February Shortage Report

Our February shortage report illustrates why this is a great time to sell your home –or especially any investment properties you have. It looks like demand might be weakening a bit. While still high, buyers may be fed up with paying increasing prices.

Here are the basics, in review of January – according to our friends at the Cromford Report:

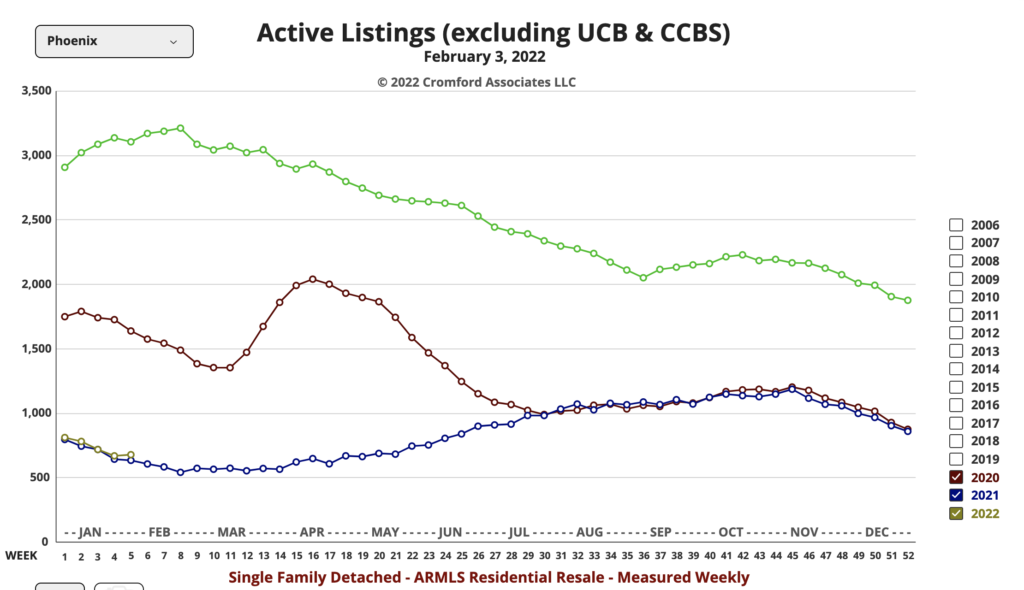

- Active Listings: 4,876 versus 5,180 last year – down 5.9% – and down 15.6% from 5,776 last month

- Pending Listings: 7,798 versus 7,070 last year – up 10.3% – and up 22.6% from 6,359 last month

- Monthly Sales: 7,114 versus 7,354 last year – down 3.3% – and down 23.3% from 9,271 last month

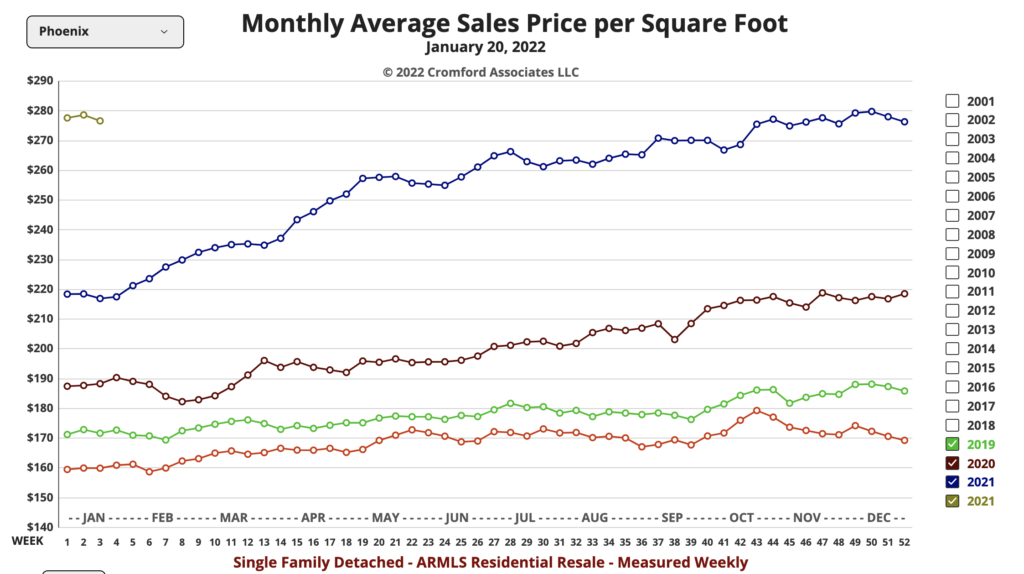

- Monthly Average Sales Price per Sq. Ft.: $274.45 versus $217.47 last year – up 26.2% – and up 2.5% from $267.87 last month

- Monthly Median Sales Price: $433,500 versus $339,000 last year – up 27.9% – and up 2.0% from $425,000 last month

“The downward trend in supply that started in late October continued throughout January, taking us to another record low – the lowest number of active listings at the end of January we have ever recorded. Last year’s 5,181 struck as as extremely low at the time, but we have 6% less in 2022. However most of the missing supply is at the high end of the market. Most cheaper areas have more supply than this time last year.

Demand looks very strong when you look at pending listings, up more than 10% compared with this time last year.

January closings were down about 3% compared to last year. and using the Cromford® Demand Index we see that although it remains high, it is starting to weaken. This is probably a result of buyer weariness with the prices going up another 2% to 2.5% during January. The median is up $94,500 over the past 12 months, an increase of almost 28%.

The outlook for February is for prices to keep rising and demand to weaken slightly. It is not certain whether demand will weaken enough to cause supply to rise or if we will continue to struggle with desperately low numbers of active listings. Only a very steep rise in supply will work if we are to see prices stabilize, never mind start coming back down.”