Investors & Home Prices, P. 4

In this part two of a multi-part series. I’m exploring at how investors and other factors drove driving up home prices and what we should do to keep it from happening again. See part 3, here.

So, detractors are saying that investors are causing this market crisis. The private equity firms will tell you that they have nothing to do with it. If anything, they are helpful to fixing up older properties.

I neither think that private equity firms are the sole problem, nor are they as benign as they like to believe.

There are some undeniable facts.

First, while private equity firms “only” account for about 400,000 SFRs out of tens of millions of homes, it is clear that they have be buying up larger chucks of the market in recent years –just as the other factors we’ve discussed have been driving prices as well.

I’m confident that a talented economist could show that private equity firms and individual investors are fueling speculators and contributing in an out-sized way to high prices.

Second, private equity firms or individual buyers (renters, flippers or STR owners) are all targeting those neighborhoods where home prices are lowest. They buy the cheap property, fix it up and make a profit from the improvements.

An economist would say they are finding previously unseen value. But, like many things in the study of economics, this analysis is blind to the downsides to neighborhoods. And, I’m not just talking about the (very important) social damage of moving people out of affordable homes.

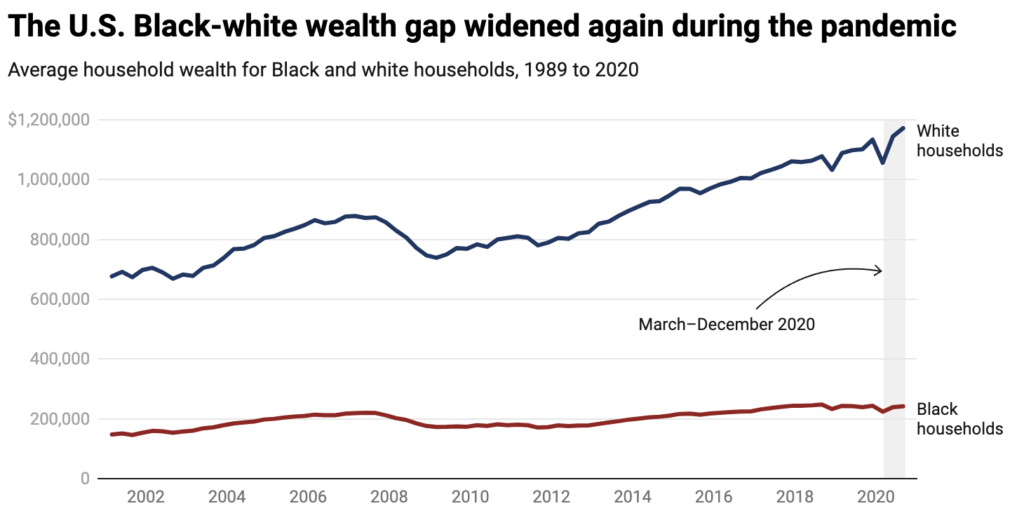

By increasing the value of the home and selling it (cost + improvement + profit margin), they are forcing the new owners or new renters to pay a higher price. Those new owners or renters are padding the profits of people who probably already have money and reducing the chance of the new owners or renters to build their own inter-generational wealth. This is especially true of people trapped as renters.

The private equity boosters are painting a rosy picture of the value that they’ve added to the market, without considering the affects on people who are, in all likelihood, significantly less privileged than themselves.

And now, as interest rates go up, more first time home buyers may exit the market, leaving more buyers who can purchase with cash.

So, what should or could be done? Here are my suggestions:

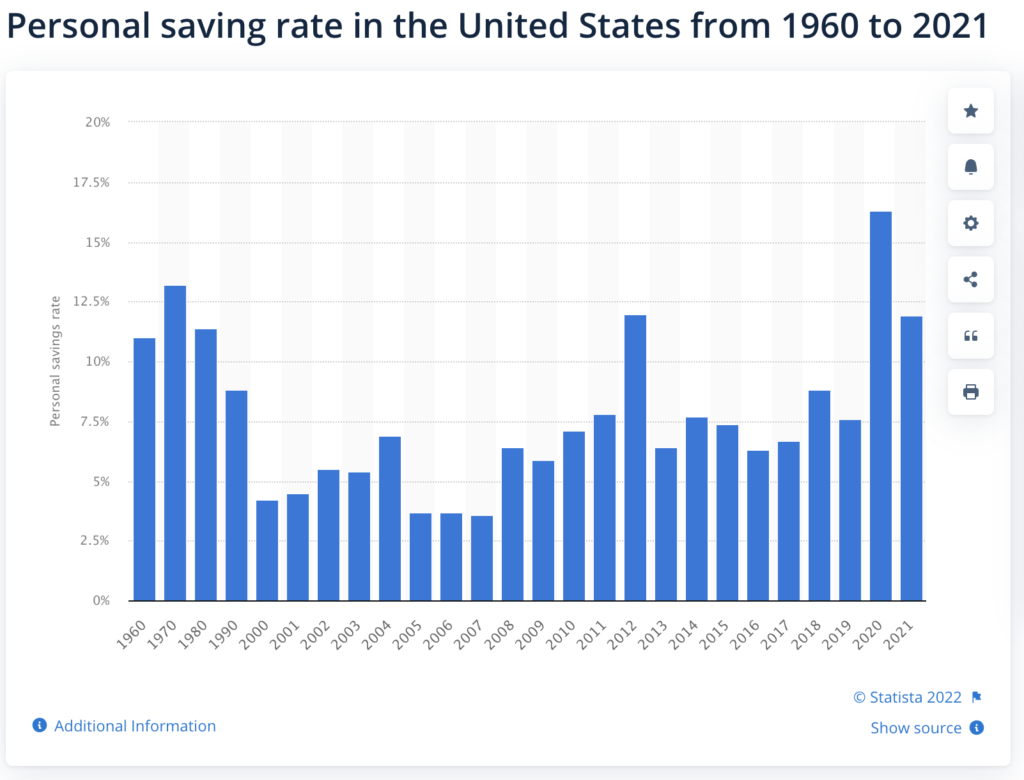

1. Call me a radical, but neighborhoods are not the stock market. Fannie Mae and Freddie Mac, plus state pension funds should not be investing in the housing market in this manner. We don’t need equity money to infuse cash in to homes. Americans are saving more money than they have in years, and there is plenty out there for individuals to invest in SFRs to meet the demand.

2. STR companies should implement “one owner, one home” rules or similar policies in more major markets around the country. According to this article, AirBnB has implemented such policies. But those not only need to be applied in other market. In addition local governments need more control over STRs, especially in Arizona.

3. There should be similar restrictions on how many homes other investors can purchase. Neighborhoods were never designed to be a commodities market. They should first and foremost be there for families to live peacefully and with long-term stability.

4. Raise awareness about the affect of SFR investments on BIPIC communities. The National Association of Realtors is not really fulfilling its pledge to equal opportunity unless it is going the extra mile and helping minority families to build inter-generational wealth. As long as black and brown families are disproportionately forced in to rental arrangements, we are not addressing inter-generational wealth building.

5. Fix immigration policy so builders can hire more workers. Yeah, I know. I might as well be asking for unicorns to deliver my groceries. But it’s true, so it’s on the list.

6. We need some reforms to protect condo developers and owners from defect litigation.

7. NIMBY neighbors, who are often the same privileged people who benefit from exclusivity in the housing market, need to stop being the same people who prevent others from accessing the same wealth, security and quality of life that they’ve enjoyed. (Here’s an interesting defense of what some folks incorrectly term as “gentrification.”)

8. We need to reform the euclidean building codes that favor inefficient SFRs that contribute to climate change, sprawl and unhealthy communities.

Like I said. No simple explanation for the problem and no simple answer. But, like other things, it takes all of us getting more involved in our communities and thinking of the greater good as much as we think of ourselves.