Check out this news, below, tracking the enrollment downtown.

After only four years, ASU downtown is up to 11,503 students. They are expecting upwards of 20,000 by 2012.

I am thrilled. Downtown students tend to be serious students and graduate students. These folks, along with faculty and staff, are going to make up the neighborhoods around downtown.

For those of us in Garfield, I think this is great. I think it means that we are going to have a vibrant community of people who are engaged as home owners or land lords. I think it will result if homes being renovated and people being active in the neighborhood.

It is a great time to invest in Garfield as the next campus community.

I’d love to hear your thoughts on it all.

———————-

[Source: Arizona State University] — Enrollment at ASU this fall has reached a record 68,064 students, a thousand more than last year’s 67,082. ASU’s enrollment has grown by nearly 13,000 students since 2002, when it adopted the mission of becoming a high-quality, high-access university.

- The Downtown Phoenix campus grew to 11,503 students in its fourth year. Last year there were 8,431 enrolled. (26.7%)

- Enrollment at the West campus grew to 10,380 from 9,572 last year. (7.8%)

- At the Tempe campus, 55,552 students are enrolled, increasing over last year’s 52,734. (5.1%)

- Enrollment at the Polytechnic campus in Mesa is 9,146, down from last year’s 9,614. (-5.1%)

More students are attending ASU full-time, almost five percent more than last year. Of the total enrollment, 13,787 are graduate students. The number of ethnic minority students increased more than seven percent, from 17,334 to 18,600. The proportion of ethnic minority students among first-time freshmen increased from 31.5% to 34.2%.

Campus enrollment figures total more than the overall unduplicated count of 68,064, as ASU students take advantage of the courses that are offered by departments throughout the university, not just at the campus that is the academic home of the student.

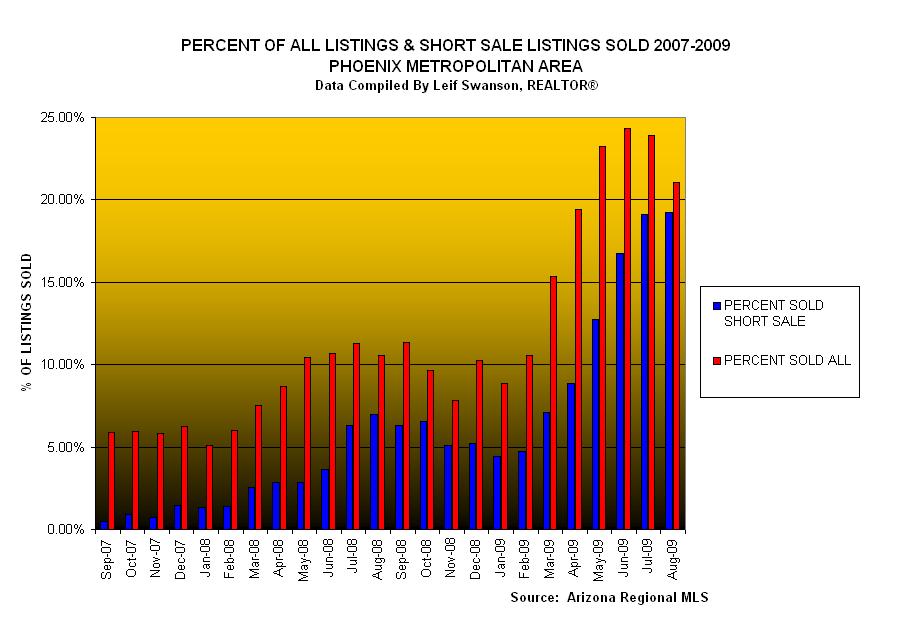

Notice also that there is a greater trend toward short sales over foreclosures. The percent of foreclosures continues to drop both as Closed transactions (44%) and in the Pending category (35%). 25% of the active listings were short sales. 31% of the pending sales were short sales.

Notice also that there is a greater trend toward short sales over foreclosures. The percent of foreclosures continues to drop both as Closed transactions (44%) and in the Pending category (35%). 25% of the active listings were short sales. 31% of the pending sales were short sales. If you are FHA-financed and get an offer accepted by the end of next week, you

If you are FHA-financed and get an offer accepted by the end of next week, you

unrealistically large for their income, it encourages sprawl, it is a huge drain on our general fund when we can’t afford it and it is used by people for second homes. Heck, my parents take an interest deduction on their stinkin’ RV because it is a second home!

unrealistically large for their income, it encourages sprawl, it is a huge drain on our general fund when we can’t afford it and it is used by people for second homes. Heck, my parents take an interest deduction on their stinkin’ RV because it is a second home! A legislator (

A legislator (