So, were you waiting for the election to purchase a home?

So, were you waiting for the election to purchase a home?

Well, the election is over and people are asking me whether its safe to purchase a home, or whether we should expect market turmoil under our new president.

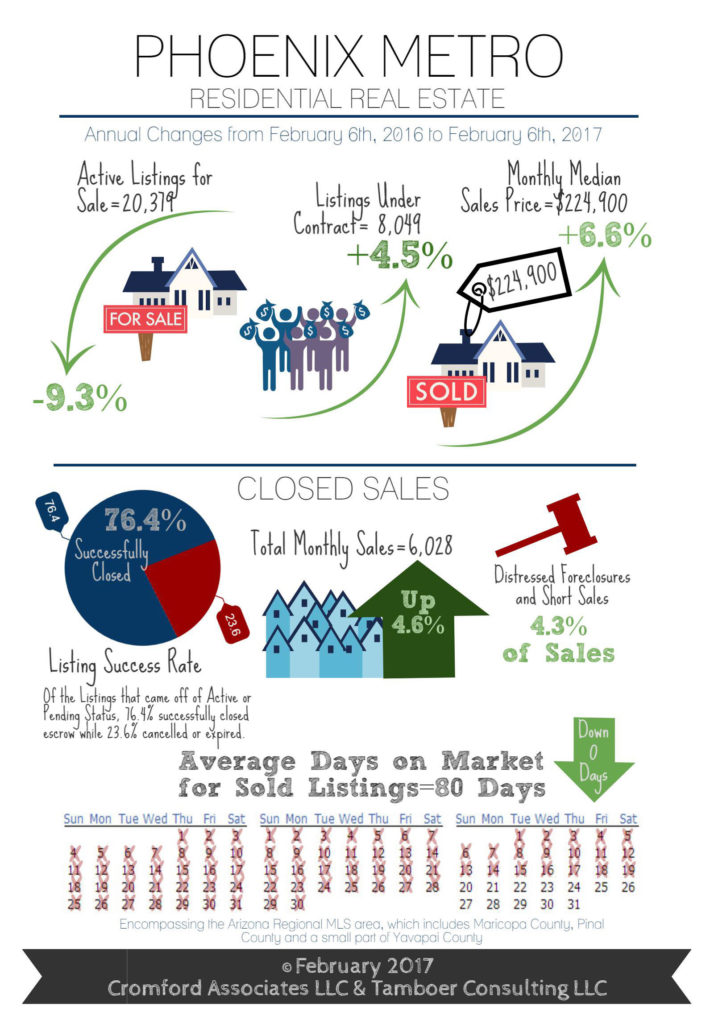

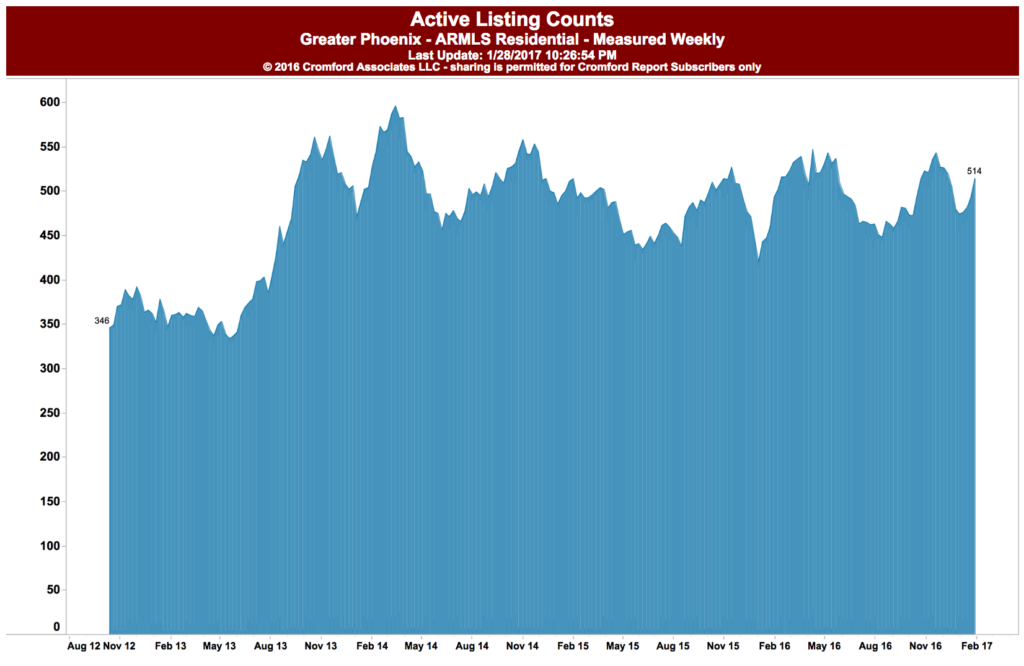

They’ve seen stories like this one from the Arizona Republic, which speaks to scarcity in the housing market and makes a tenuous tie to the presidential election.

Here’s another article from Slate indicating that people have been putting off major buying decisions due to the election. While I’m sure some people have held off on major decisions, we have not seen that among our clients. We’ve been busy!

Even so, if folks have been waiting for the election to decide until now, we will know it in about a month. If monthly sales numbers bounce, then you will know that people are re-entering the market. I’ll look back in about a month and let you know what we see. If you are inclined to believe that people have been waiting to act, then you will want to act before that bounce happens.

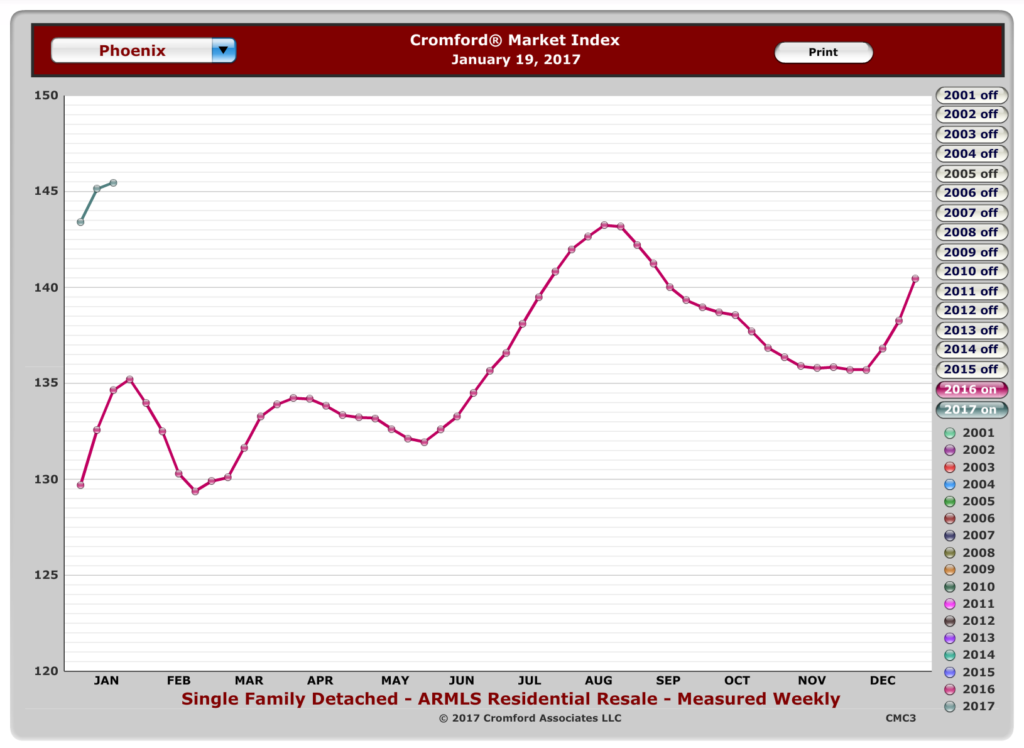

More than anything, let me put these fears to rest: the real estate market is not likely to undergo some serious upheaval any time soon.

First, here’s some advice that I found to be accurate in this article, which really points to how short-term fears about a presidential election might benefit a few, but are not a good reason to act quickly for most. Here’s the key take-away quote:

“I don’t think it’s a wise idea to try to time any markets, especially housing,” says real estate expert Kurt Westfield at WCE Equity Group. “Housing markets are very localized, subject to microeconomic shifts. The election takes place on a much larger macroeconomic scale.”

Second, let’s talk about the nature of the real estate market and why you should not act in haste. Nor should you hold off if you need to buy or sell. In other words, just act on your housing needs as they are today.

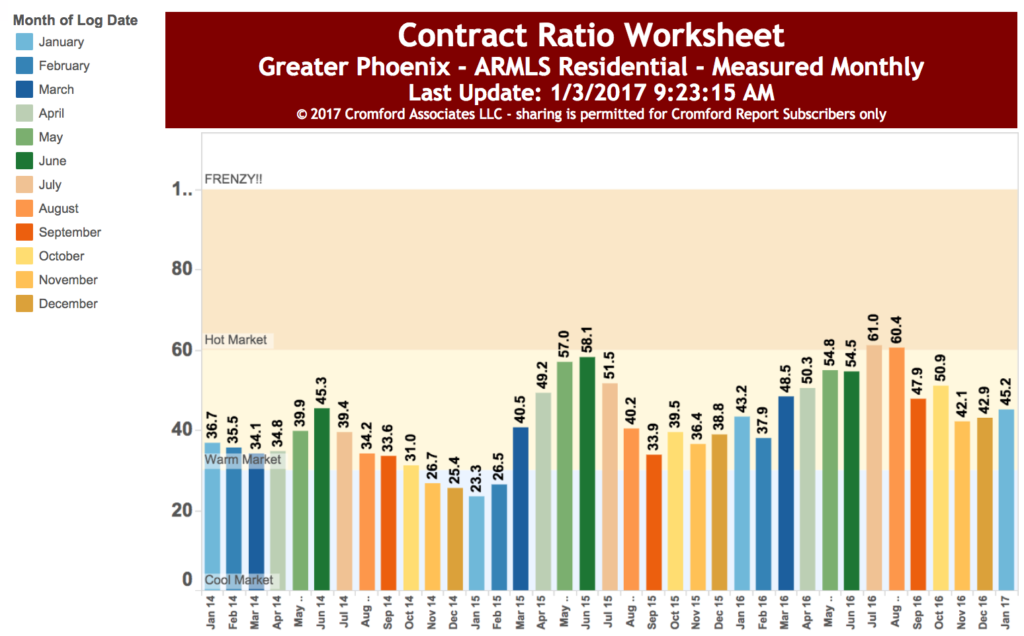

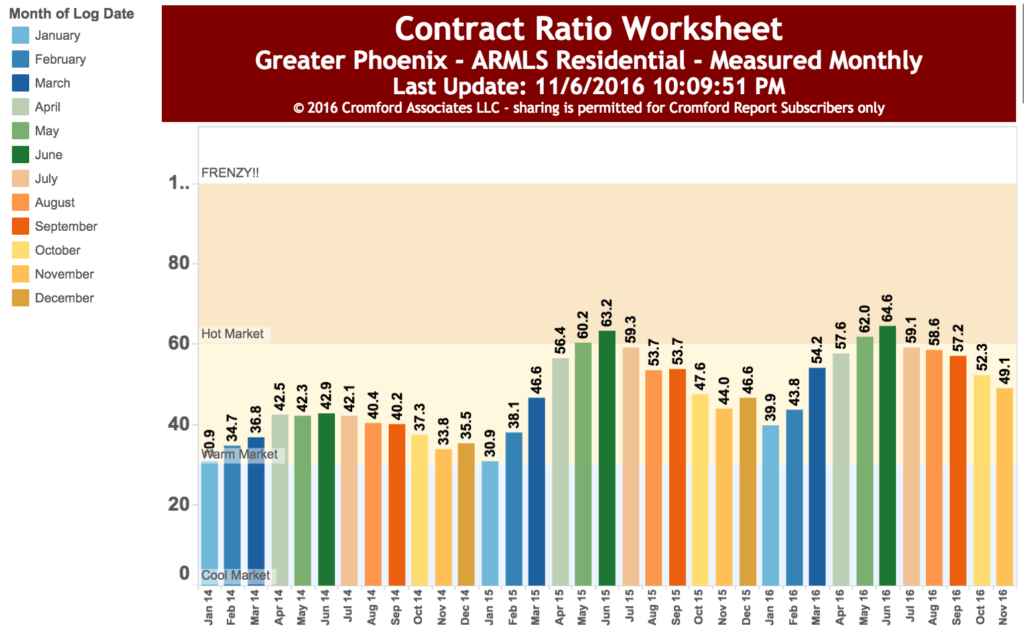

The most important thing to keep in mind is that the markets move very slowly. I know. It did not feel that way in 2008 when people’s homes seemed to lose value in months. But, when you look at that data, it still took months, not days or weeks for major movements to take place.

Sure, you will see small changes around the end-of-year holidays when people are focussed family and parties, but that’s an annual deal and does not change the market too much.

The thing you should most be aware of in the short term (3-6 months) is interest rates. While they are still historically low and probably won’t jump too quickly, a one percent increase represents a lot of money over the life of a loan. We know that the Federal Reserve Bank is talking about interest rate increases, so we encourage you to speak with your lender about what he or she is seeing.

In other words, don’t hit the panic button on interest rates. Just keep an eye on it. Make your decision based on what you need when you need it.

Let’s turn for a second to the long-term view (18 months to 2 years) just so I can make one point about Donald Trump’s threats to deport 11 million people. If his threats are carried out in whole or in part, then you will definitely see a major hit to our real estate market, according to Tina Tamboer of the Cromford Report.

I want to be careful here and temper that previous comment. That is IF he can forcibly deport people or IF they choose to leave on their own. And even then, the affects would be seen 3-6 months after he takes action.

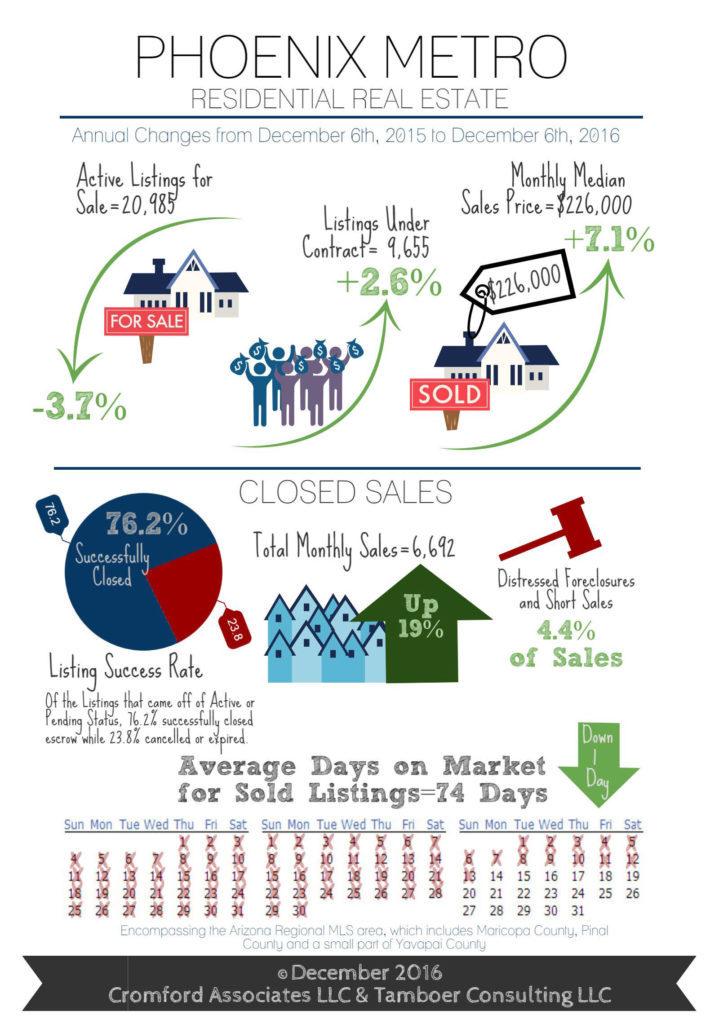

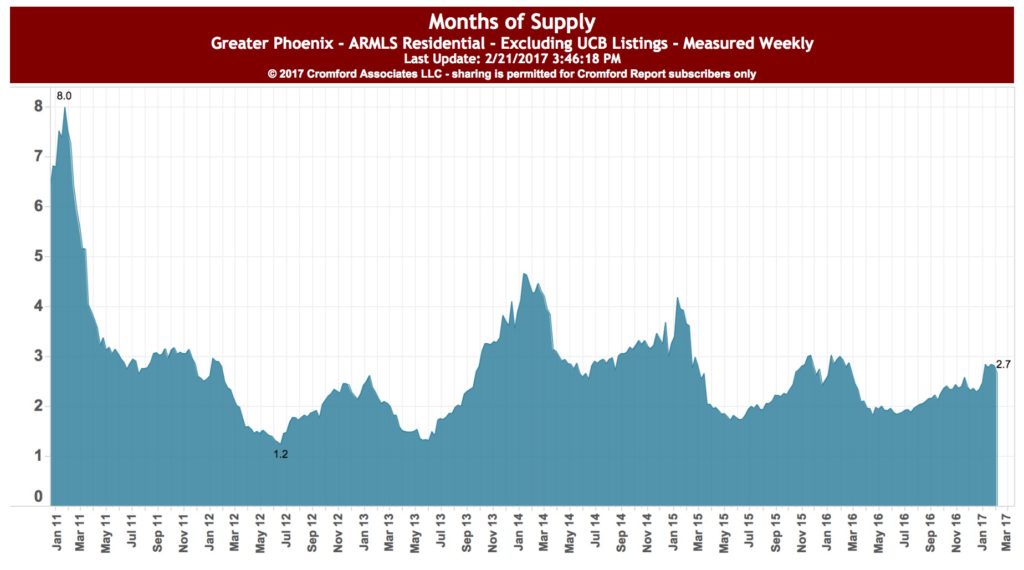

According to Tina, we would see a dramatic increase in supply of homes (as people move away) at the same time we would see a huge reduction in demand (as immigrants would no longer purchase homes). Yes, immigrants own homes.

But this would also impact those folks who own rental properties. Many of whom voted for our next president. Further, according to Tina, the impact would not be localized to certain neighborhoods. The impact would be valley-wide.

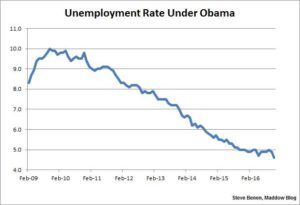

In the even longer term, according to Tina, Arizona’s population is aging quickly and we don’t have younger people to replace the aging population who can afford to purchase homes. Otherwise in the next 15-20 years we will have a huge excess of homes and prices will depress significantly.

This means that we need to find some solution to the immigration issue, which allows immigration in to Arizona.

You know, the very thing that the next president ran against.

We can help you make the right decision on your sale or purchase. Contact us at 602-456-9388.

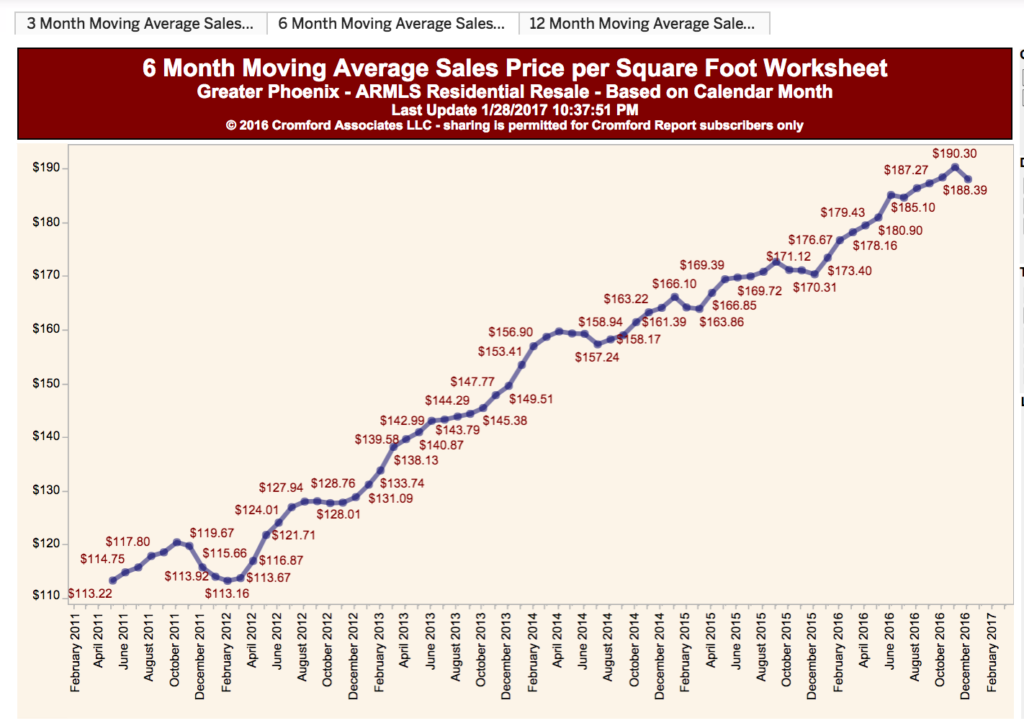

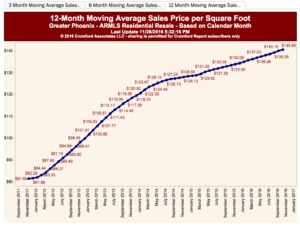

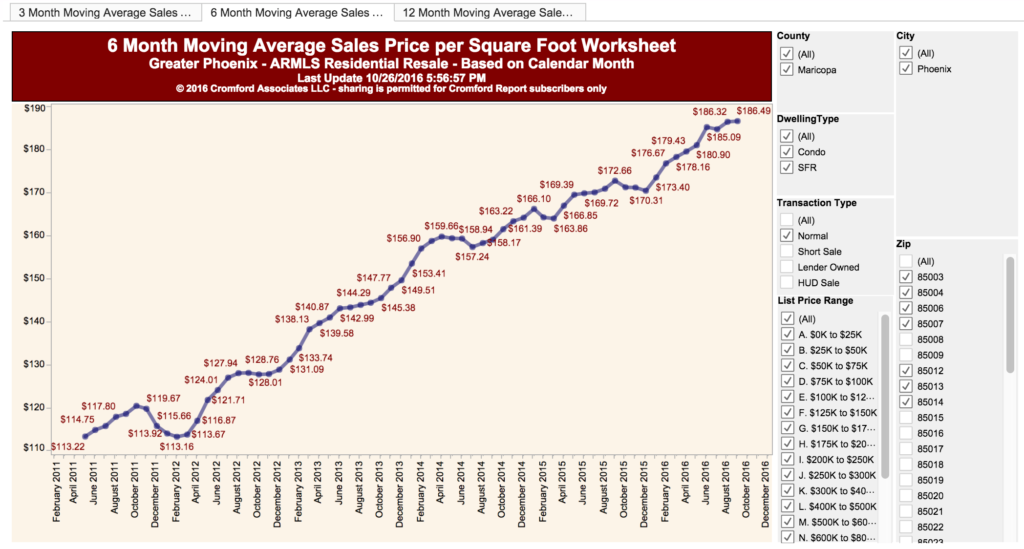

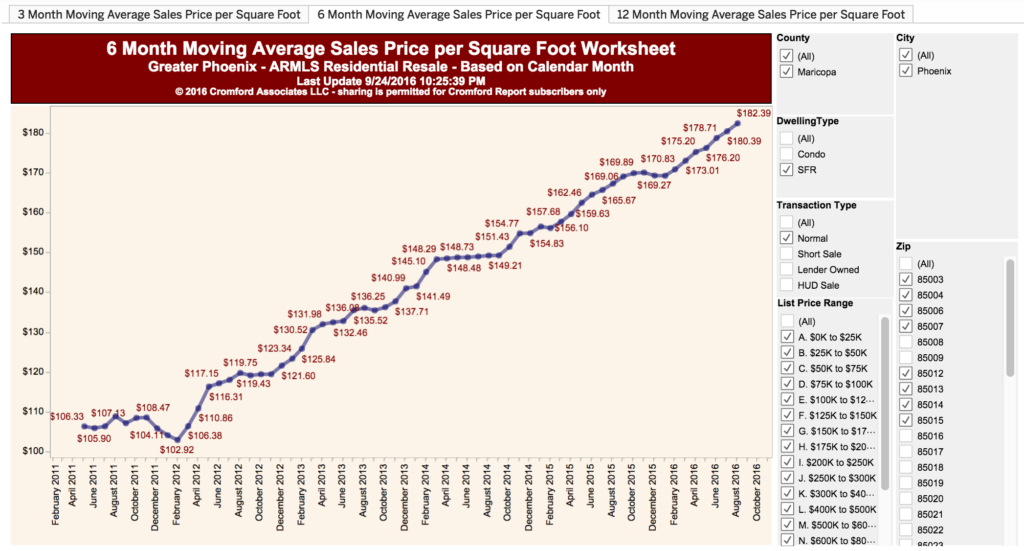

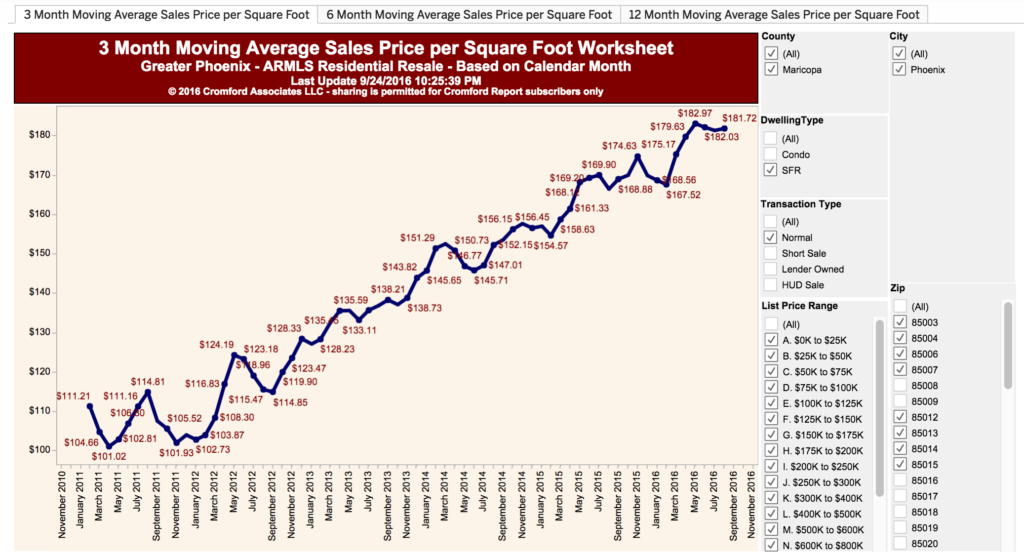

They caution, however, “This may sound like a big difference but the monthly average $/SF can change quite a bit over a short period. For example between January 16 and January 21 it rose from $144.88 to $147.00, a change of 1.5% in just 6 days.”

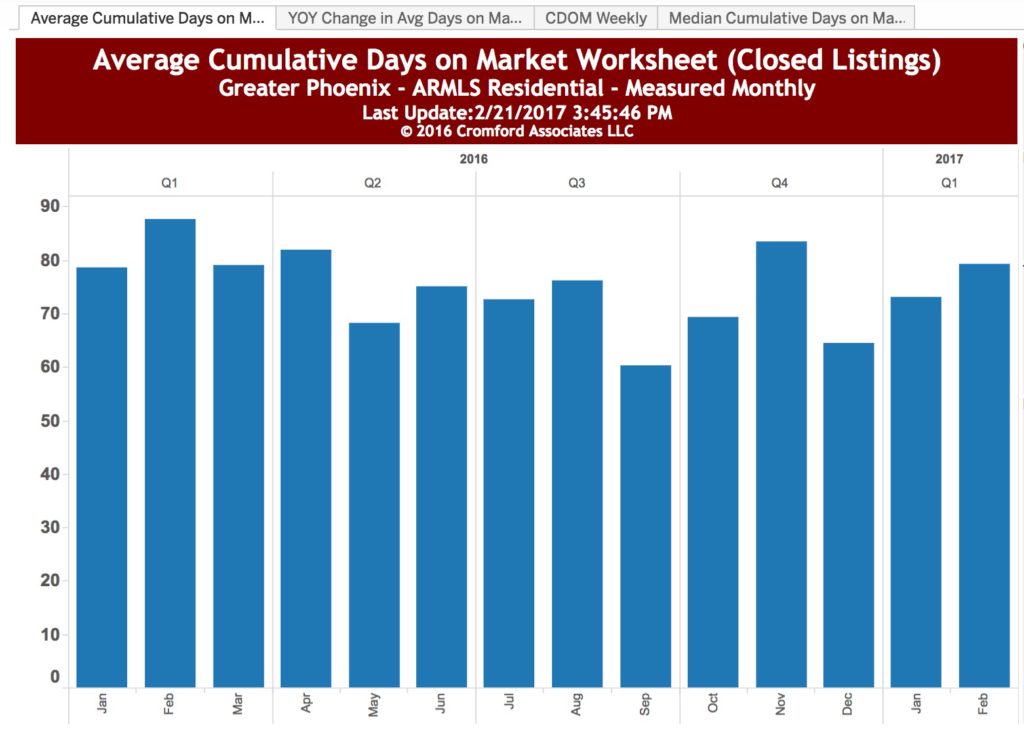

They caution, however, “This may sound like a big difference but the monthly average $/SF can change quite a bit over a short period. For example between January 16 and January 21 it rose from $144.88 to $147.00, a change of 1.5% in just 6 days.” In the CenPho market, we are seeing a small up-tick in days-on-market. I think this is probably still reflects those folks who listed around the holidays and just accumulated days-on-market, while everybody else ate Thanksgiving dinner and celebrated the New Year, nary a thought of buying a home.

In the CenPho market, we are seeing a small up-tick in days-on-market. I think this is probably still reflects those folks who listed around the holidays and just accumulated days-on-market, while everybody else ate Thanksgiving dinner and celebrated the New Year, nary a thought of buying a home.