Our friends at the Cromford Report are always great about allowing us to share their analysis. As an agent, their information really gives me an edge that will benefit you.

Our friends at the Cromford Report are always great about allowing us to share their analysis. As an agent, their information really gives me an edge that will benefit you.

Here’s are some highlights from they have to say about why we have seen a sudden shift to a seller’s market:

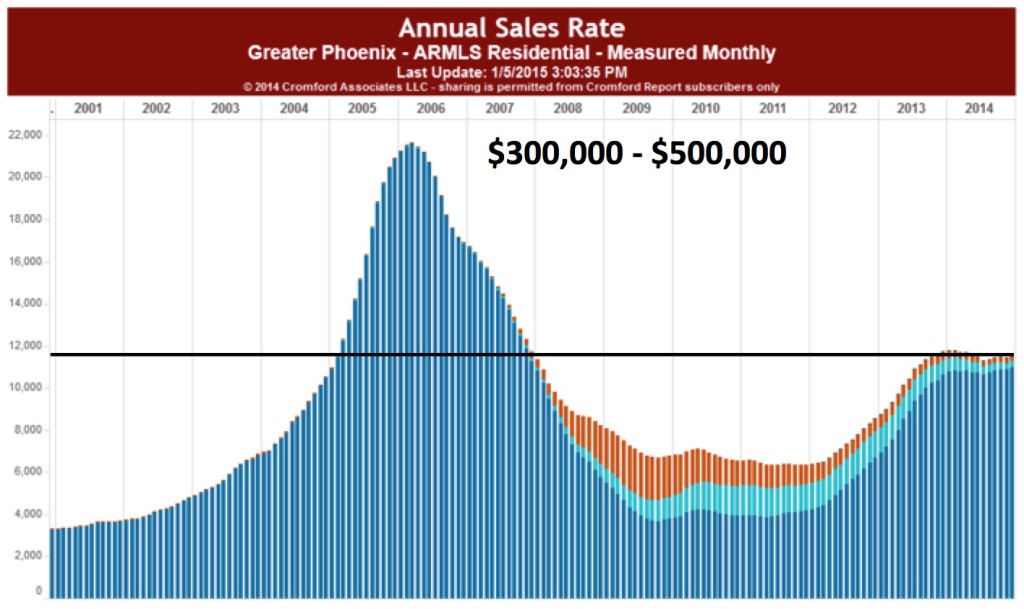

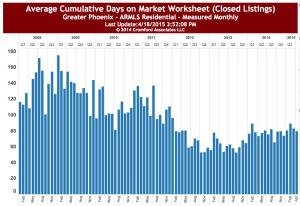

April continued the trends we saw in March with significant improvement in demand and volumes, though different price ranges are experiencing very different supply dynamics.

Currently the supply situation is the most important thing to watch and this is what determines how much competition buyers will experience.

Here are the basic ARMLS numbers for May 1, 2015 relative to May 1, 2014 for all areas & types:

• Active Listings (excluding UCB): 21,512 versus 26,205 last year – down 17.9% – and down 3.5% from 22,303 last month

• Pending Listings: 7,951 versus 7,199 last year – up 10.4% – and up 1.2% from 7,853 last month

• Monthly Sales: 8,363 versus 7,572 last year – up 10.4% – and up 6.0% from 7,887 last month

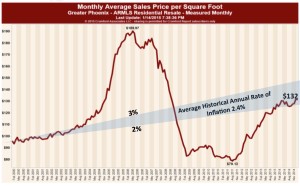

• Monthly Average Sales Price per Sq. Ft.: $135.88 versus $130.27 last year – up 4.3% – and up 2.9% from $131.99 last month

• Monthly Median Sales Price: $202,000 versus $190,000 last year – up 6.3% – and up 1.0% from $200,000 last month

From a seller’s perspective there is a lot of encouragement in this batch of numbers, though buyers might be dismayed to see price per sq. ft. rise by almost 3% in a single month.

For the sub-$200K price bands we are seeing mostly unexceptional demand, but exceptionally low supply, which is leading to multiple offer situations and strong upward price pressure.

As we move upmarket from $250K, things become a little easier for buyers because supply is less scarce. Once we get above $400K there are more active listings than last year and most buyers are having a much easier time with less competition from other buyers. In other words, demand is good but supply is plentiful at these higher price points.

Personally, I would add my own analysis here to mention that homes in the historic areas and CenPho tend to command higher prices than most areas. So, our experience with our clients right now shows that this tightness in supply goes up closer to $300k. In other words, it is difficult to get offers in quickly enough for nice listings in historic areas, even at the higher prices.

If you are thinking of buying or selling, please give me a call and I’ll help you put a strategy together, which takes these trends in to account. Call me at 602-456-9388.

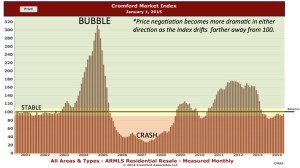

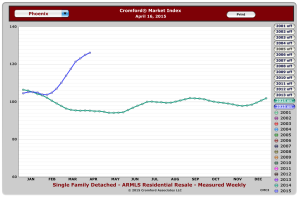

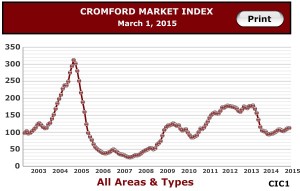

Index was showing that the market was turning toward a sellers’ advantage. I was shocked to see that trend taking an extreme swing upward.

Index was showing that the market was turning toward a sellers’ advantage. I was shocked to see that trend taking an extreme swing upward.

I’m sure you’ve heard of home buyer programs over the years, programs that are funded by cities or counties and which help you buy your first home, if you qualify.

I’m sure you’ve heard of home buyer programs over the years, programs that are funded by cities or counties and which help you buy your first home, if you qualify. The following is an excerpt from the Cromford Report’s comments from March 30th on the state of rentals in the Valley.

The following is an excerpt from the Cromford Report’s comments from March 30th on the state of rentals in the Valley.

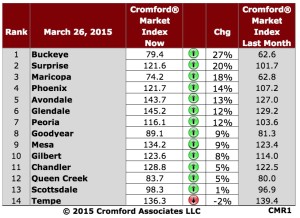

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

Just in the last month, the index for Phoenix has moved upward 14%. Only Tempe dropped.

You’ve probably heard me lament about the fact that Generation Y home buyers are not coming in to the housing market as quickly as we had hoped.

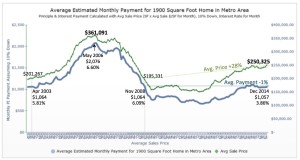

You’ve probably heard me lament about the fact that Generation Y home buyers are not coming in to the housing market as quickly as we had hoped. I don’t want to give you heart palpitations, but if you are planning to purchase a home, you might want to do it sooner this year, rather than later.

I don’t want to give you heart palpitations, but if you are planning to purchase a home, you might want to do it sooner this year, rather than later.