Interest Rates May Be Moving Up Already

But they are still historically low. So, don’t panic.

I am constantly reminded by old-timers that rates in 1981 were as high as 14%. Back then people would do seller carry-backs, which meant that the seller of the house would actually act as the lender. If you were the buyer, you would pay the seller every month for some number of years and then you were expected to pay off the loan. That usually meant that you would find financing in that time or get your rich uncle to pay it off for you.

It makes me wonder why we don’t do more seller carry-backs. Probably because people don’t know how to make them work. With all of the people who have foreclosed on homes, you would think there would be a market for that kind of thing. If your credit is a mess because you lost your home, you could still get a house by making a deal with the seller.

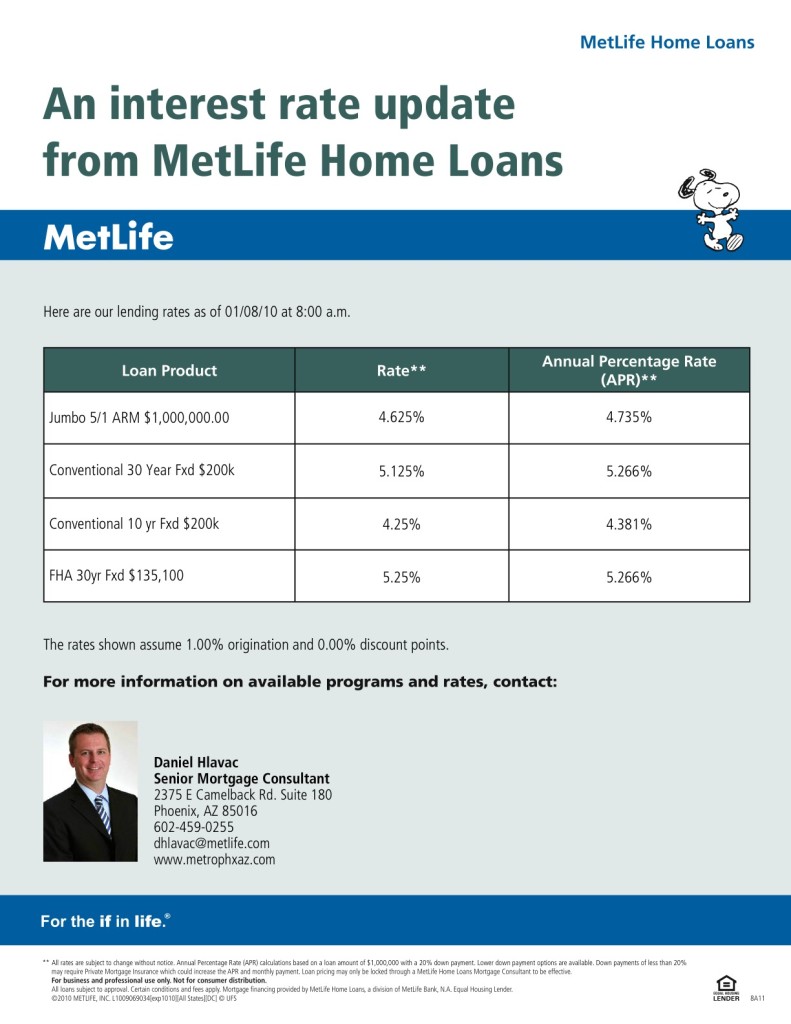

My friend Dan at Met Life regularly sends me updated interest rates that they offer.

You can see that rates are moving up a little. As I’ve said in previous posts, watch for these to climb higher in March. For now, you can still do really well with a new loan. Give Dan a call or shoot me an email for more information.

Leave a Comment