand. However if the 30 year fixed mortgage rate stays between 6% and 6.75%, then we should have confidence that the housing market can operate normally at this level. Prior to 2009, anything under 7% was considered a low interest rate and rates under 5% were unheard of.

To achieve confidence we need several months of interest rate stability. This is by no means certain to happen, but it is possible. Once the fear is removed, we should see more signs of a recovery in demand and volumes will rise back towards a more normal level.”