For the August 2017 Market Update, we are turning to look at the role of rentals on the sales market, with the help of Tina at the Cromford Report.

For those of you who own rental property, or who are deciding what to do with your rental property, this month’s analysis is particularly relevant.

Here’s the Cromford take on the August 2017 Market Update.

For Buyers:

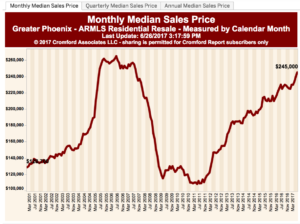

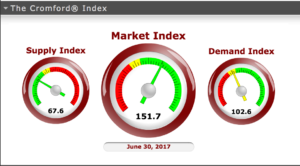

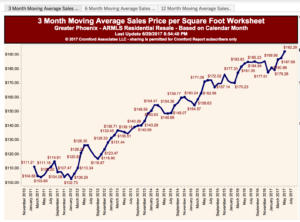

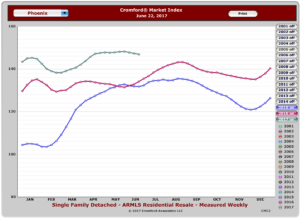

Good news for buyers, listings for sale between $150K and $300K stopped declining over the past 4 weeks. This is good news because as the summer progresses, there are fewer buyers to compete with in the marketplace which offers a seasonal relief for those still willing to brave high temperatures and scalding door knobs to view homes. Supply is still extremely low, but this slight improvement gives as much relief as a hot breeze on a July afternoon. It’s not much, but it’s something. Meanwhile, luxury buyers may notice fewer properties to look at this summer as demand was higher during the Spring season and overall inventory has been dropping due to a higher number of closings and seasonal cancellations/expirations. Expect inventory in price ranges above $500K to continue declining seasonally until settling into a stagnant level in August and early-September.

For Sellers:

There has been a lot of talk about the increased production of luxury apartments and what impact they will have on the residential real estate market. One segment that is starting to see their influence is apartment-style condominium rentals leased through the Arizona Regional MLS. While rents on single family homes and townhouses continue to rise, successful leases of apartment-style condominiums have dropped 11% in average rates from a high of $1.26/sf in January 2017 to $1.12/sf by June. The drop is consistent across all lease price ranges for this type of rental and is not seasonal. Areas that have been particularly affected are Tempe, Old Town Scottsdale and the Central Corridor including Downtown Phoenix. Considering the lack of supply for sale in affordable price ranges and the added competition from brand new apartment complexes, this may be a good time for landlords of apartment-style rentals to consider selling if they’re unwilling or unable to reduce their rental rate.

Commentary written by Tina Tamboer, Senior Real Estate Analyst with The Cromford Report

©2017 Cromford Associates LLC and Tamboer Consulting LLC

What we’ve seen for the August 2017 Market Update anecdotally may seem to contradict this analysis.

We had clients who purchased an affordable condo at about $90,000 in CenPho. We closed very quickly (three weeks) and, since the property was vacant, prepared them with resources to get ready to rent the property as soon as they closed. They advertised the condo for rent and had about 8 possible renters within days. They interviewed, chose and the new tenant moved in this week.

In other words, they were clamoring for an affordable rental.

The reason this does not contradict Tina’s analysis may have to do with price point. The new build apartment complexes that she is referring to are often renting much higher than a 40-year old condo. We have often felt that the new rentals are priced too high for the market, and I think that is why the rental rates for the new properties have dropped. As we’ve said before, the apartments are over-built.

That will probably continue to depress rental rates. If you own an older property, however, you are probably right where the rental rates need to be.

So, if you are thinking of purchasing a rental property, now may be the time. Give us a call at 602-456-9388 and we’ll help.