The April Market Report, with the help of our friends at the Cromford Report, is here for your viewing pleasure.

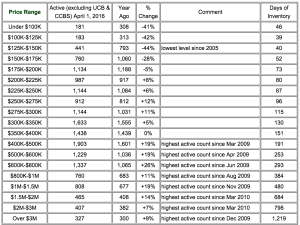

First, the supply price range:

When they examine the number of active single family listings by price range, they can clearly see the long term shortage of affordable homes, the adequate supply in the mid-range and the glut of luxury homes for sale.

To put that another way, from $400,000 upwards we have more active listings than we have seen in the last 6 years, so buyers have plenty of choice and therefore negotiating power.

However, below $200,000 we have a chronic shortage of homes available for purchase, and there is precious little to rent too. Here sellers have most of the negotiating power.

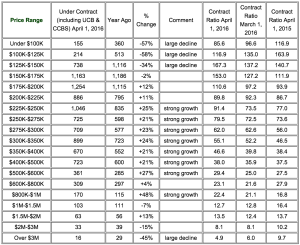

Now, let’s look at the demand price range:

From $225,000 to $600,000 we have far more listings under contract that at this time last year. We also see very strong growth for the sector from $800,000 to $1 million.

From $175,000 to $225,000 and from $1.5 million to $2 million we have moderate increases in listings under contract of between 10% and 15%. For the sector from $1.5 to $2 million this goes a little way to mitigating the increase in supply.

In plain English, th shortage of supply means the market under $175,000 is much smaller than last year, showing there is no lack of buyer interest. Below $125,000 there is not much for sale and buyer interest is lower than last year too.

So, what does the April Market Report mean for you?

- If you are looking for a home between $200,000 and $600,000 expect languid growth in the number of listings compared to last year, yet a strong increase in the number of those homes that are pending or under contract.

- If you are looking to sell a home between $200,000 and $600,000, expect to sell quickly if you price right.

To build the right strategy for you, call us at 602-456-9388 and we can help.

I had the pleasure this month of doing a presentation to a

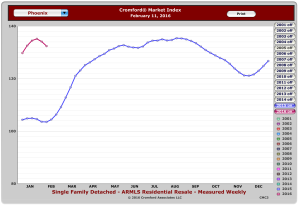

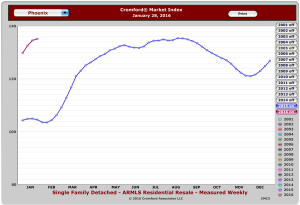

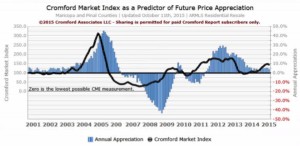

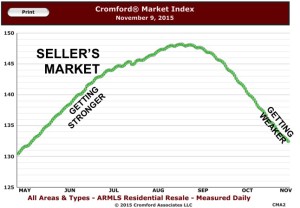

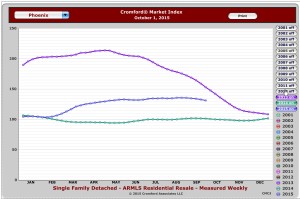

I had the pleasure this month of doing a presentation to a  Paradoxically, you CAN see the market index dropping while prices are still increasing. But once sellers see fewer and fewer buyers, or stay on the market longer, prices begin to drop.

Paradoxically, you CAN see the market index dropping while prices are still increasing. But once sellers see fewer and fewer buyers, or stay on the market longer, prices begin to drop.

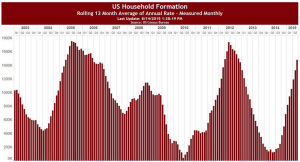

I think its an interesting story for Phoenix, in particular. After the recession, we saw young couples choosing to rent longer, or even live with family for a while. Add that to the fact that this new generation of home buyer is coming on the market with higher levels of debt than ever before, and we see the makings of some serious downward pressure on the sub-$200k market.

I think its an interesting story for Phoenix, in particular. After the recession, we saw young couples choosing to rent longer, or even live with family for a while. Add that to the fact that this new generation of home buyer is coming on the market with higher levels of debt than ever before, and we see the makings of some serious downward pressure on the sub-$200k market.

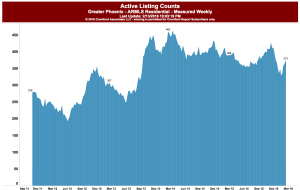

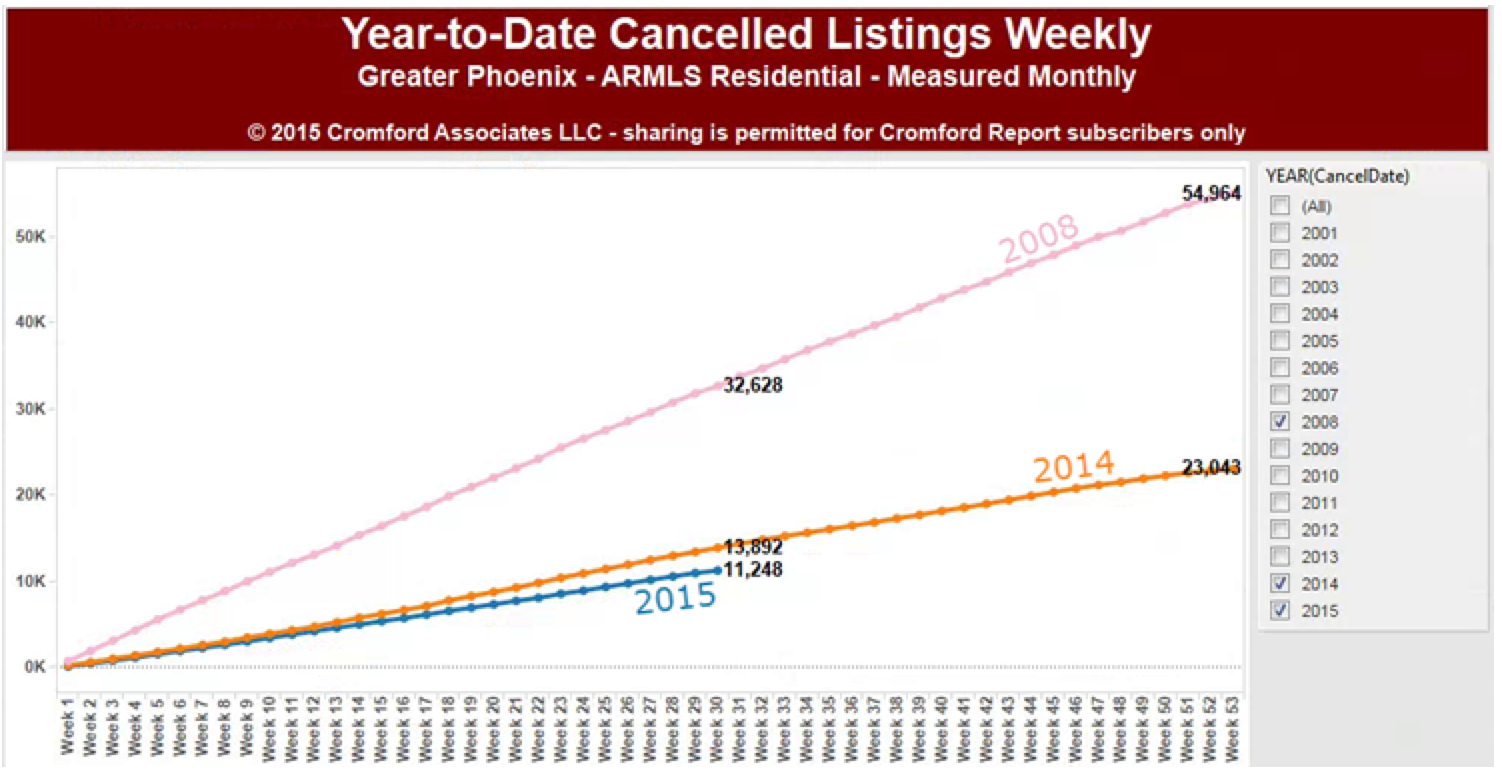

ere’s another interesting indicator: how many listings are cancelled after being on the market for a while.

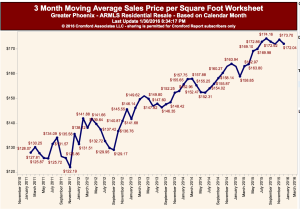

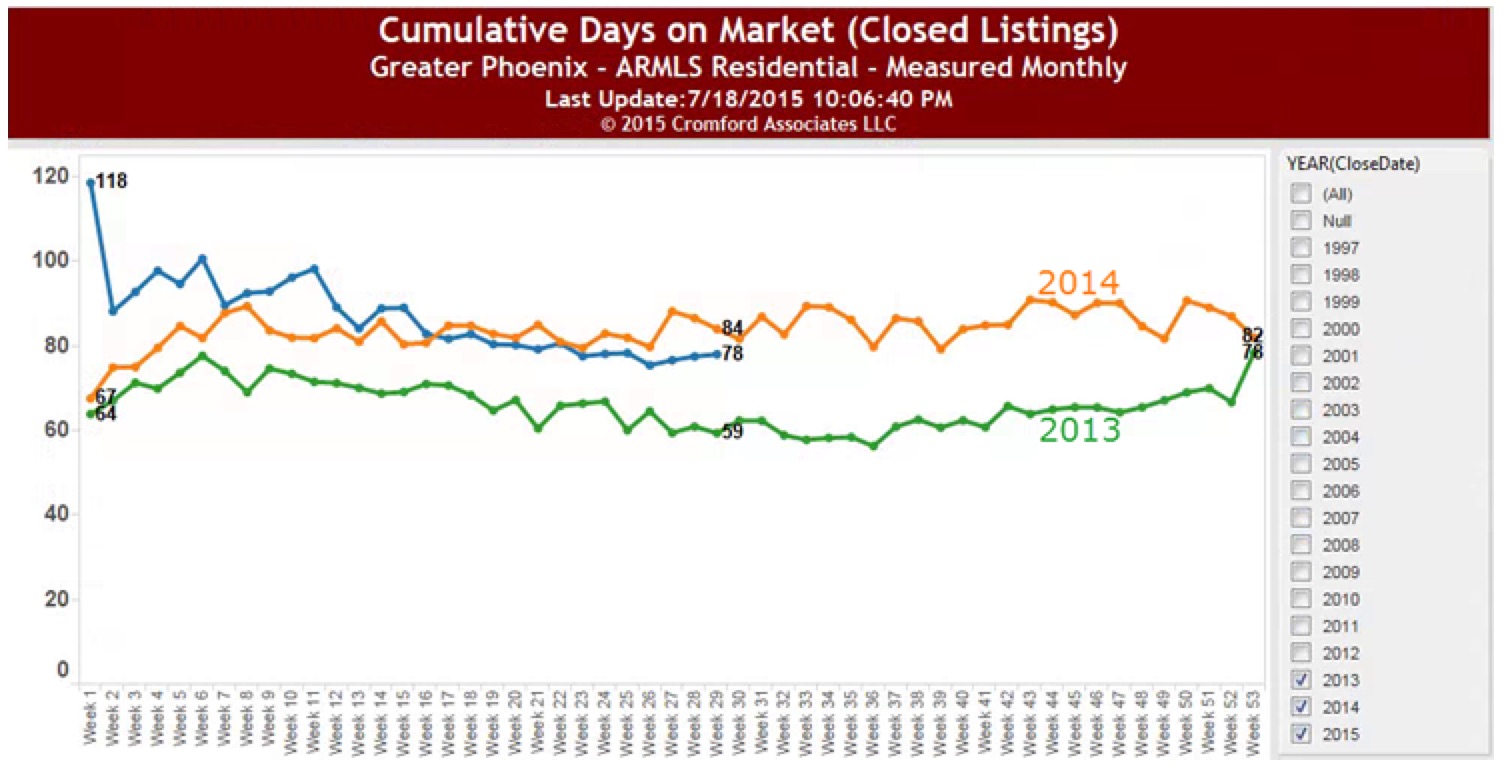

ere’s another interesting indicator: how many listings are cancelled after being on the market for a while. Also notice that the number of days on market (average) is a little lower than last year. So, this year they are selling. Prices are increasing slightly over last year and people are selling homes. I don’t see any indication that these price increases are irrational. However if interest rates rise later this year and buyers can’t get loans as easily, those prices may be forced to come down and this dynamic will change. If that happens, I don’t see major changes in 2015 –probably next year.

Also notice that the number of days on market (average) is a little lower than last year. So, this year they are selling. Prices are increasing slightly over last year and people are selling homes. I don’t see any indication that these price increases are irrational. However if interest rates rise later this year and buyers can’t get loans as easily, those prices may be forced to come down and this dynamic will change. If that happens, I don’t see major changes in 2015 –probably next year.