The Arizona Republic and other news outlets vacillate between terror and hope.

At one moment they are telling us that the real estate market is about to enter a tailspin not seen since the History Channel did a major retrospective of WWII airplane dog fights.

In the next moment they are telling us that the fragrant flowers of prosperity and recovery are about to pop out of the ground around our feet.

Thanks, guys. Now, here is the data.

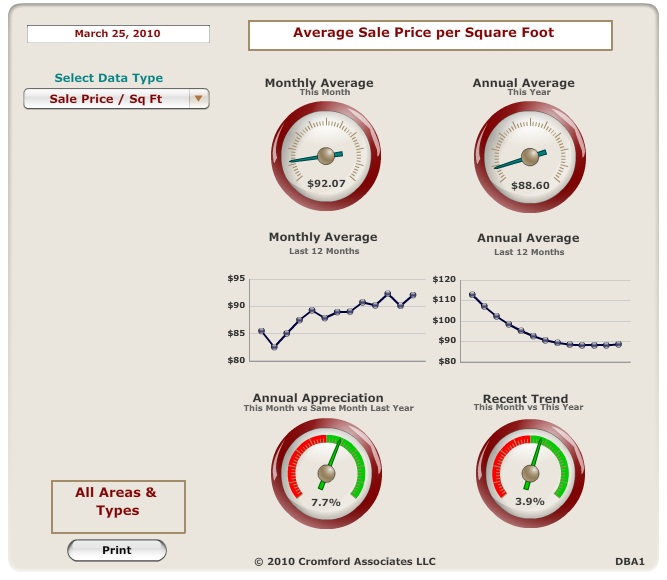

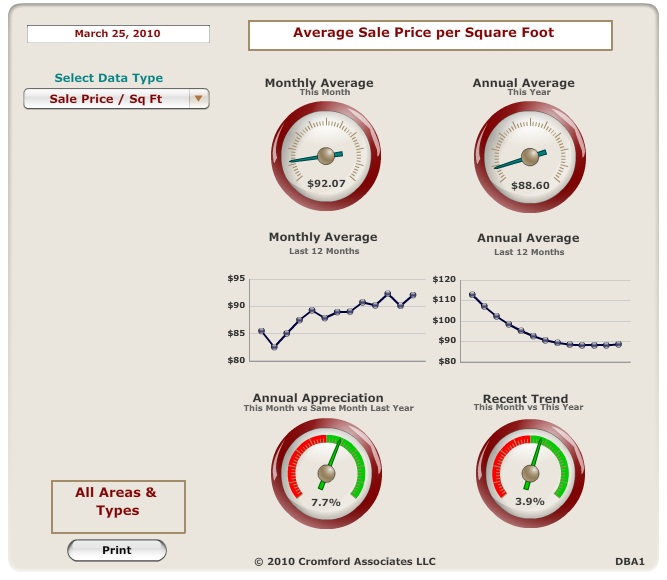

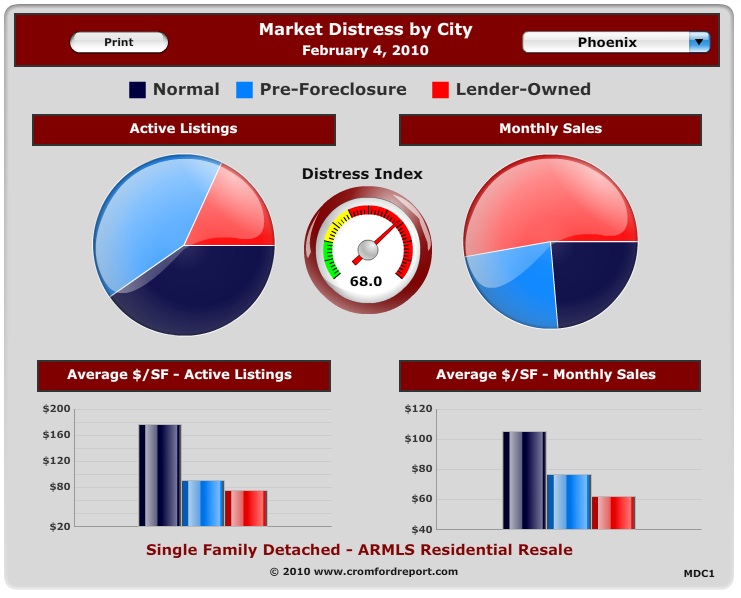

This table is from the Cromford Report. If you’ve been following for a while, you know that I talk about this information source quite a bit. The Cromford Report takes data directly from the Multi-Listing Service, which is the most accurate report of sales in Arizona.

This data is for Maricopa County. Look at the gauges for “Annual Appreciation” and “National Trend”.

You can see that we are in the green zone. This means that we have appreciated in prices 7.7% over the same month last year. It also means that March is doing 3.9% better than the entire year. Now, the second gauge does not say much, as it is only March. But these are positive signs.

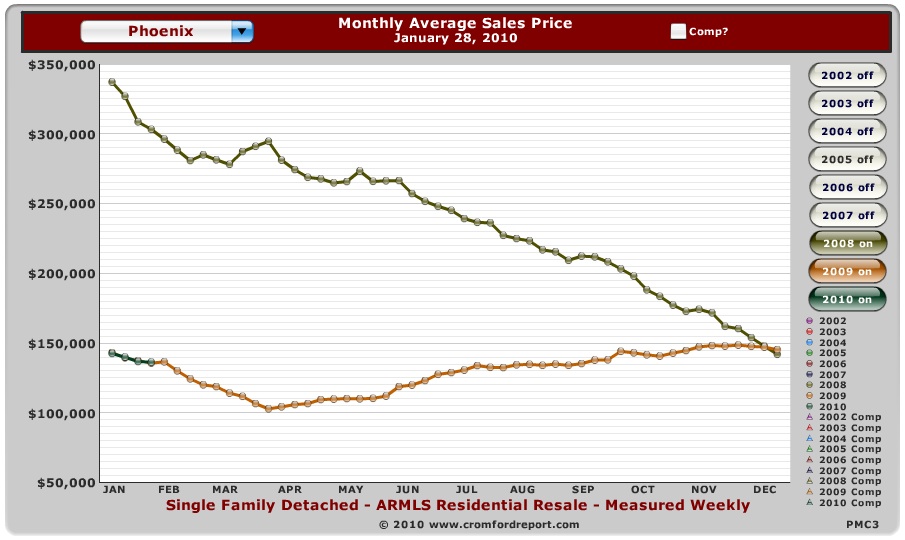

The Monthly Average is showing that homes are selling for more on a square foot basis than they were last year. Annual Average is a measure of sales prices, averaged at any moment over the last twelve months. These have seemed to bottom out.

Now, I don’t want the press to only print rosy stories in some attempt to talk our way to recovery. But here are some things they are doing wrong:

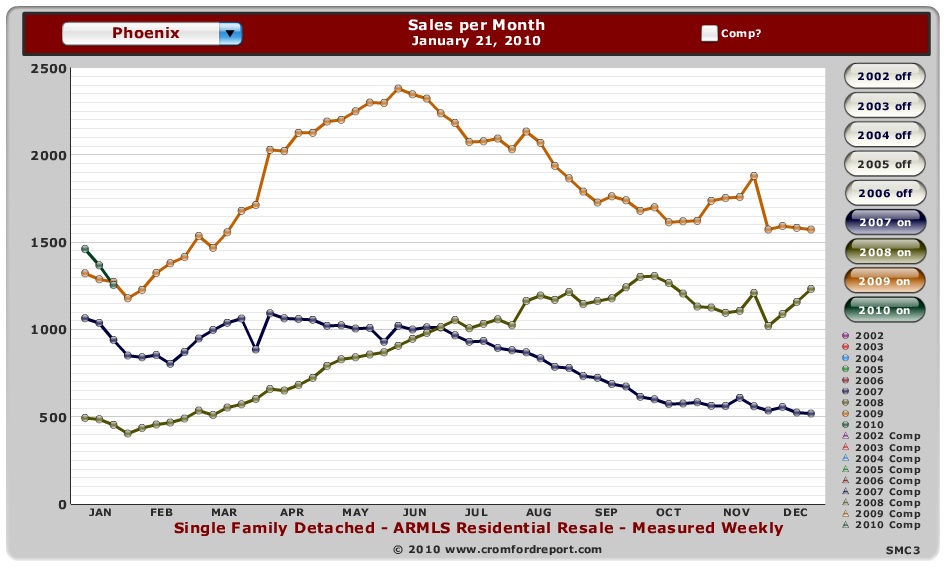

1) They report sales trends that are at least 3 months old. So right now they are talking about Christmas and January sales trends. Those months tend to be slower.

2) They are using national data and applying it to Arizona. That is like saying that Arizona’s average summer temperature is 75 degrees because that is what it is nationally.

3) They keep reporting that we won’t recover until 2014, which is a minority view.

4) They keep talking about a glut of homes coming on the market, which has not happened the last three times they reported on it and shows little understanding of how banks like to slowly let homes on to the market to avoid price drops.

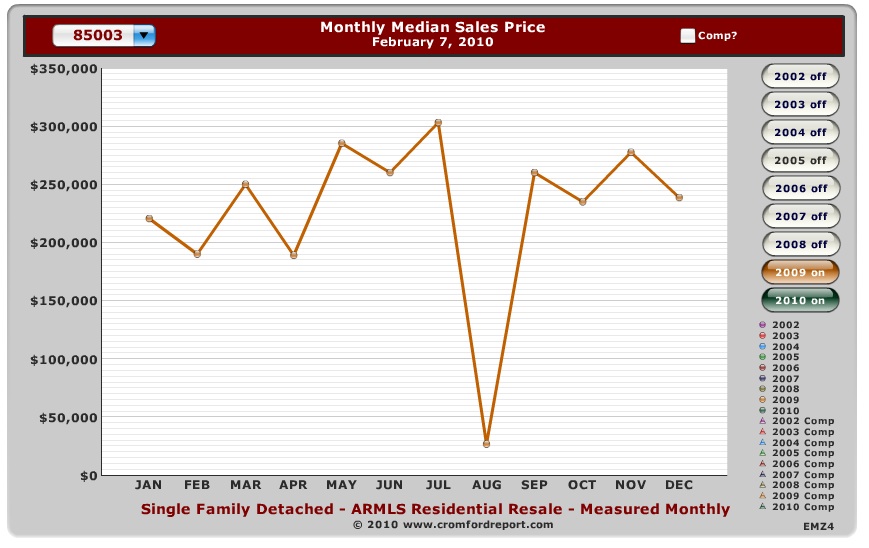

5) They ignore that certain parts of the city, specifically Central Phoenix, are doing better than the suburbs and people are moving in to town, thus driving the market!

Here are the conclusions I get from the data:

1) You can never perfectly guess the lowest or highest point of the market. But if you buy generally in the low point and sell generally in the high point, then you are following Warren Buffet’s model (be greedy when the market is bad and miserly when the market is good).

2) I sold my first house at 2.5 times what I bought it for because I sold when I first started hearing news on the radio of price drops. Well, we are getting news of price increases now, so my estimate is that now is the time to buy.

3) If you are buying for yourself, then you don’t need to worry too much about price fluctuations. This is not day trading. Buy it low and hold it for at least 5 years. You will be fine.

4) The market may not recover tomorrow. It will probably not fall lower. But if you are buying now and holding you are in a great position.

Please feel free to contact me for more information and to have a look at the market.

Really. It’s going away. The $8,000 first time home buyer and the $6,500 repeat home tax credits will not longer be available after the end of April. So, set your clocks!

Really. It’s going away. The $8,000 first time home buyer and the $6,500 repeat home tax credits will not longer be available after the end of April. So, set your clocks!

1)

1)

….in other words, even if prices are going down, interest rates are likely go up later this year and undermine any price drops.

….in other words, even if prices are going down, interest rates are likely go up later this year and undermine any price drops.